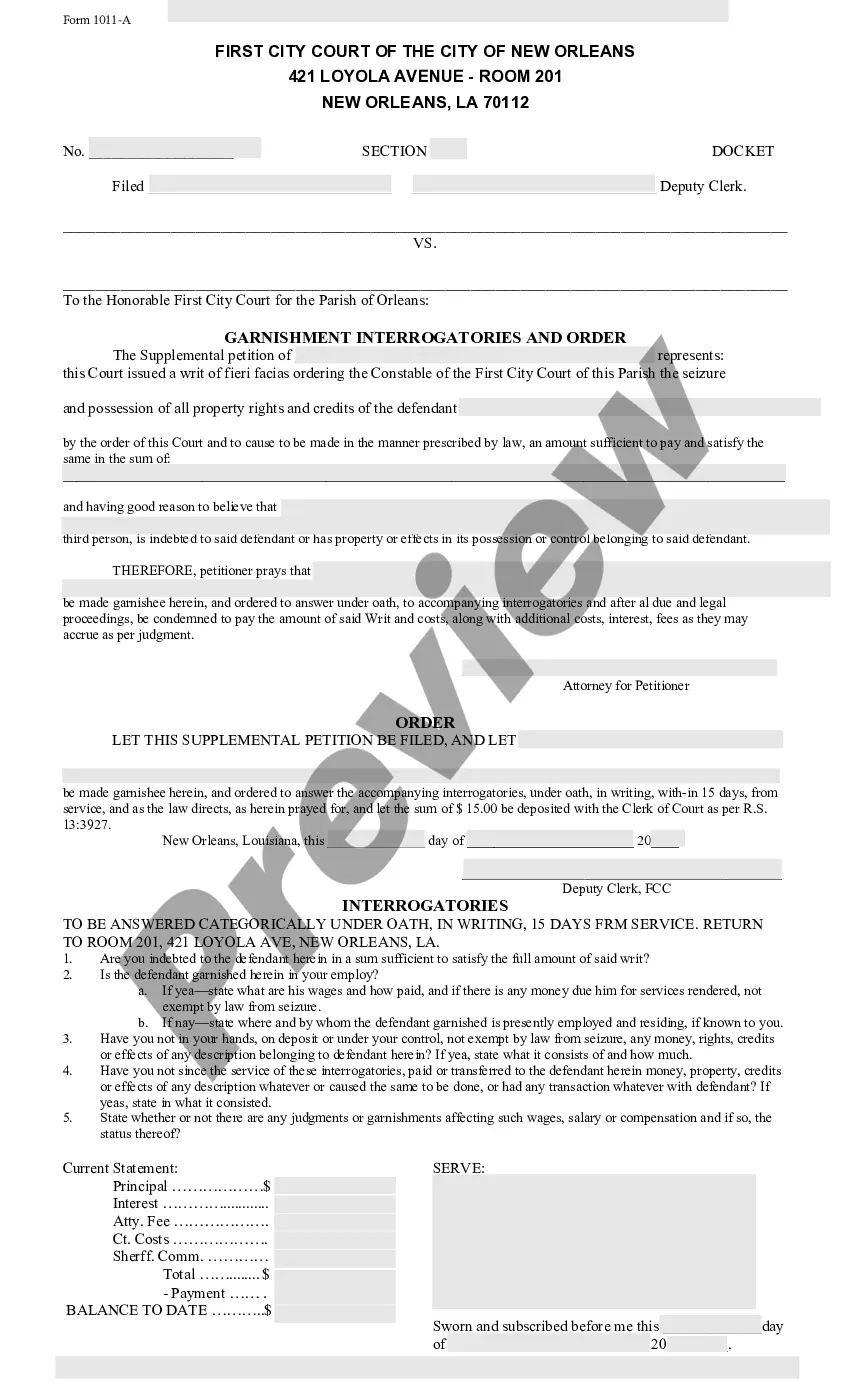

Louisiana Garnishment Interrogatories And Order is a legal document issued by the court, which requires an employer to provide information about an employee’s wages, salary, and benefits. This document orders an employer to withhold a portion of the employee’s wages for a certain period of time, in order to satisfy a debt. The garnishment is paid directly to the creditor, rather than the employee. There are two types of Louisiana Garnishment Interrogatories And Order: a regular garnishment and a continuing garnishment. A regular garnishment is a one-time garnishment order for a specific amount of money, and it is valid for a specific period of time. A continuing garnishment is a repeated garnishment order for a specific amount of money, which is automatically renewed until the debt is satisfied. In either case, the employer must provide detailed information regarding the employee’s wages, salary, and benefits, including gross and net wages, deductions, and other benefits. The employer must also provide a copy of a pay stub for the employee for the period in which the garnishment is in effect. The employer must also complete and return a garnishment form to the court, which includes the name and address of the creditor, the amount of the garnishment, and the period of time for which the garnishment is in effect. Failure to comply with the Louisiana Garnishment Interrogatories And Order can result in legal action, including fines and potential jail time.

Louisiana Garnishment Interrogatories And Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Garnishment Interrogatories And Order?

Creating official documents can be a significant hassle if you lack readily available fillable templates.

With the US Legal Forms online repository of official paperwork, you can trust the forms you encounter, as all of them adhere to federal and state regulations and are reviewed by our experts.

Here’s a brief guide for you.

- So if you need to create Louisiana Garnishment Interrogatories And Order, our platform is the ideal spot to download it.

- Acquiring your Louisiana Garnishment Interrogatories And Order from our platform is as straightforward as can be.

- Previously registered users with an active subscription merely need to Log In and click the Download button after they find the correct template.

- In case you are unfamiliar with our platform, signing up with a valid subscription will require only a few moments.

Form popularity

FAQ

You may claim your exemptions from garnishment by filing an affidavit with the court describing the exemption and your claim to it. Your affidavit also must be sent to the judgment creditor and any attorney for the judgment creditor.

Once the judgment is final and the creditor gets a wage garnishment, you usually can't object to the garnishment itself. But under Louisiana law, the judge may reopen the case if you file a motion to present evidence ?affecting the proper continuance? of the wage garnishment.

Revised Statute 70 defines distraint to include the secretary's right to levy upon and seize and the taxpayer's wages to satisfy any assessment of tax, penalty, or interest due. If you owe monies to LDR that are collectible by distraint, the law allows LDR to garnish your wages for up to 25 percent of your pay.

If you owe monies to LDR that are collectible by distraint, the law allows LDR to garnish your wages for up to 25 percent of your pay. A notice was sent to your employer that includes your debt amount and the name of the Tax Officer assigned to your case.

Louisiana Laws - Louisiana State Legislature. A. (1) The sheriff shall serve upon the garnishee the citation and a copy of the petition and of the interrogatories, together with a notice that a seizure is thereby effected against any property of or indebtedness to the judgment debtor.

There are generally only two ways to stop wage garnishment in Louisiana. You can either pay the amount you owe off, or you can file for bankruptcy. If you decide to pay the full amount, you can do this by either paying a one-time lump sum, or you can allow the wage garnishment to continue until the full amount is paid.

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.