Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolution Selecting Depository Bank For Corporation And Account Signatories?

If you need to finalize, obtain, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

Different templates for business and individual purposes are organized by categories and jurisdictions, or keywords. Use US Legal Forms to find the Louisiana Resolution Choosing Depository Bank for Corporation and Account Signatories within a few clicks.

Every legal document template you download is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Louisiana Resolution Choosing Depository Bank for Corporation and Account Signatories with US Legal Forms. There are millions of professional and state-specific forms available for your business or individual needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Louisiana Resolution Choosing Depository Bank for Corporation and Account Signatories.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate region/state.

- Step 2. Use the Review option to check the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the checkout process. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Louisiana Resolution Choosing Depository Bank for Corporation and Account Signatories.

Form popularity

FAQ

MDI in banking, or Minority Depository Institution, represents a category of banks that prioritize serving minority communities. These institutions play a key role in enhancing financial access and addressing the needs of underrepresented groups. Exploring the advantages of MDIs can be beneficial for your corporation during the Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories.

In the realm of finance, MDI stands for Minority Depository Institution, meaning these organizations work to expand access to banking for underrepresented populations. MDIs contribute to economic opportunity and community development, making them vital in creating a more equitable financial landscape. When considering the Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, MDIs can provide valuable support and services.

Banks that are not FDIC insured typically include credit unions and certain state-chartered banks that choose not to participate in the program. Online lenders and investment banks may also fall under this category. It is crucial to be cautious when selecting a bank, especially in the context of Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, to ensure your funds are properly secured.

To determine if a bank is FDIC insured, you can check the bank's official website or look for the FDIC logo displayed at the bank's physical location. Additionally, the FDIC provides a tool on its website where you can search for insured institutions. Selecting an FDIC-insured bank is a key consideration during the Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories process.

In banking, MDI refers to a Minority Depository Institution. These institutions are crucial for promoting financial services within minority communities. When considering the Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, MDIs can offer unique advantages in community engagement and service familiarity.

FDIC-approved banks are those institutions that have insurance from the Federal Deposit Insurance Corporation. This insurance protects depositors by ensuring that their deposits are safe up to a certain limit. When you engage in Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, it is wise to choose an FDIC-approved bank to safeguard your corporation's assets.

MDI stands for Minority Depository Institution. These banks and credit unions are dedicated to serving the needs of minority populations and fostering economic development. Understanding MDIs is essential in the context of Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, as they play a crucial role in ensuring equitable access to banking services.

An MDI credit union is a minority depository institution credit union that provides banking services to underrepresented communities. These institutions focus on serving people from diverse backgrounds and promoting financial inclusion. When considering the Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, partnering with an MDI credit union can enhance your commitment to community support.

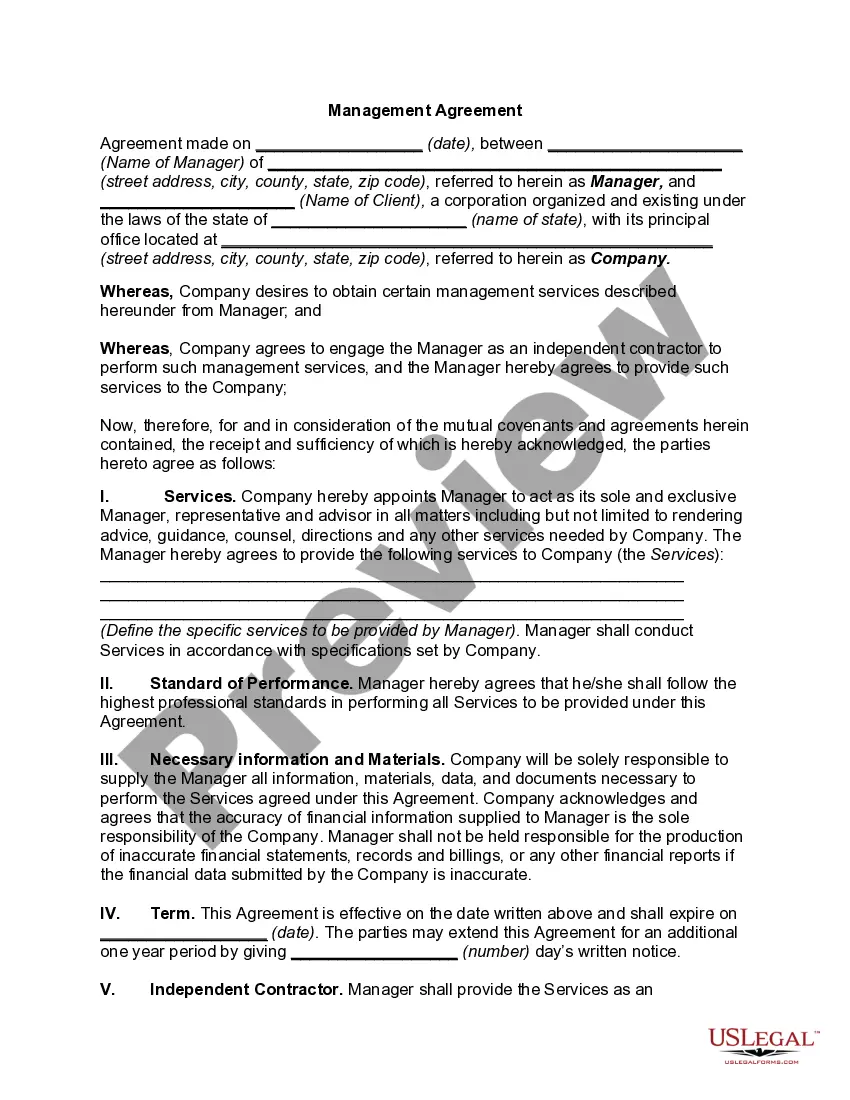

A corporate resolution is any formal decision made by a corporation's board of directors or shareholders regarding the management of the company. This document typically outlines key actions, such as appointing officers, authorizing contracts, or managing financial accounts. Incorporating a well-defined Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories supports clarity and legal compliance in your corporate governance.

A resolution to add a bank signatory is a formal document that authorizes a new individual to have signing authority on the corporation’s bank accounts. This resolution must state the specific powers granted to the signatory and often requires approval from the board of directors. By creating a clear Louisiana Resolution Selecting Depository Bank for Corporation and Account Signatories, you can streamline the process and ensure all parties are informed.