Louisiana Partnership Agreement - Short Form

Description

How to fill out Partnership Agreement - Short Form?

US Legal Forms - one of many greatest libraries of lawful types in the United States - gives a variety of lawful file themes you are able to obtain or printing. Using the internet site, you may get 1000s of types for company and specific uses, categorized by categories, suggests, or key phrases.You can get the most recent versions of types much like the Louisiana Partnership Agreement - Short Form in seconds.

If you already have a membership, log in and obtain Louisiana Partnership Agreement - Short Form in the US Legal Forms library. The Obtain switch will show up on each and every type you perspective. You have access to all earlier delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share basic instructions to obtain began:

- Be sure to have picked out the best type for the town/area. Click on the Preview switch to review the form`s information. Browse the type description to actually have selected the right type.

- If the type doesn`t suit your needs, take advantage of the Research area towards the top of the screen to obtain the one which does.

- Should you be content with the shape, affirm your option by simply clicking the Purchase now switch. Then, select the rates strategy you want and offer your references to sign up to have an account.

- Process the financial transaction. Utilize your bank card or PayPal account to accomplish the financial transaction.

- Pick the structure and obtain the shape on your own device.

- Make modifications. Fill out, change and printing and sign the delivered electronically Louisiana Partnership Agreement - Short Form.

Every design you included with your money lacks an expiry day and is also your own property permanently. So, in order to obtain or printing yet another version, just check out the My Forms segment and then click around the type you will need.

Obtain access to the Louisiana Partnership Agreement - Short Form with US Legal Forms, one of the most extensive library of lawful file themes. Use 1000s of skilled and state-distinct themes that fulfill your company or specific requirements and needs.

Form popularity

FAQ

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.

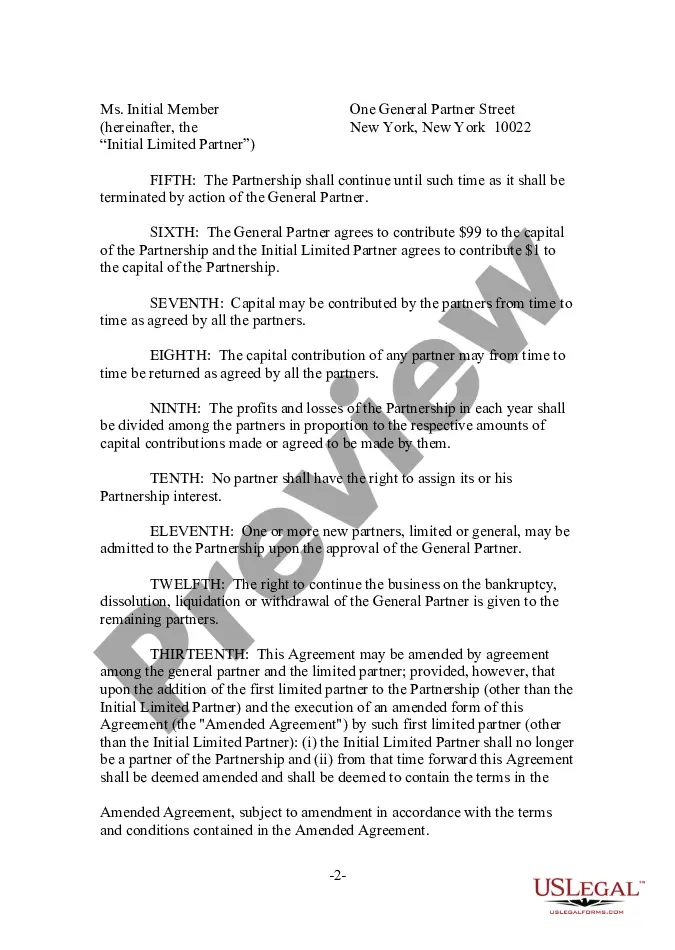

A typical partnership agreement will set out the agreed rules by which the partnership operates, and deals with matters including: Sharing of income and capital profits between the partners. Capital contributions required and made by the partners.

