Louisiana Revocable Trust for House

Description

How to fill out Revocable Trust For House?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site’s user-friendly search feature to locate the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to effortlessly find the Louisiana Revocable Trust for Home in just a few clicks.

Every legal document template you obtain is yours indefinitely. You can access all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Louisiana Revocable Trust for Home with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Louisiana Revocable Trust for Home.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

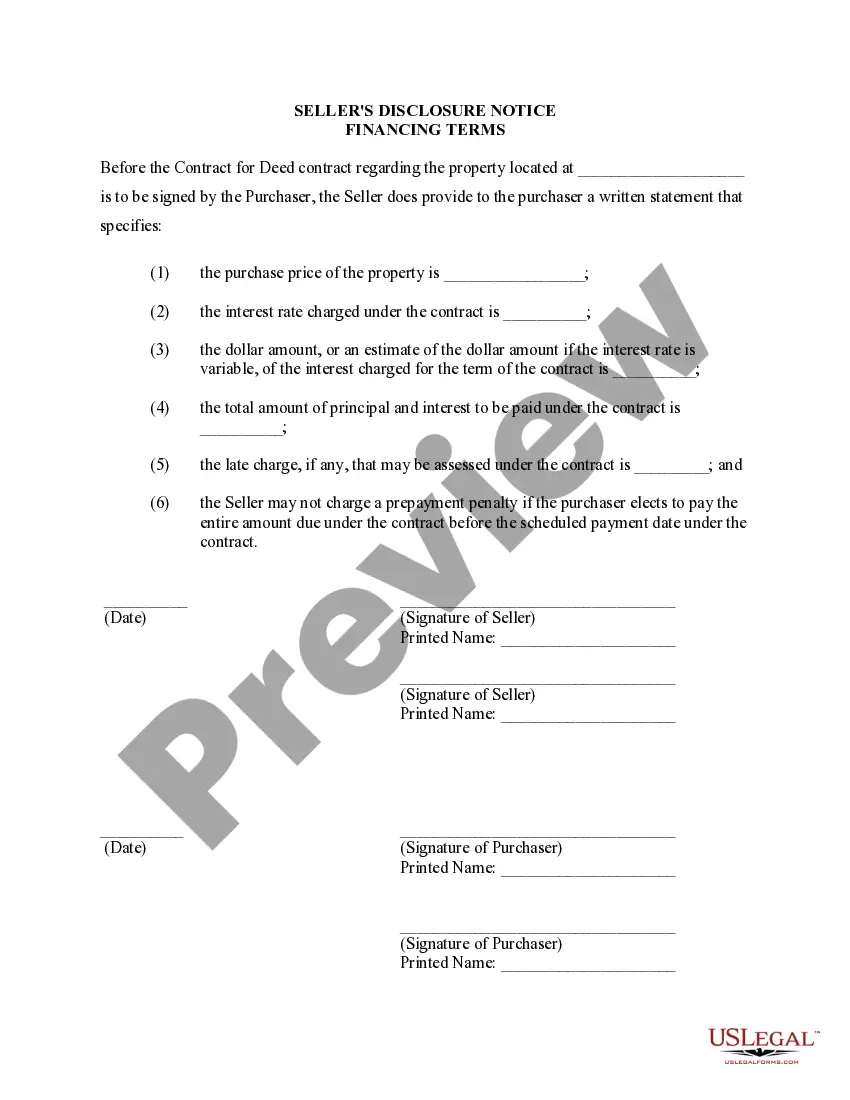

- Step 2. Use the Review option to examine the content of the form. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Louisiana Revocable Trust for Home.

Form popularity

FAQ

While many assets can benefit from a Louisiana Revocable Trust for House, certain assets may not be ideal for inclusion. For example, retirement accounts like IRAs usually require special considerations and should generally remain outside the trust. Additionally, assets that have designated beneficiaries, like life insurance policies, should not be placed in the trust as doing so can complicate the transfer process. It's wise to evaluate each asset carefully and consult experts when considering trust arrangements.

Yes, you can place a house with a mortgage in a Louisiana Revocable Trust for House. In doing so, it is crucial to inform your lender about the trust. The mortgage does not disappear when you transfer the property, but it remains in effect. By placing your home in the trust, you can ensure a smoother transition of assets to your beneficiaries without the need for probate.

Deciding whether to gift a house or place it in a Louisiana Revocable Trust for House depends on your personal goals. Gifting can simplify ownership transfer, but it may have tax implications that you should consider. In contrast, placing the house in a trust allows you to maintain control while still providing for future management and distribution. Evaluating your situation with a professional can guide you to the best choice.

A key disadvantage of a trust, including a Louisiana Revocable Trust for House, is the potential administrative burden it can impose. Managing a trust requires time and effort, as trustees must keep accurate records and adhere to specific regulations. Additionally, if the trust's terms are misinterpreted or poorly communicated, it can lead to conflicts among beneficiaries, detracting from the trust's intended benefits.

One major mistake parents often make when setting up a trust fund is neglecting to fund the trust properly. Even if they establish a Louisiana Revocable Trust for House, failing to transfer assets into the trust renders it ineffective. Regularly reviewing and updating the trust is crucial, as changing family dynamics and financial situations can affect its relevance and effectiveness.

If your parents own significant assets or wish to ensure a smooth transition of those assets after their passing, establishing a Louisiana Revocable Trust for House can be beneficial. It allows them more control over how their assets are managed and distributed. Furthermore, it helps avoid the lengthy probate process, making it easier for heirs to access the property and resources.

Placing a house in a Louisiana Revocable Trust for House provides several advantages, primarily avoiding probate. This can simplify the transfer of property upon death and enhance privacy regarding the estate. Additionally, it allows for more efficient management during your lifetime and provides a clear structure for your heirs, minimizing potential conflicts.

While placing your home in a Louisiana Revocable Trust for House offers benefits, disadvantages include potential tax implications and limited control. Once the home is in the trust, you cannot sell or lease it without following specific procedures. Moreover, some homeowners worry that transferring their property may affect their homeowner's insurance or eligibility for certain government benefits.

A common disadvantage of a family trust, such as a Louisiana Revocable Trust for House, is the complexity it can introduce into estate planning. Some families may struggle with the intricacies of managing a trust, which could lead to disagreements among family members. Furthermore, if the trust is not updated regularly, it may not reflect current family dynamics or intentions, which can create additional issues.

The best option for holding your house may be a Louisiana Revocable Trust for House, particularly if you want flexibility and control over your property during your lifetime. This type of trust allows you to make changes or revoke it anytime. It also facilitates an easier transfer of your property to heirs upon your passing, minimizing complications. Always consider your specific needs and consult a professional for tailored advice.