Hawaii Standard Terms and Conditions for Merchandise Warehouses

Description

How to fill out Standard Terms And Conditions For Merchandise Warehouses?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal document templates that you can download or create.

By using the website, you will find numerous forms for business and personal use, organized by categories, states, or keywords. You can quickly access the latest iterations of documents like the Hawaii Standard Terms and Conditions for Merchandise Warehouses.

If you already possess a membership, Log In and download the Hawaii Standard Terms and Conditions for Merchandise Warehouses from your US Legal Forms collection. The Download option will be visible on every form you view. You have the ability to access all previously acquired forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Hawaii Standard Terms and Conditions for Merchandise Warehouses.

Every template you added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or produce another copy, simply visit the My documents section and click on the document you need.

- If you want to use US Legal Forms for the first time, here are simple guidelines to help you begin.

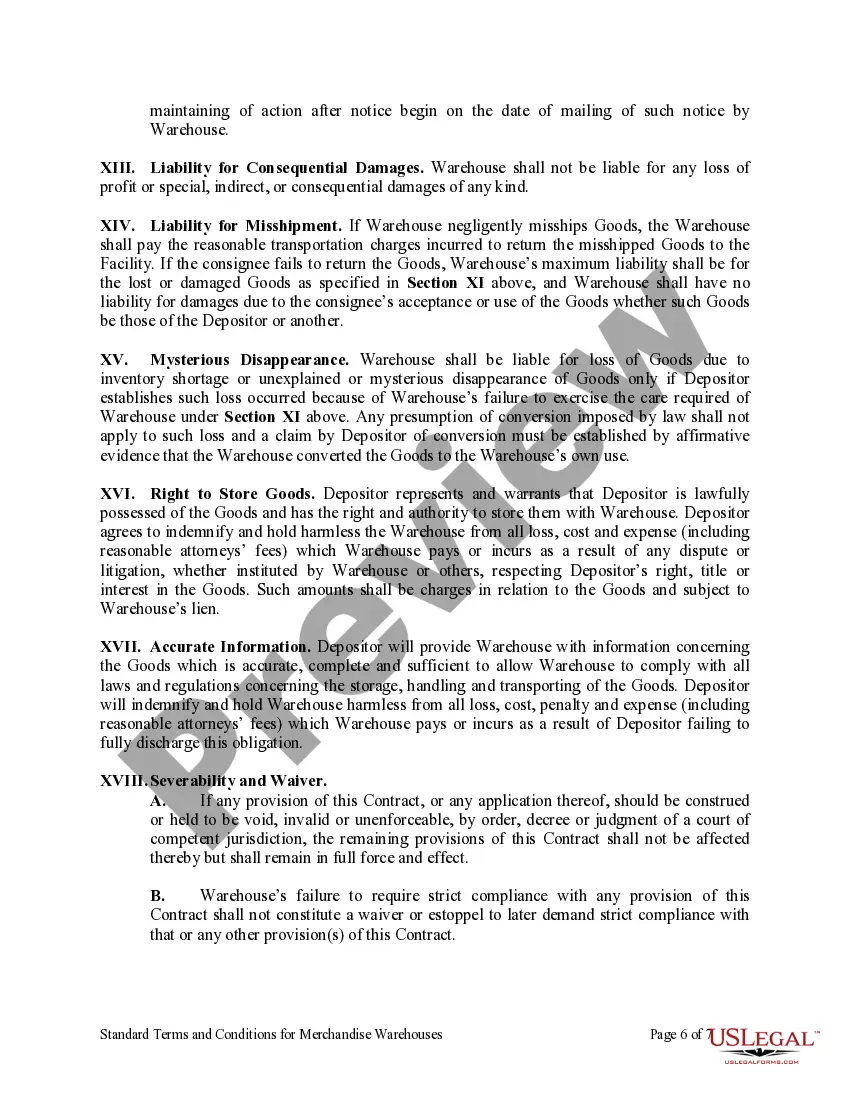

- Ensure you have selected the correct form for the region/state. Click on the Preview option to review the content of the form. Read the form's description to confirm you have chosen the correct document.

- If the form does not satisfy your needs, use the Search field at the top of the page to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the transaction.

- Select the format and download the document to your device.

Form popularity

FAQ

You can create terms and conditions for your business by drafting them based on your specific operations and legal requirements. Alternatively, consider using reputable online platforms such as US Legal Forms, which provide templates specifically designed for Hawaii Standard Terms and Conditions for Merchandise Warehouses. These resources help ensure that your terms are compliant and comprehensive.

To file the Hawaii G-49, gather your business records and revenue figures for the year. You can submit the G-49 either through traditional mail or online via the Hawaii Department of Taxation's portal. Keep your Hawaii Standard Terms and Conditions for Merchandise Warehouses on hand to reference any relevant transactions as you complete the form.

Yes, businesses in Hawaii often need to file both the G45 and G49 forms, depending on their activities. The G45 is filed quarterly, while the G49 is an annual summary of your gross income reported during the year. Understanding your Hawaii Standard Terms and Conditions for Merchandise Warehouses will help ensure compliance during these filings.

The G-49 tax form is a general excise tax return filed by businesses operating in Hawaii. This form reports the income generated from sales and services, helping the state assess appropriate taxes. Familiarizing yourself with your Hawaii Standard Terms and Conditions for Merchandise Warehouses can aid you in accurately reporting revenue.

To file the G49 Hawaii tax form online, you can access the State of Hawaii Department of Taxation's e-filing system. Fill out the required information accurately, including any details related to your Hawaii Standard Terms and Conditions for Merchandise Warehouses. This online system simplifies the submission process and provides confirmation of your filing.

Yes, you can file your Hawaii state tax online through the Department of Taxation's official website. This process is convenient and allows you to complete your filing efficiently. Ensure you have all necessary documentation, such as your Hawaii Standard Terms and Conditions for Merchandise Warehouses, to facilitate smooth submissions.