Louisiana Employee Time Report (Nonexempt)

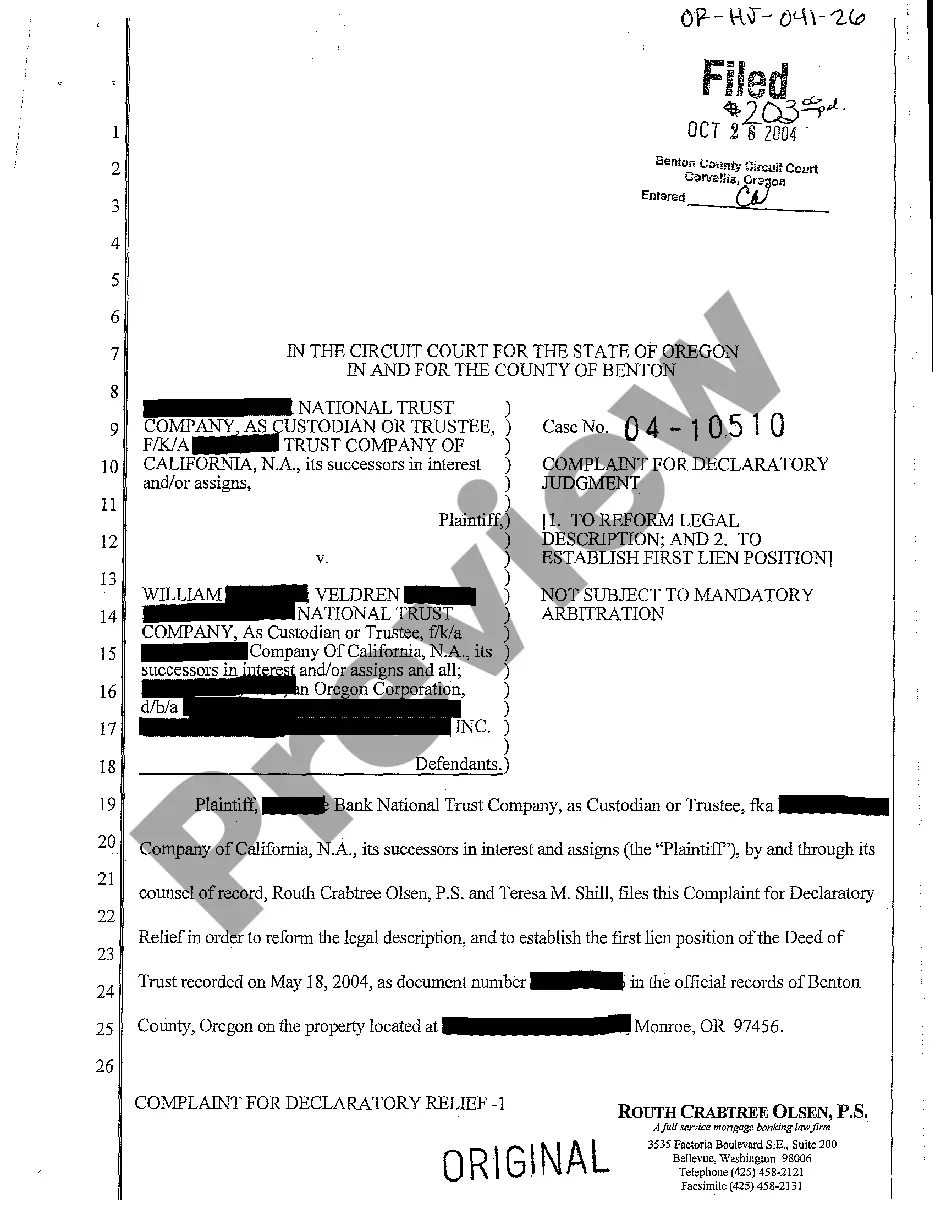

Description

How to fill out Employee Time Report (Nonexempt)?

You have the ability to devote numerous hours online attempting to discover the legal document template that aligns with the federal and state regulations you require.

US Legal Forms offers thousands of legal forms that are examined by professionals.

You can conveniently download or print the Louisiana Employee Time Report (Nonexempt) from my service.

If available, utilize the Review button to browse the document template as well. If you wish to obtain another version of the form, use the Lookup field to find the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Following that, you can complete, amend, print, or sign the Louisiana Employee Time Report (Nonexempt).

- Every legal document template you acquire belongs to you permanently.

- To obtain another copy of the acquired form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/town of choice.

- Check the template details to confirm you have selected the right form.

Form popularity

FAQ

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Exempt employees are exempt from California overtime laws. This means that, if you are an exempt employee, your employer does not need to pay you time and a half if you work: more than eight hours in a workday, or. more than 40 hours in a workweek, or. otherwise work off the clock.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Art. 84. Hours worked. Hours worked shall include (a) all time during which an employee is required to be on duty or to be at a prescribed workplace; and (b) all time during which an employee is suffered or permitted to work.

There is no legally defined number of hours for full time employment, where individual employers can decide how many hours per week are to be considered full time. The hours that workers are expected to work will usually be set out in the company working hours policy and/or within individual contracts of employment.

If an employee works, on average, more than 30 hours per week or more than 130 hours per month, this is considered full-time by IRS guidelines.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Exempt workers are exempt from overtime payso even if they work more than 40 hours in a workweek, they're not eligible for overtime pay. So, whether a salaried employee has to fill out a timesheet will come down to whether they're considered exempt or non-exempt.

(a) All full-time employees in the classified service shall have a regular schedule of 40 hours per work week. However, an appointing authority may establish an 80-hour bi-weekly work schedule for employees who are considered exempt by the Fair Labor Standards Act (FLSA).

If an employee works, on average, more than 30 hours per week or more than 130 hours per month, this is considered full-time by IRS guidelines.