The documents in this package are state-specific and include the following:

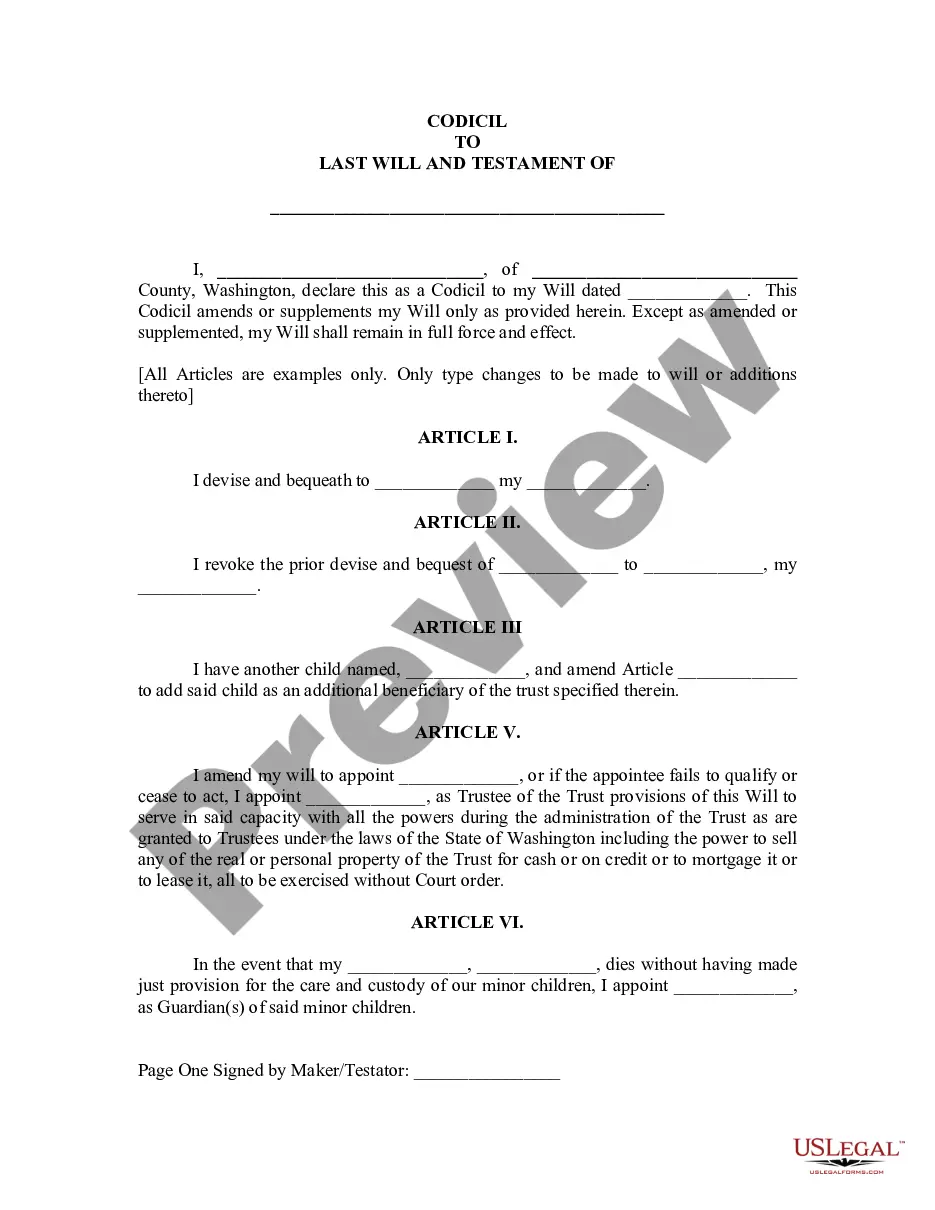

