Washington Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Employ the site's straightforward and effective search feature to locate the documents you require.

A broad range of templates for business and personal purposes are categorized by types and jurisdictions or keywords. Use US Legal Forms to find the Washington Shareholders' Agreement with Special Distribution of Dividends among Shareholders in a Close Corporation in just a few clicks.

Every legal document template you purchase is yours forever. You can access every form you have acquired in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Washington Shareholders' Agreement with Special Distribution of Dividends among Shareholders in a Close Corporation with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- In case you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the Washington Shareholders' Agreement with Special Distribution of Dividends among Shareholders in a Close Corporation.

- You can also access forms you have previously obtained from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

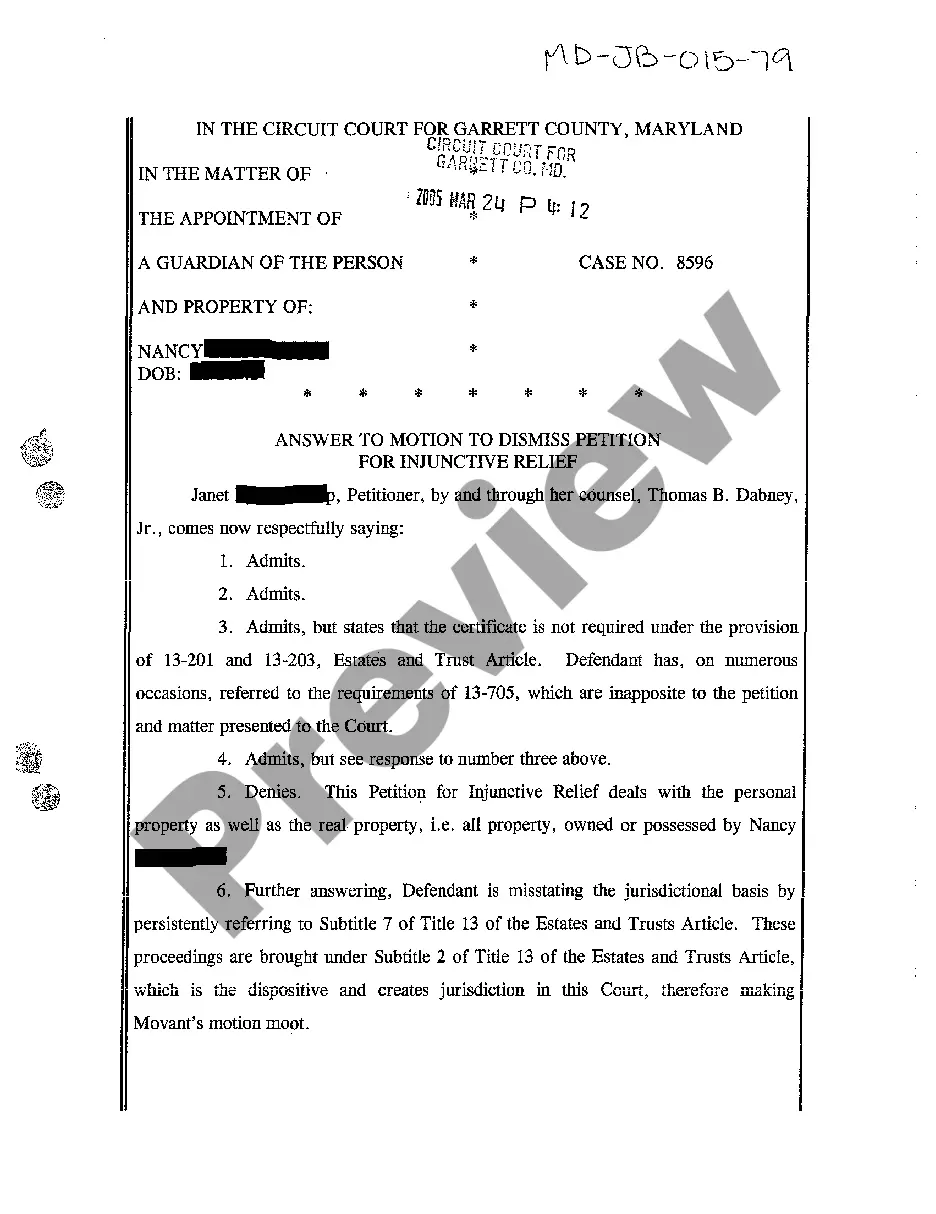

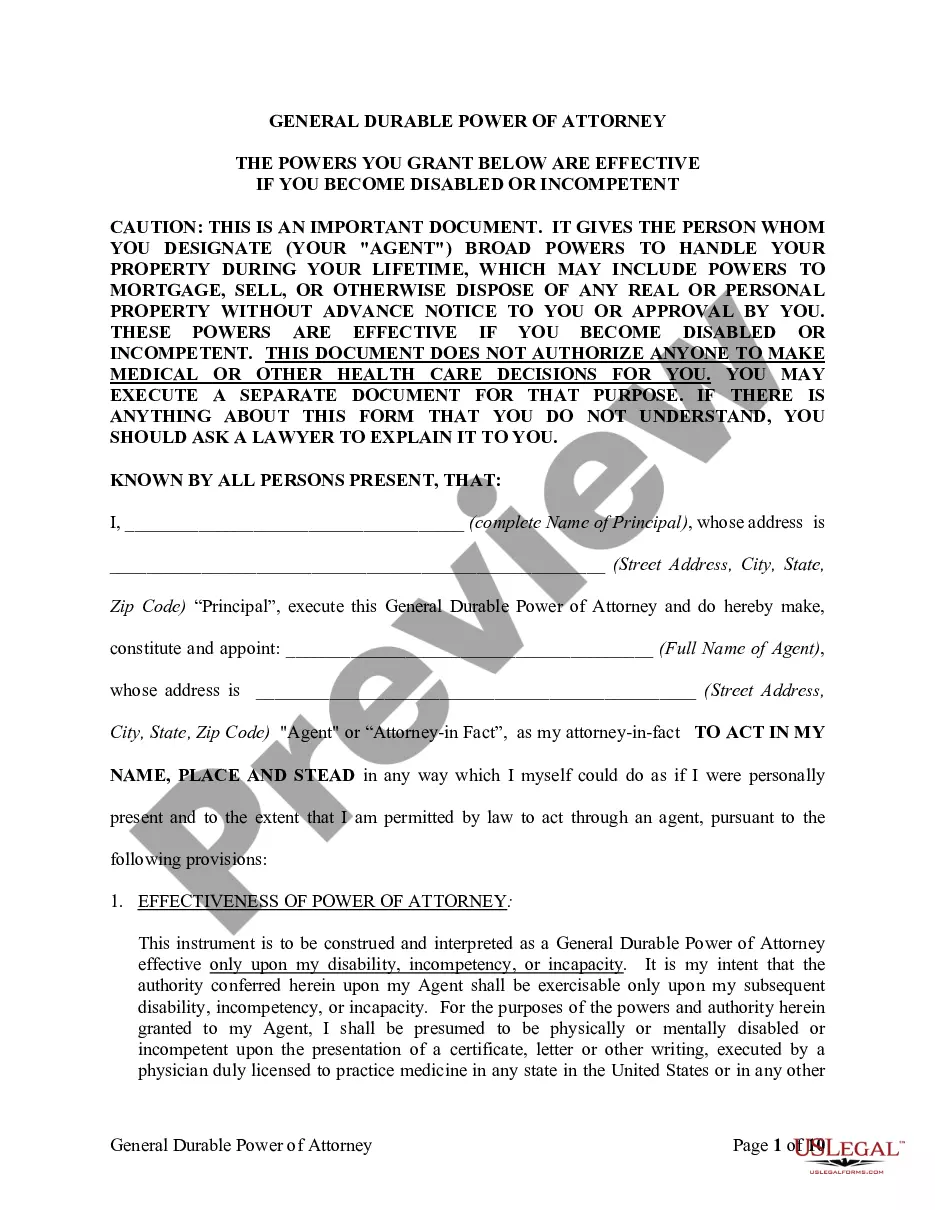

- Step 2. Utilize the Review option to examine the form's details. Don't forget to read the overview.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing option you prefer and provide your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Washington Shareholders' Agreement with Special Distribution of Dividends among Shareholders in a Close Corporation.

Form popularity

FAQ

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

The MOI automatically binds new shareholders without their explicit agreement, while a Shareholders Agreement needs to be agreed to before being binding.

A Medium of Instruction Certificate (MOI) is the certificate which states the language in which you completed your degree education. It is not necessary that the instruction language is the official language of the country or state.

The term MOI is an abbreviation for Memorandum of Incorporation. It is a document that sets out the rights, duties and responsibilities of shareholders, directors and other persons involved in a company.

A Partnership Agreement sets out information such as business objective, management, funding, responsibilities and obligations of each Partner, and dispute management. A shareholder is someone who owns a share in a company.

Shareholders and directors have two completely different roles in a company. The shareholders (also called members) own the company by owning its shares and the directors manage it. Unless the articles say so (and most do not) a director does not need to be a shareholder and a shareholder has no right to be a director.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

Key Takeaways Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, dividends, the right to inspect corporate documents, and the right to sue for wrongful acts.

The most important document governing a company is the Memorandum of Incorporation (MOI). The MOI sets out the rules governing the conduct of the company, as specified by its owners.