Louisiana Private Placement Financing

Description

How to fill out Private Placement Financing?

US Legal Forms - one of many largest libraries of legitimate forms in the USA - provides a wide range of legitimate document web templates you may download or print out. Making use of the internet site, you may get a large number of forms for enterprise and individual reasons, sorted by categories, claims, or key phrases.You can find the most recent models of forms such as the Louisiana Private Placement Financing in seconds.

If you currently have a membership, log in and download Louisiana Private Placement Financing in the US Legal Forms library. The Download switch will show up on each form you look at. You have access to all formerly saved forms inside the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, listed below are simple instructions to help you get started out:

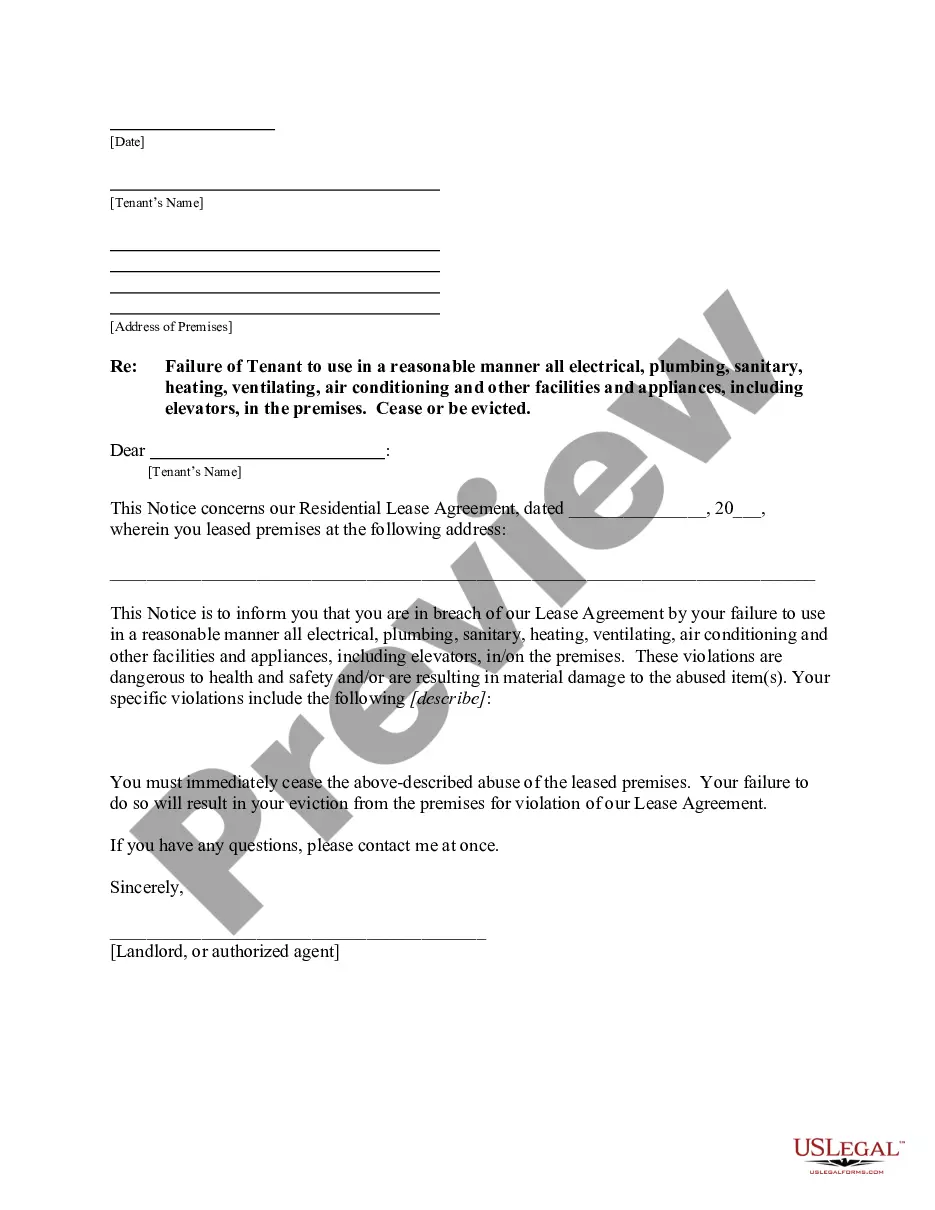

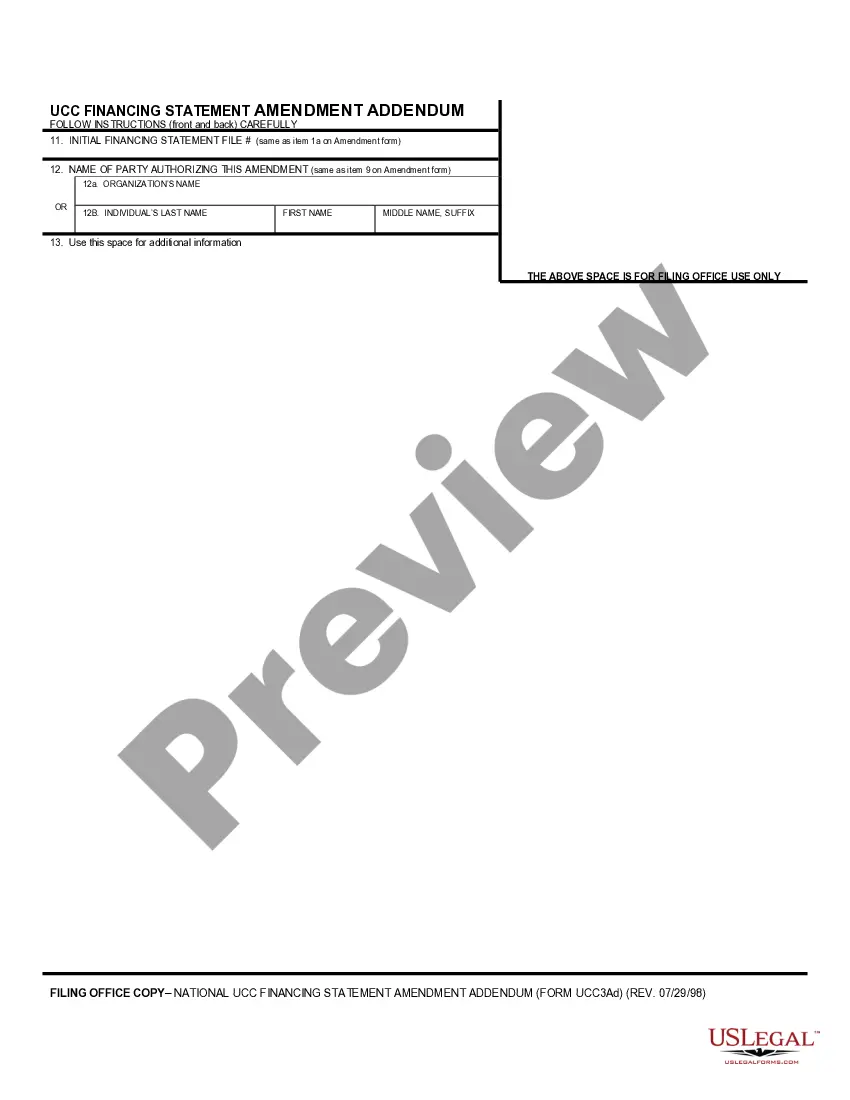

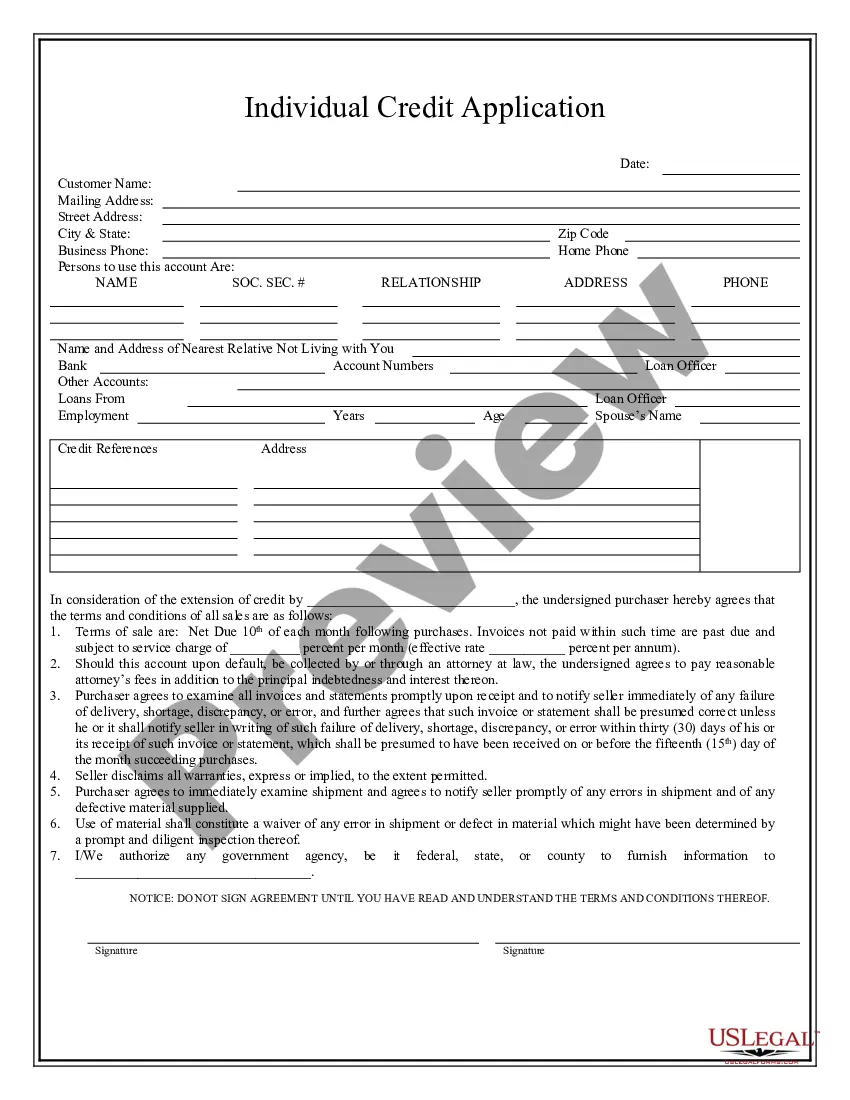

- Be sure to have picked the correct form for the metropolis/area. Click the Preview switch to analyze the form`s content. Read the form explanation to ensure that you have selected the proper form.

- In case the form doesn`t fit your demands, use the Look for industry towards the top of the monitor to discover the one that does.