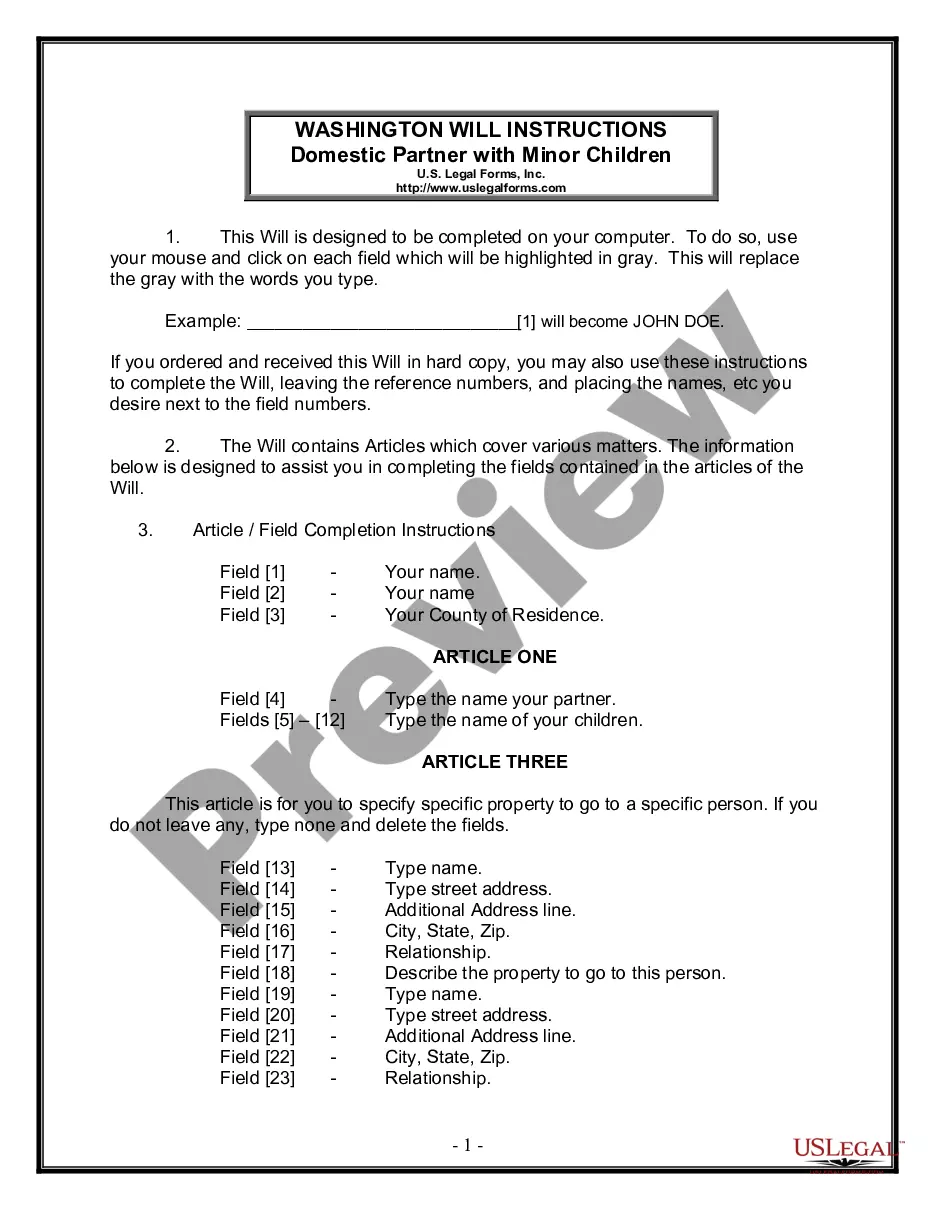

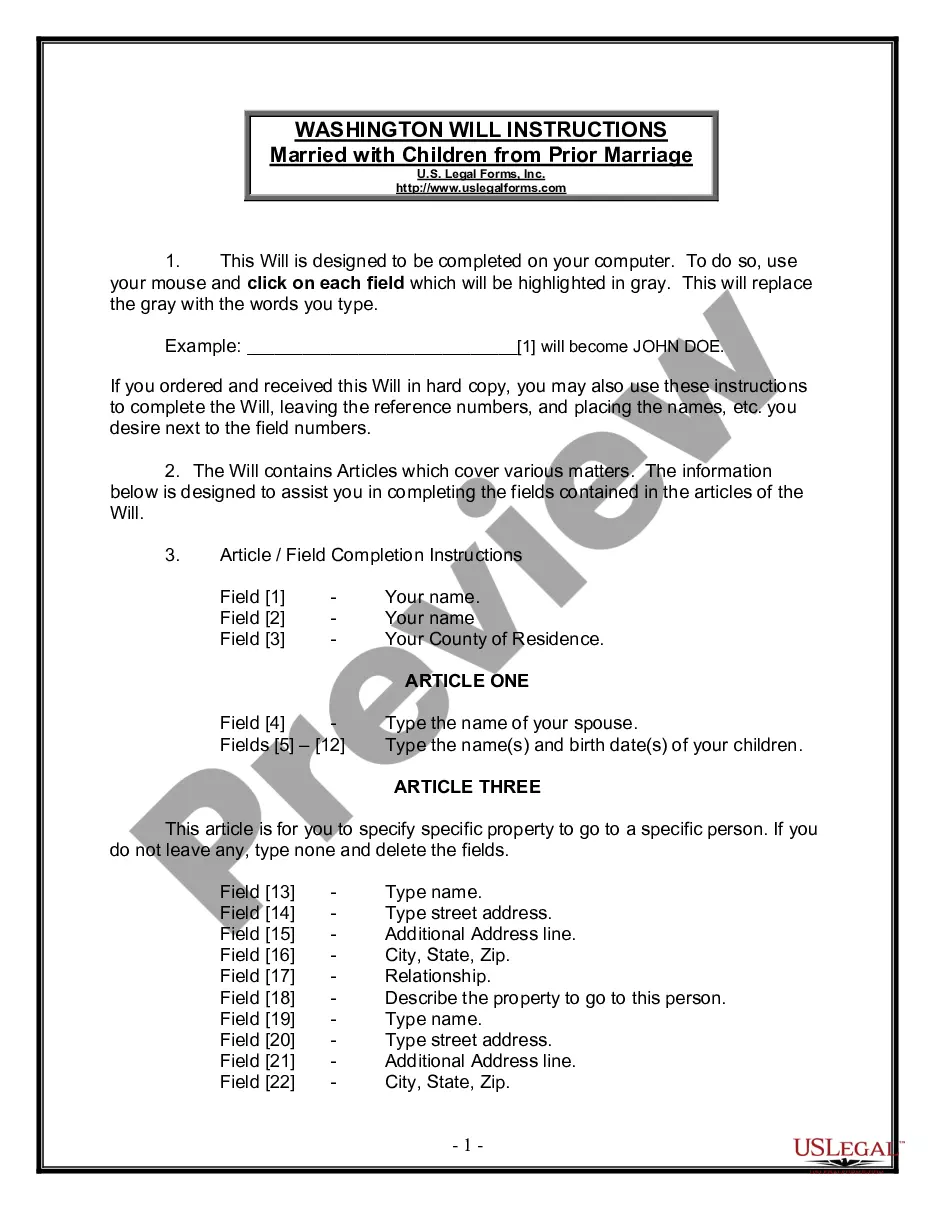

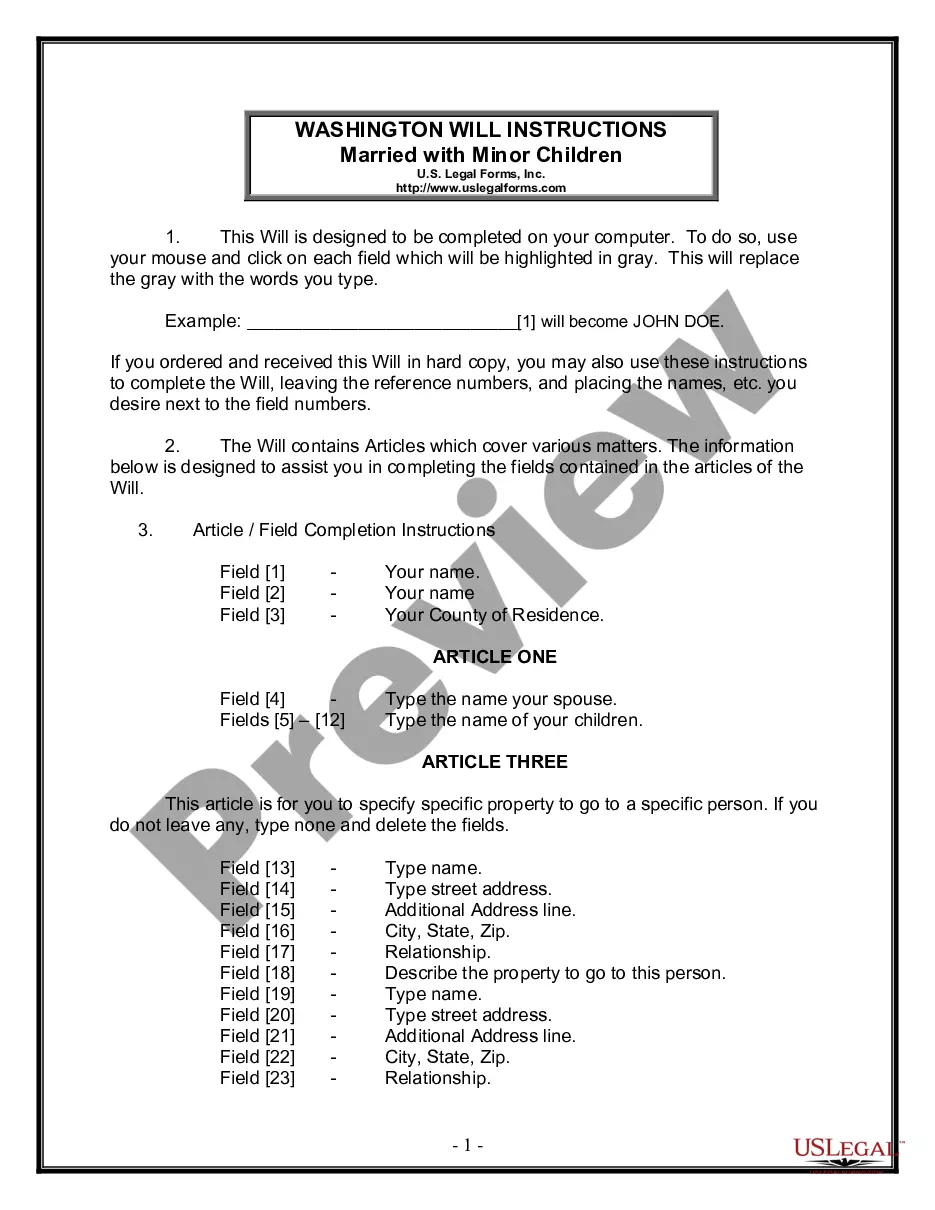

