Louisiana Pot Testamentary Trust

Description

How to fill out Pot Testamentary Trust?

If you wish to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the website's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal use are categorized by types and suggestions, or keywords.

Step 4. After you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and submit your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the payment.

- Utilize US Legal Forms to locate the Louisiana Pot Testamentary Trust with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Louisiana Pot Testamentary Trust.

- You can also access forms you have previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to examine the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A testamentary trust (a trust established by will after death) is subject to tax at graduated income tax rates. Conversely, an inter vivos trust (a trust created during a settlor's lifetime) is taxed at the highest marginal tax rate applicable to individuals (currently 43.7% in BC).

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

The main benefits of testamentary trusts are their ability to protect assets and to reduce tax paid by beneficiaries from income earned from the inheritance.

Since the income earned within a testamentary trust is taxed on a separate tax return at graduated tax rates, an income- splitting opportunity arises for your beneficiaries. For example, let's assume an adult child is in the top marginal tax bracket of approximately 46% (top marginal tax rate varies by province).

Currently, taxable income earned in a testamentary trust is subject to the same graduated tax rates as an individual taxpayer (this is subject to change after December 31, 2015).

The adult pays the top marginal tax rate on their non-inheritance income. the beneficiaries of the testamentary trust include three. the low income rebate applies to the distributions to minors and. the inheritance earns income of $60,000 per annum.

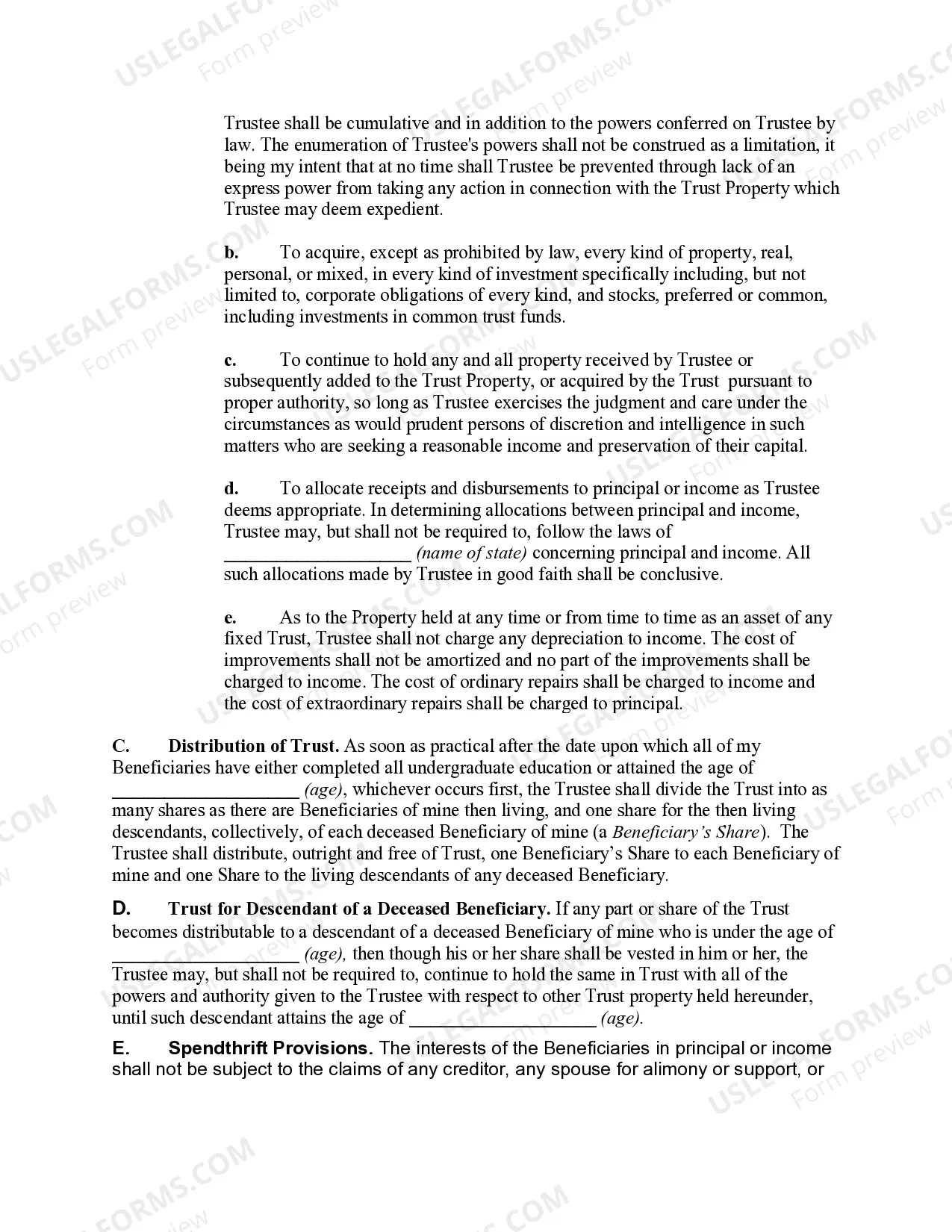

A testamentary trust is set up in a person's will and starts upon their death. It holds and protects all, or some, of the person's assets such as property and investments. The trust looks after the assets for the beneficiaries. Beneficiaries are the people or organisations that will benefit from the trust.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.