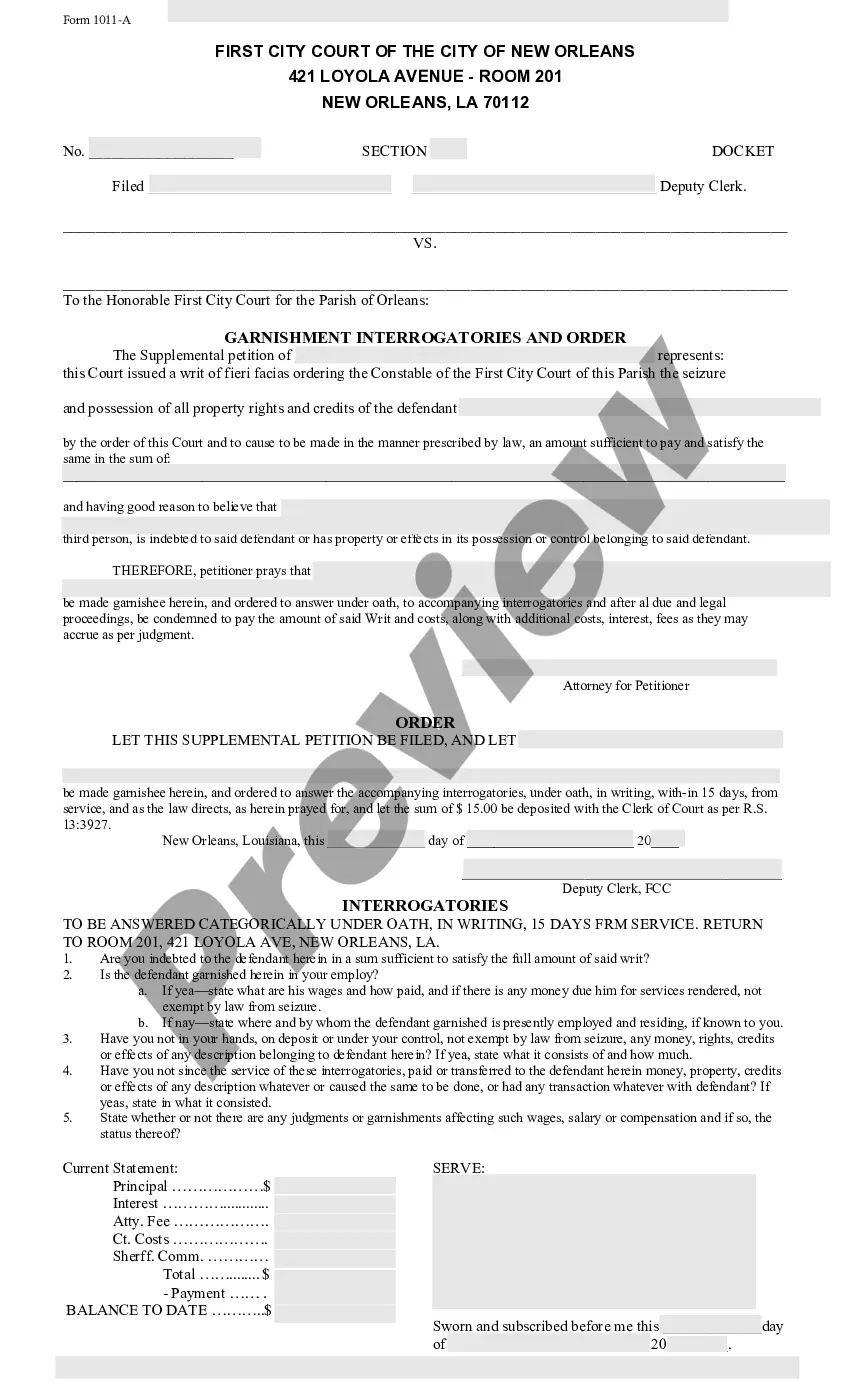

Louisiana Garnishment & Interrogatories are legal documents used in Louisiana to collect a debt. A garnishment is a court order that requires a third party, such as an employer, to withhold a certain amount of a debtor’s wages and pay it to the creditor. An interrogatory is a written set of questions that one party to a lawsuit asks the other party to answer. There are two types of Louisiana Garnishment & Interrogatories: a wage garnishment and a bank garnishment. A wage garnishment requires the debtor’s employer to withhold a portion of the debtor’s wages and pay it to the creditor. A bank garnishment requires the debtor’s bank to freeze the debtor’s account and pay the creditor a specified amount of money. An interrogatory is a written set of questions that the creditor sends to the debtor. The debtor must answer the questions in writing within a certain amount of time. The interrogatory will typically ask for information about the debtor’s assets, income, debts, and other financial information.

Louisiana Garnishment & Interrogatories

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Garnishment & Interrogatories?

Drafting legal documents can be quite a hassle unless you have access to pre-prepared fillable templates. With the US Legal Forms digital collection of official paperwork, you can feel assured about the forms you acquire, as all of them align with federal and state regulations and are verified by our specialists.

Obtaining your Louisiana Garnishment & Interrogatories from our platform is as easy as 1-2-3. Previously authenticated users with an active subscription simply need to Log In and click the Download button after finding the appropriate template. Afterwards, if needed, users can select the same document from the My documents tab of their account.

Haven’t you utilized US Legal Forms yet? Register for our platform today to obtain any formal document swiftly and effortlessly whenever you need to, and keep your paperwork organized!

- Document compliance confirmation. Make sure to thoroughly check the contents of the form you wish to ensure it meets your requirements and adheres to your state’s legal standards. Viewing your document and reading its overall description will assist you in this process.

- Alternative search (optional). If you encounter any discrepancies, explore the library using the Search tab at the top of the page until you discover a suitable template, then click Buy Now when you see the one you require.

- Account creation and form purchase. Register for an account with US Legal Forms. After your account has been verified, Log In and choose your desired subscription plan. Make a payment to proceed (both PayPal and credit card options are available).

- Template download and future use. Select the file format for your Louisiana Garnishment & Interrogatories and click Download to save it onto your device. Print it for manual completion, or use a feature-rich online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

Once the judgment is final and the creditor gets a wage garnishment, you usually can't object to the garnishment itself. But under Louisiana law, the judge may reopen the case if you file a motion to present evidence ?affecting the proper continuance? of the wage garnishment.

Revised Statute 70 defines distraint to include the secretary's right to levy upon and seize and the taxpayer's wages to satisfy any assessment of tax, penalty, or interest due. If you owe monies to LDR that are collectible by distraint, the law allows LDR to garnish your wages for up to 25 percent of your pay.

There are limits to how much can be garnished from a debtor's wages in Louisiana. Under Louisiana law, the maximum amount that can be garnished is 25% of the debtor's disposable earnings, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.

What is a Writ of Fieri Facias? It's a written command issued by a Louisiana court to a sheriff to obtain the amount of a money judgment out of the property of a judgment debtor. ?Fieri Facias? means ?you should cause (it) to be done,? and in modern parlance the Writ is also referred to as the ?Writ of Execution.?

To obtain a wage garnishment, the creditor must first file a lawsuit against you to get a judgment. The judgment gives the creditor the right to take collection actions against you, including wage garnishment. Once the creditor has the judgment, they will need to file a garnishment petition and order with the court.

Limits on Wage Garnishment in Louisiana On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.

Revised Statute 70 defines distraint to include the secretary's right to levy upon and seize and the taxpayer's wages to satisfy any assessment of tax, penalty, or interest due. If you owe monies to LDR that are collectible by distraint, the law allows LDR to garnish your wages for up to 25 percent of your pay.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.