Louisiana Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

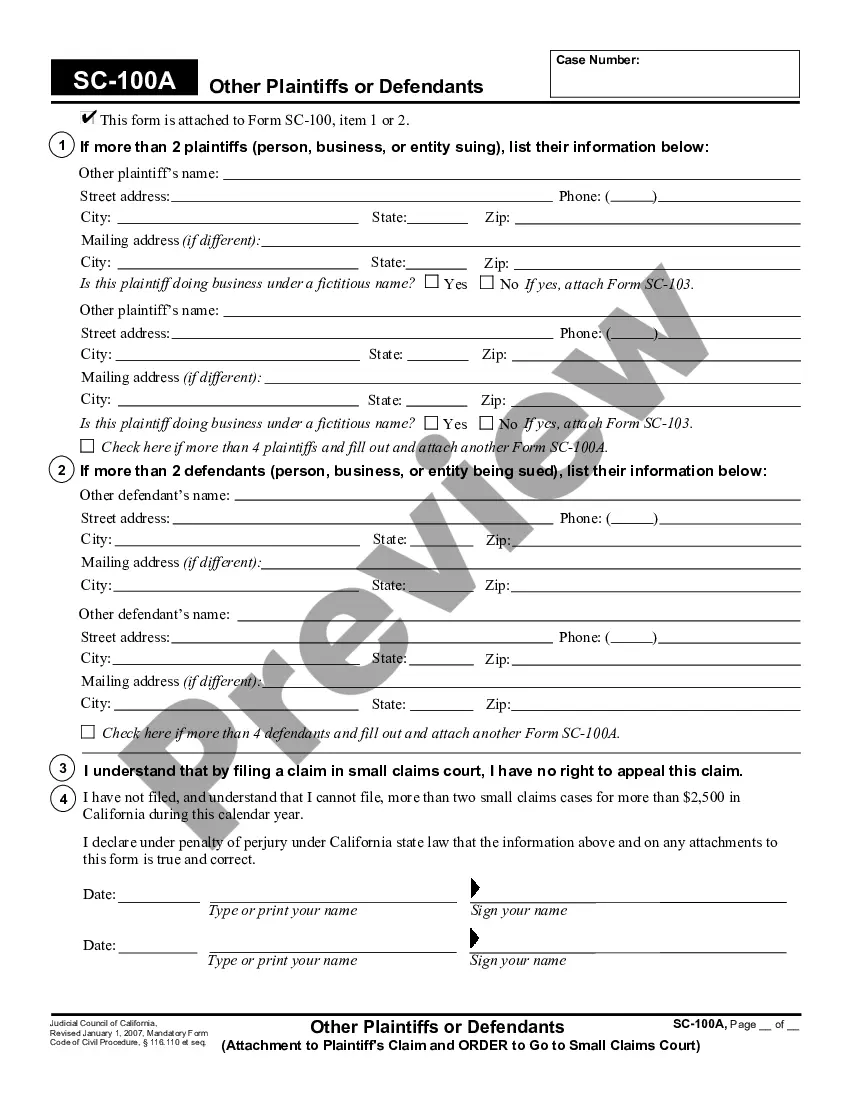

How to fill out Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

US Legal Forms - one of the leading collections of legal forms in the country - provides a vast assortment of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords.

You can find the latest versions of forms such as the Louisiana Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement within minutes.

Review the form summary to ensure you have selected the right one.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you already have an account, Log In and download the Louisiana Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement from your collection on US Legal Forms.

- The Download button will appear on every form that you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are some simple steps to help you get started.

- Make sure to select the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

QBI also includes the estate's or trust's share of items of income, gain, deduction, and loss from trades or business conducted by partnerships (other than PTPs), S corporations, and other estates or trusts.

Key TakeawaysTrust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

According to the IRS, gifts, inheritances, and bequests are generally not considered taxable income for recipients. If you receive property that produces income, though, such as dividends or IRA distributions, that income will be taxable to you.

Estates and trusts. Generally, a non-grantor trust or estate may either claim the QBI deduction or provide information to their beneficiaries.

Trusts: allocating income to beneficiaries but taxed to trust. The basic rules are as follows: If any of the trust's income is payable in a taxation year to a beneficiary, that amount is deductible in computing the trust's income for year. The amount payable is then included in the beneficiary's income.

After money is placed into the trust, the interest it accumulates is taxable as incomeeither to the beneficiary or the trust. The trust is required to pay taxes on any interest income it holds and doesn't distribute past year-end. Interest income the trust distributes is taxable to the beneficiary who gets it.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

When the trustee of a trust makes a trust fund distribution to beneficiaries containing trust income, the trustee will usually deduct the distribution amount from the trust's tax return and provide the beneficiary with a K-1 tax form, which is specific to trusts and distinguishes between how much of a beneficiary's

Section 199A does apply to non-grantor trusts and its beneficiaries. The taxable income threshold amounts follow that of single individuals.

A simple trust must distribute all of its trust accounting income (or FAI) annually, either under the terms of the document or under state law. A complex trust doesn't have to distribute all of its income or make principal distributions.