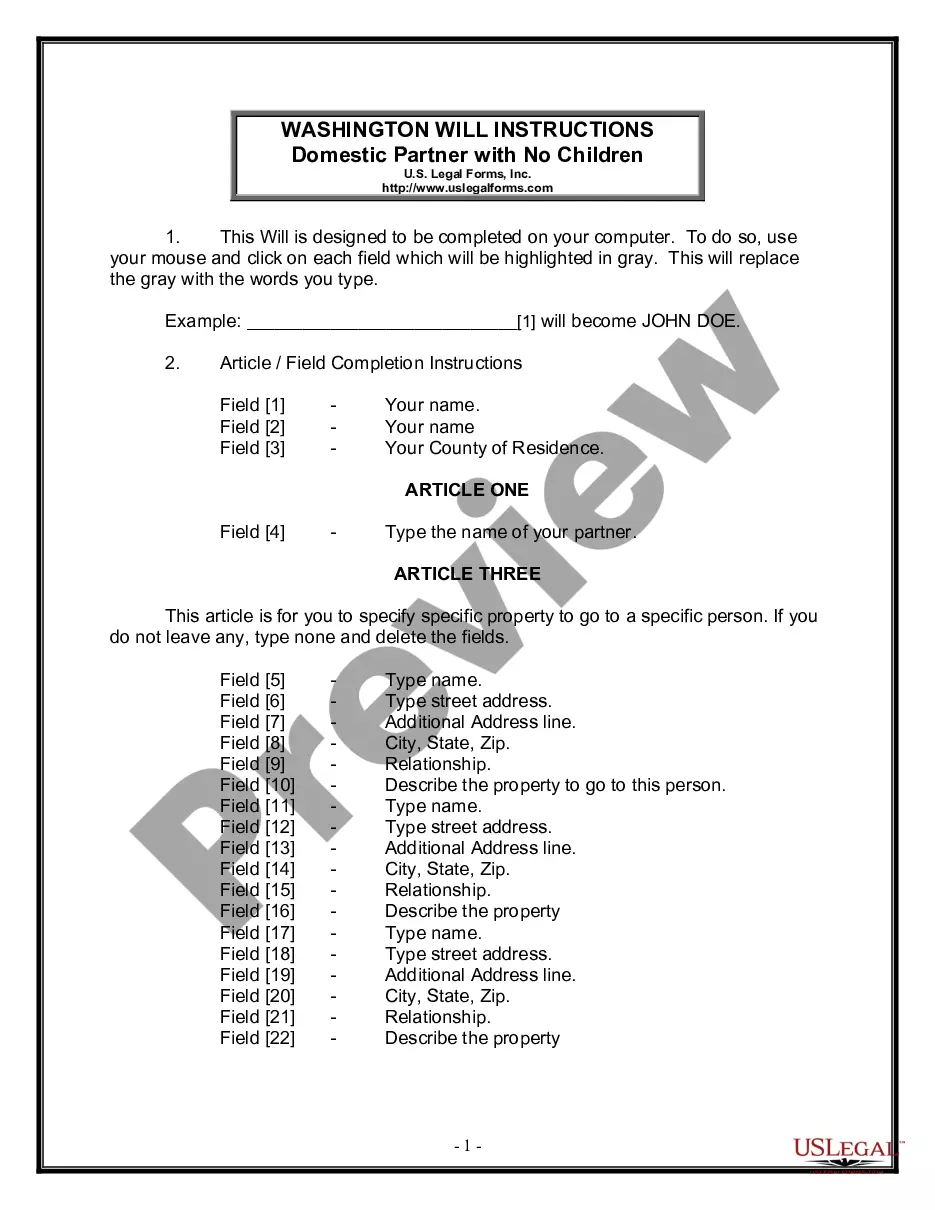

1) Last Will and Testament

2) Advance Healthcare Directive

3) General Power of Attorney

4) New Resident Guide

Purchase this package and save up to 40% over purchasing the forms separately!