- If you are pleased with the form, affirm your choice by visiting the Purchase now switch. Then, pick the rates strategy you prefer and supply your qualifications to sign up to have an accounts.

- Approach the purchase. Make use of your bank card or PayPal accounts to finish the purchase.

- Pick the file format and download the form on your system.

- Make changes. Fill up, revise and print out and signal the saved Louisiana Private Placement Financing.

Every single template you included in your bank account lacks an expiry date and is your own property for a long time. So, in order to download or print out yet another copy, just visit the My Forms section and then click on the form you want.

Gain access to the Louisiana Private Placement Financing with US Legal Forms, the most comprehensive library of legitimate document web templates. Use a large number of skilled and state-distinct web templates that satisfy your small business or individual demands and demands.

Form popularity

FAQ

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and.

Rule 506 (formally 17 CFR § 230.506) is a Securities and Exchange Commission (SEC) regulation that allows private placement under Regulation D and enables issuers to offer an unlimited amount in securities.

Under rule 506 b, issuers of securities are exempt from the registration requirements of the Securities Act for unlimited size offerings. However, to qualify under this rule, the securities that are being offered can only be bought by accredited investors and no more than thirty-five unaccredited investors.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

A general exemption from registration for private offerings of securities. The exemption allows the issuer to offer or sell only to sophisticated investors who do not need the protections provided under the SEC's registration and disclosure regulations.

Section 4(a)(2) of the Securities Act of 1933 (the ?Act?) exempts from registration "transactions by an issuer not involving any public offering." It is section 4(a)(2) that permits an issuer to sell securities in a "private placement" without registration under the Act.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

Rule 504 is not a common method of privately placing securities because the $5,000,000 cap is unattractive to many large issuers. Rule 506, which restricts who can purchase securities in a private placement but does not cap the offering amount, is the more common method of private placement under Regulation D.