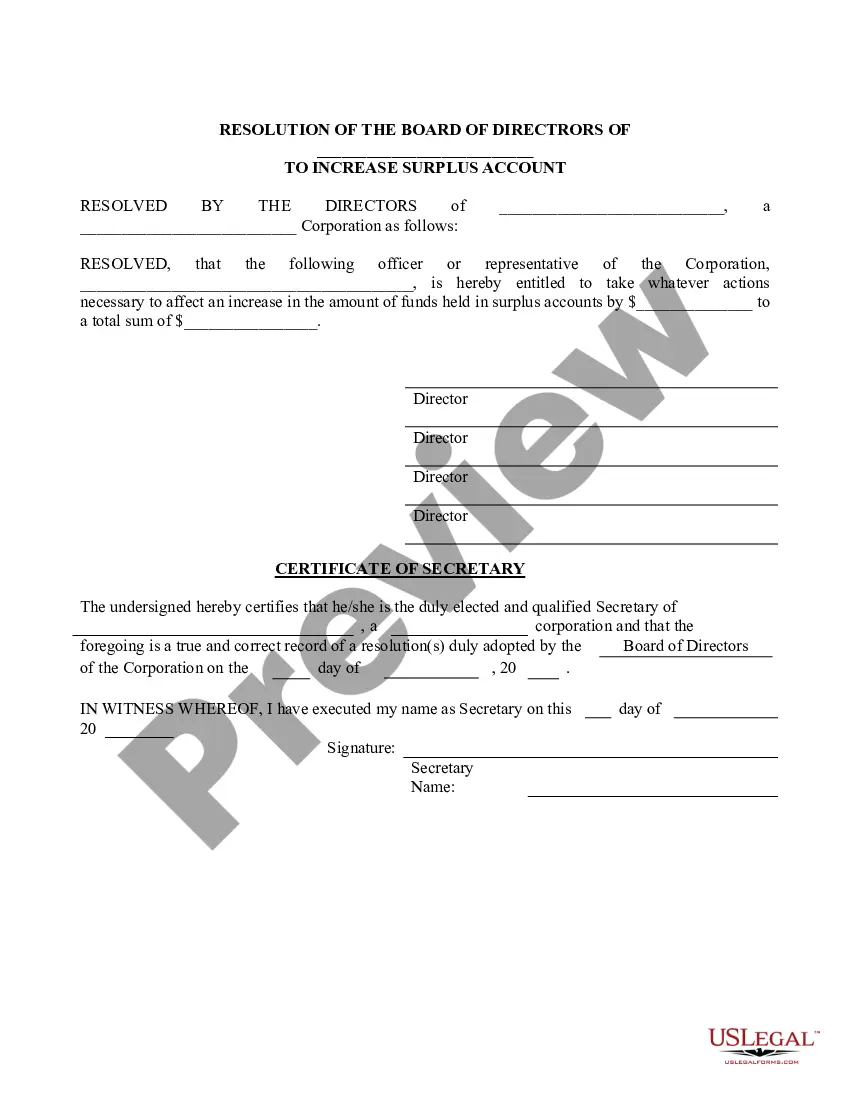

Louisiana Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

You can dedicate hours online trying to locate the legal documents template that complies with the federal and state regulations you require.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can download or print the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions from the service.

Examine the form description to make sure you have selected the correct form. If available, take advantage of the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions.

- Each legal document template you obtain is yours permanently.

- To acquire another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

Form popularity

FAQ

While the specific corporate tax rate in Louisiana for 2025 is not yet finalized, it is expected to follow a similar rate structure to previous years. Keep an eye on any proposed legislation that may influence these rates. Effectively planning for potential changes can enhance your corporate financial strategies. The Louisiana Increase Dividend - Resolution Form - Corporate Resolutions can help facilitate this preparation.

The Louisiana corporate tax rate is structured into brackets to reflect the corporation's income. For 2024, rates range from 3 percent to 8 percent, based on the amount of income earned. Understanding these rates can significantly affect your financial strategy. For detailed guidance, consider utilizing the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions.

In Louisiana, the primary corporate income tax form is the Form C, also known as the Louisiana Corporation Income and Franchise Tax Return. Corporations must accurately complete this form to report income and calculate taxes owed. This compliance is crucial to avoid penalties and interest. Refer to the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions for additional insights and assistance.

Recent changes in Louisiana corporate income tax laws aim to simplify compliance and improve overall tax fairness. This includes adjustments in rates and brackets, which may impact your corporate tax liabilities. Staying updated on these changes is essential for financial planning. Using the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions will help you align your resolutions with current regulations.

For 2024, Louisiana’s corporate tax rate varies based on income brackets. The rates can be as low as 3 percent for lower-income corporations, up to a maximum of 8 percent for high-income entities. This structure encourages corporate growth while ensuring fairness. When considering tax strategy, the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions can be very beneficial.

In Louisiana, the state tax rate for corporations in 2024 is structured with a progressive system. The maximum rate can reach up to 8 percent, depending on the income level. It's important to stay informed of these rates when planning your corporate strategy. Utilize the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions to navigate these tax considerations.

The federal corporate income tax rate for 2024 remains at a flat rate of 21 percent. This rate applies to all corporations, regardless of size, making tax planning more straightforward. Understanding your obligations allows you to better prepare your corporate resolutions. For comprehensive resources, check out the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions.

Yes, Louisiana accepts federal extensions for corporate taxes. If your corporation files for a federal extension, Louisiana allows you to use that as a basis for an extension of time to file your state corporate taxes. This helps you avoid late fees and penalties. To ensure compliance, consult the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions.

A corporate resolution for signing authority is a specific type of resolution that designates individuals within the company who are authorized to execute documents on behalf of the corporation. This resolution ensures that only approved personnel can commit the corporation to contractual obligations and other legally binding decisions. Utilizing the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions can help establish clear signing authorities and enhance operational governance.

A certified copy of resolution is an official duplicate of the corporate resolution that has been verified and attested by an authorized corporate officer. This certified document is essential for legal purposes, proving that the resolution was properly enacted by the governing body. When using the Louisiana Increase Dividend - Resolution Form - Corporate Resolutions, obtaining a certified copy adds credibility to your corporate documentation.