Washington Shareholders Agreement - Short Form

Description

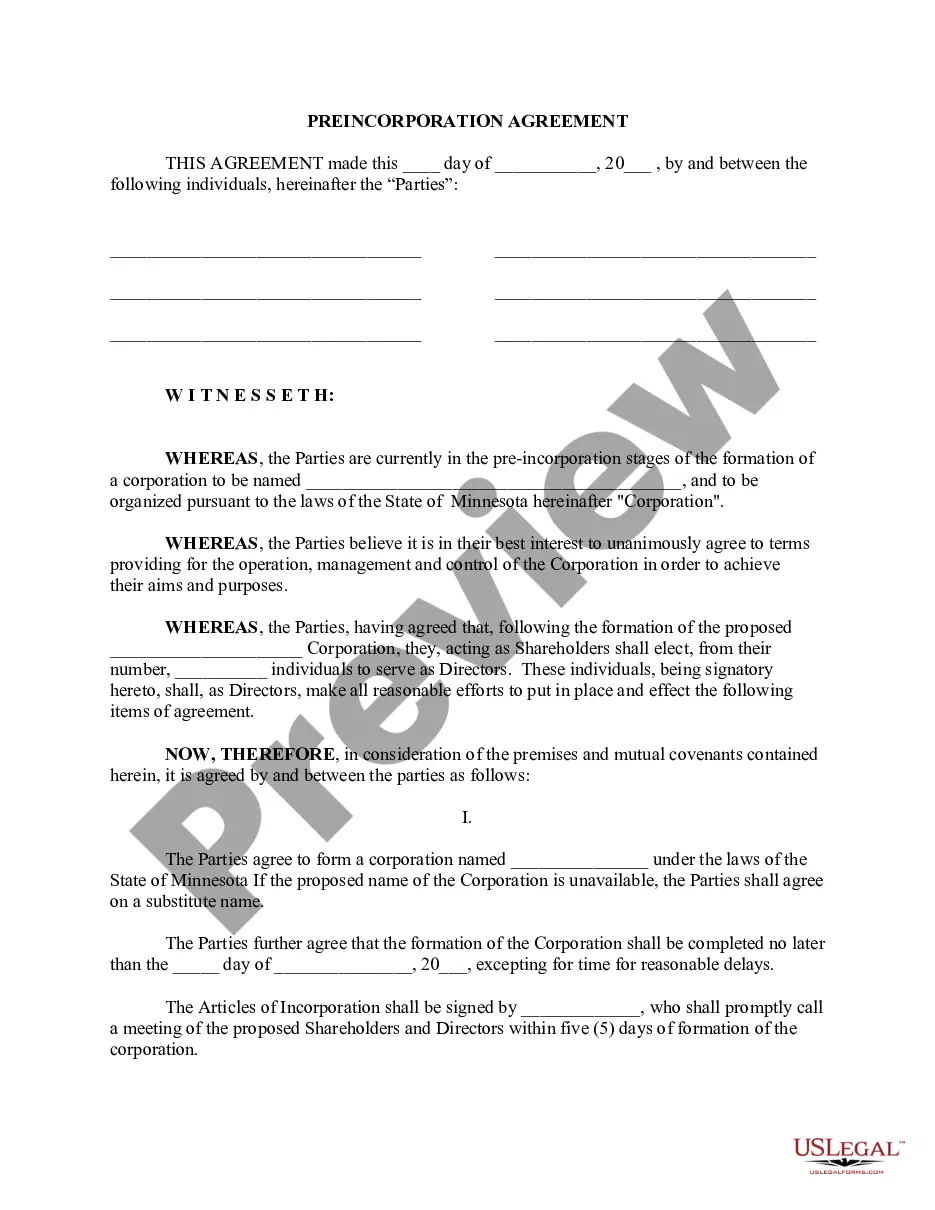

How to fill out Shareholders Agreement - Short Form?

It is feasible to invest hours online trying to locate the authentic document template that satisfies the federal and state requirements you seek.

US Legal Forms offers numerous authentic forms that have been evaluated by experts.

You can easily access or print the Washington Shareholders Agreement - Short Form from the service.

To find another variation of the form, utilize the Search field to identify the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Washington Shareholders Agreement - Short Form.

- Each authentic document template you acquire belongs to you permanently.

- To obtain an additional copy of any acquired form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

Filing an S corporation in Washington State requires you to submit the articles of incorporation to the Secretary of State and ensure compliance with state business regulations. After successfully setting up your S corp, the next step involves filing for S corporation status with the IRS using Form 2553. Consider incorporating a Washington Shareholders Agreement - Short Form at this stage to define shareholder roles and responsibilities clearly.

To start an AC corporation in Washington State, follow state guidelines by first choosing a name and then registering that name with the Secretary of State. You'll need to prepare and file your articles of incorporation, as well as draft a Washington Shareholders Agreement - Short Form to establish governance and shareholder relations. Consulting with a legal platform could help streamline this process.

Yes, you can file for an S corporation yourself by completing the required forms with the IRS and your state government. However, this process can become complex, especially regarding maintaining compliance and tax filings. Utilizing a Washington Shareholders Agreement - Short Form can simplify governance issues, and using platforms like uslegalforms can help you manage the necessary paperwork more efficiently.

Starting an AC corporation in Washington State involves several steps. First, select a name that reflects your business and meets state regulations. Next, file the necessary documents with the Washington Secretary of State, and create a Washington Shareholders Agreement - Short Form to align the interests and duties of shareholders. This agreement is crucial for smooth operations and governance.

To start your own C corporation, begin by choosing a unique name for your business that complies with state regulations. You'll also need to file articles of incorporation with the Washington Secretary of State and create bylaws that govern your corporation. Additionally, establishing a Washington Shareholders Agreement - Short Form can clarify ownership rights and responsibilities, providing a solid foundation for your C corp.

The minimum income for an S corporation does not have a specific threshold; however, it's essential for such a business to generate enough profit to cover expenses and provide a reasonable salary for its owner or shareholders. An S corp can be a beneficial structure for maximizing tax advantages, especially when paired with a Washington Shareholders Agreement - Short Form. Always consider consulting a tax professional to understand the best approach for your situation.

A shareholders agreement should include details such as the responsibilities of shareholders, voting rights, and procedures for selling shares. Don't forget to specify how disputes will be resolved and the method for amending the agreement. Including these elements in your Washington Shareholders Agreement - Short Form helps create a solid foundation for business operations.

Writing a Washington Shareholders Agreement - Short Form begins with identifying the specific needs of your business and its shareholders. Gather input from all stakeholders to ensure their interests are represented. You can also use uslegalforms for templates and guidance, ensuring that your agreement covers all necessary legal frameworks in a clear and concise manner.

In a Washington Shareholders Agreement - Short Form, you should include essential elements such as shareholder rights, voting procedures, and exit strategies. Additionally, outline the process for transferring shares, dispute resolution mechanisms, and how profits will be distributed. Comprehensive coverage of these topics helps prevent future conflicts and promotes smooth governance.

A Washington Shareholders Agreement - Short Form outlines the fundamental rules governing the relationship between shareholders in a company. It typically covers ownership structure, management roles, and dividend distribution. This document serves to protect the interests of all parties involved and ensures clarity in business operations.