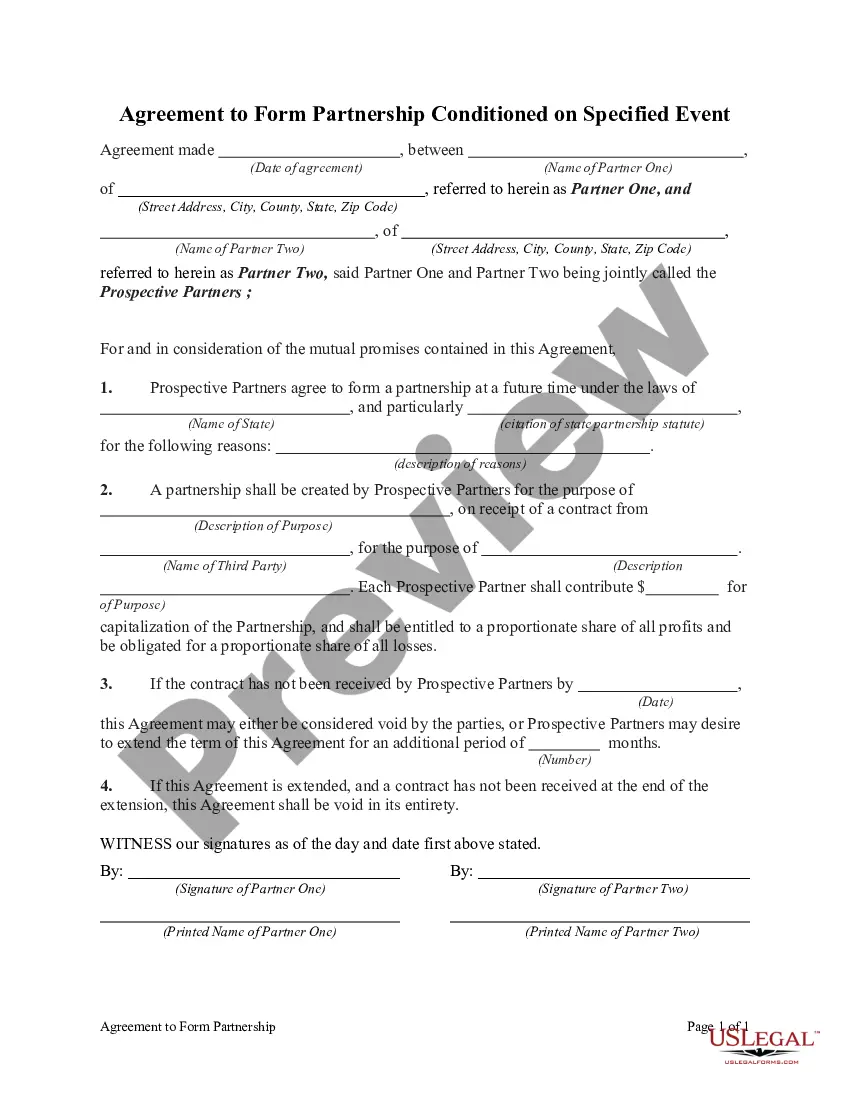

Louisiana Agreement to Form Partnership in the Future in Order to Carry Out a Contract to be Obtained

Description

How to fill out Agreement To Form Partnership In The Future In Order To Carry Out A Contract To Be Obtained?

Finding the appropriate legal document template can be a challenge.

Certainly, there are a multitude of templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Louisiana Agreement to Form Partnership in the Future in Order to Execute a Contract to be Obtained, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your city/region. You can view the form using the Preview button and read the form details to verify it is suitable for your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to download the Louisiana Agreement to Form Partnership in the Future in Order to Execute a Contract to be Obtained.

- Use your account to browse the legal forms you may have acquired previously.

- Navigate to the My documents section of your account and retrieve another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

Form popularity

FAQ

Filing Requirements Louisiana Revised Statute 1.1(F)(4) requires the electronic filing of all composite partnership returns.

Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income. Partners who are themselves partnerships are required to file all applicable Louisiana tax returns.

Partnerships and corporations have different standards for filing an information return or income tax return. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes.

Under a partnership, you'll need to submit a tax return both for your business, and an individual return as a partner of the business, allowing you to separate business expenses and deductions from private expenses.

Except as provided below, every domestic partnership must file Form 1065, unless it neither receives income nor incurs any expenditures treated as deductions or credits for federal income tax purposes.

Any partnership doing business in Louisiana or deriving any income from sources therein, regardless of the amount and regardless of the residence of the partners, must file a Partnership Return of Income, Form IT-565 if any partner is a nonresident of Louisiana or if any partner is not a natural person.

Louisiana will recognize and accept the federal extension authorizing the same extended due date as the federal. Attach a copy of your federal application, Federal Form 7004, to your completed Louisiana return. If you do not have a federal extension, you should use this form to apply for a state extension.

FILING REQUIREMENTSLouisiana Revised Statute 1.1(F)(4) requires the electronic filing of all composite partnership returns. If tax credits are claimed on the composite return: ALL nonresident partners must be included on the return and on Schedule of Included Partner's Share of Income and Tax.

Partners who are corporations are required to file Form CIFT-620 to report any partnership income. Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income. Partners who are themselves partnerships are required to file all applicable Louisiana tax returns.

States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.