Louisiana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Choosing the best authorized document design could be a have a problem. Of course, there are a lot of templates available online, but how do you find the authorized type you need? Make use of the US Legal Forms web site. The services gives thousands of templates, such as the Louisiana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, which you can use for business and personal requires. Every one of the types are checked by experts and meet up with state and federal specifications.

If you are currently listed, log in to your accounts and click on the Acquire option to obtain the Louisiana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Make use of accounts to look with the authorized types you may have ordered earlier. Visit the My Forms tab of your accounts and obtain yet another copy in the document you need.

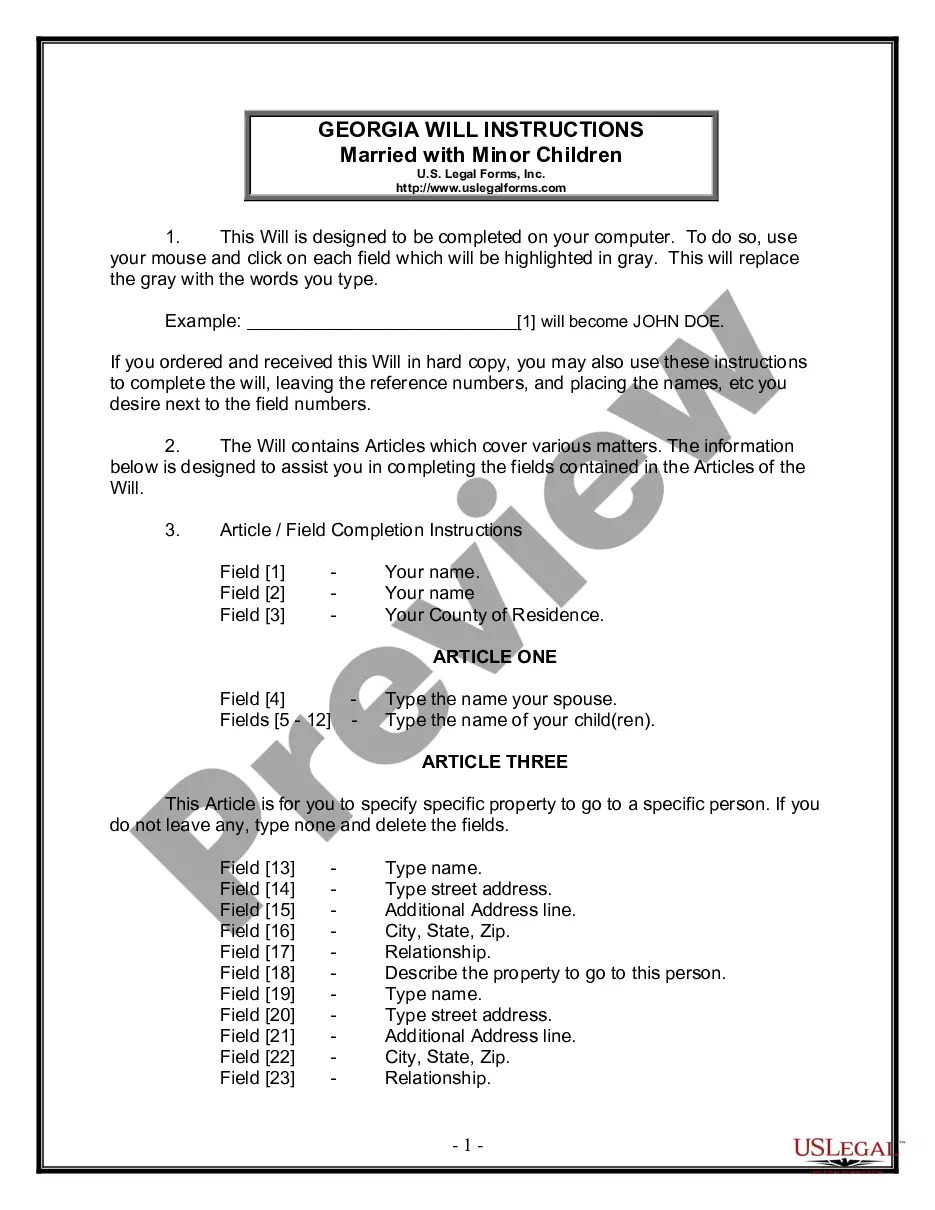

If you are a brand new user of US Legal Forms, here are basic directions that you can follow:

- First, be sure you have selected the appropriate type to your city/state. It is possible to look through the form making use of the Review option and read the form outline to make certain this is basically the right one for you.

- If the type will not meet up with your expectations, use the Seach area to get the correct type.

- Once you are certain the form is suitable, click the Get now option to obtain the type.

- Select the costs strategy you desire and enter in the needed information and facts. Create your accounts and purchase the order with your PayPal accounts or credit card.

- Select the file structure and down load the authorized document design to your gadget.

- Total, edit and printing and indication the attained Louisiana Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

US Legal Forms is the largest local library of authorized types where you can find different document templates. Make use of the company to down load professionally-produced paperwork that follow express specifications.

Form popularity

FAQ

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Conversion ratio: The number of common shares that an investor receives at the time of the conversion of a convertible preferred stock. The ratio is set by the company when the convertible preferred stock is issued.

Conversion ratio: The number of common shares that an investor receives at the time of the conversion of a convertible preferred stock. The ratio is set by the company when the convertible preferred stock is issued. Conversion price: The price at which a convertible preferred share can be converted into common shares.