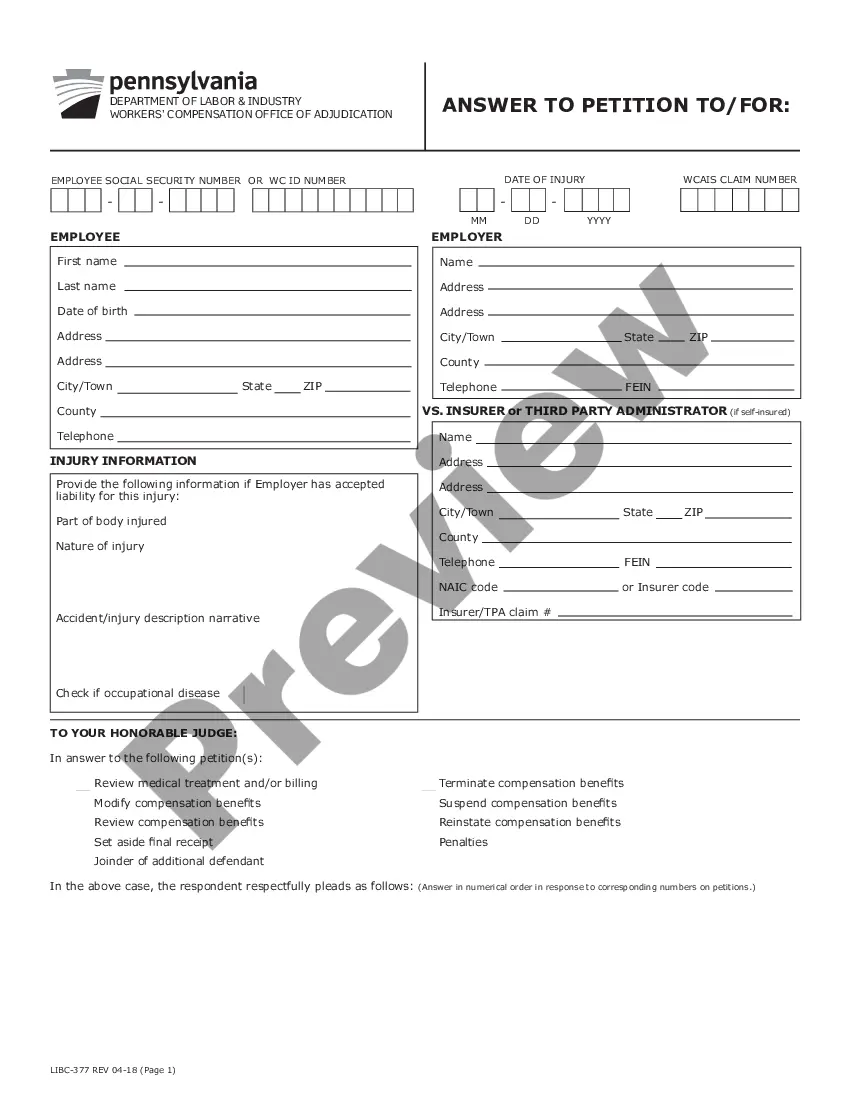

Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income. Partners who are themselves partnerships are required to file all applicable Louisiana tax returns.

A limited partnership agreement helps protect your business into the future by outlining each partner's roles and responsibilities, as well as how they share in the business profits. You should use a limited partnership agreement if you want to form a limited partnership or formalize an existing limited partnership.

What does Limited partnership agreement (LPA) mean? Written agreement between the general partner(s) and limited partners to a limited partnership setting out the rights and duties of the partners between themselves.

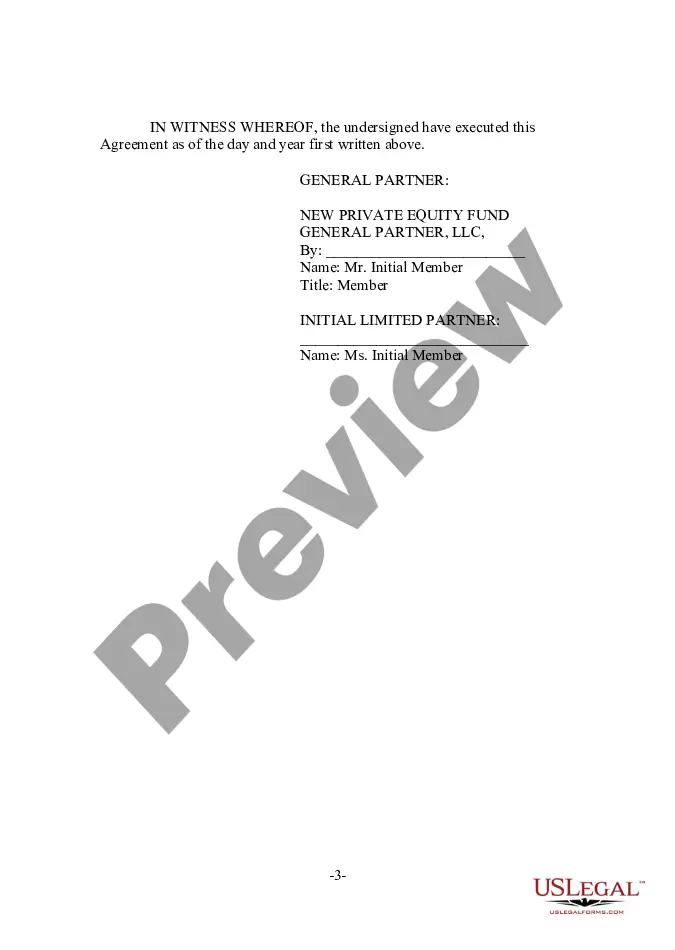

Use the following steps to draft a partnership agreement: Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

Domestic partners may establish the existence of their domestic partnership by executing and filing an original declaration of domestic partnership with the clerk of council and paying the required registration fee.

Steps to Create a Louisiana General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Louisiana state tax identification numbers.