Louisiana Trust Transfer Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

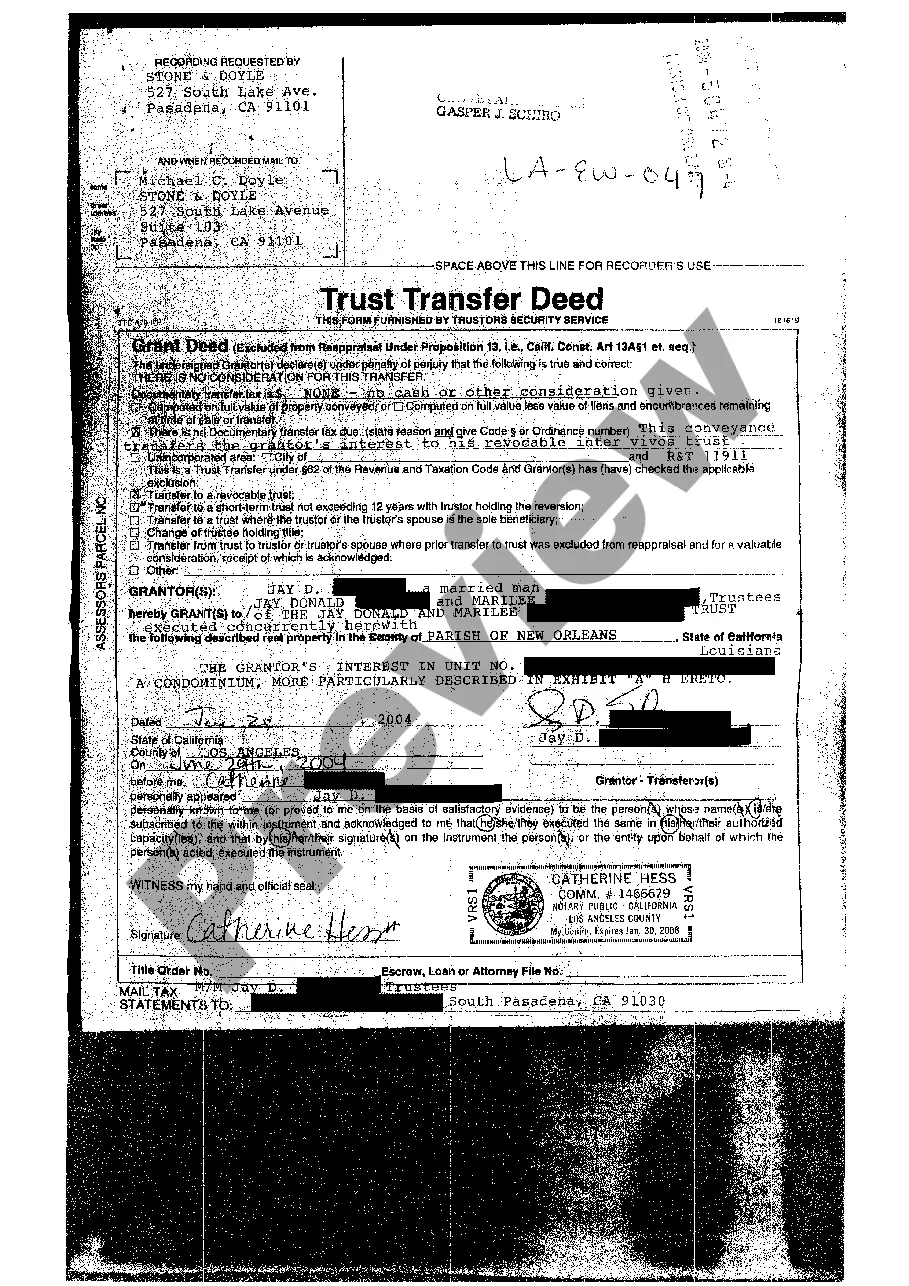

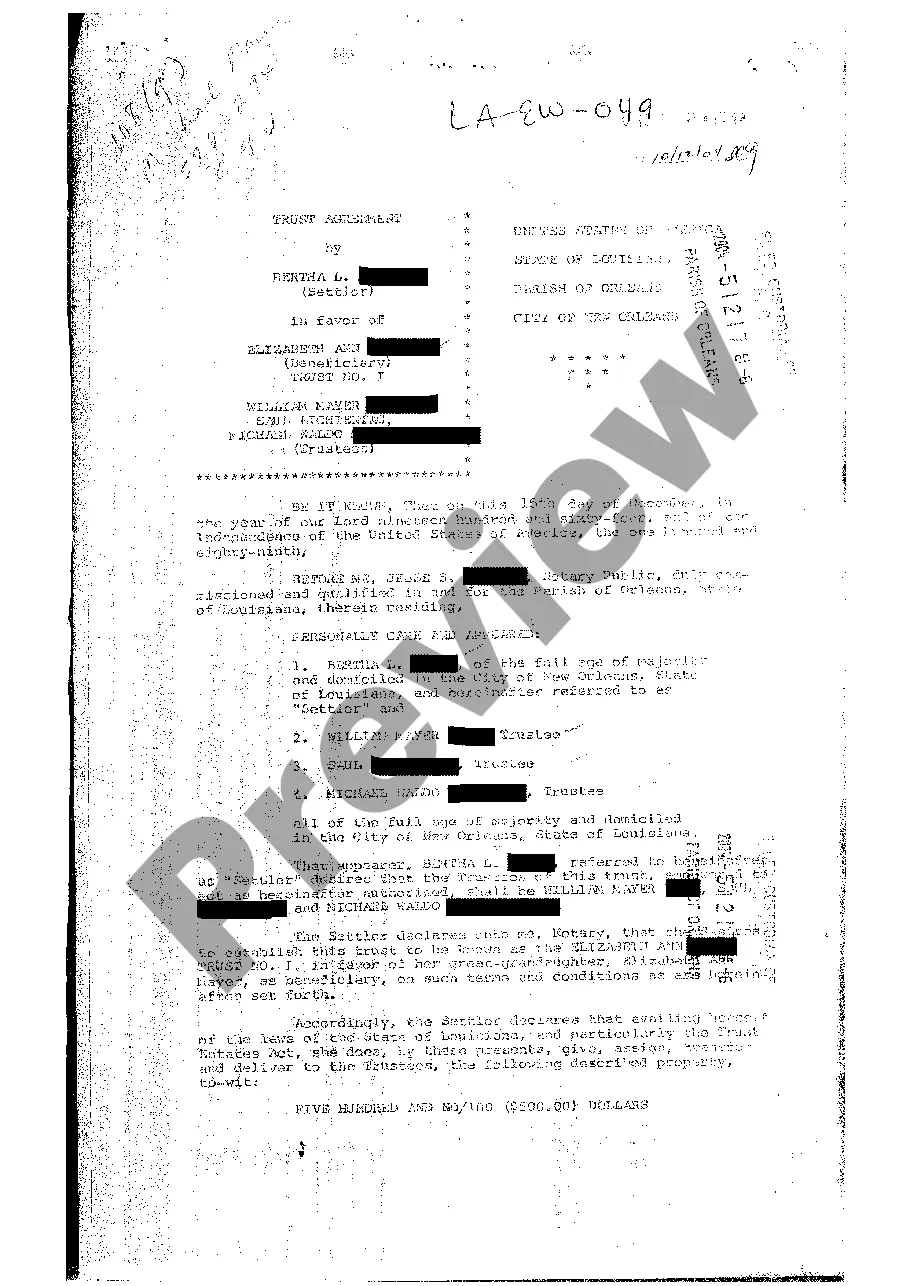

Trust Transfer Deed: A legal document used in the United States to transfer ownership of real property from one party to another. The trust transfer deed places the property into a trust rather than transferring it directly to the beneficiary. This arrangement is often used for estate planning and asset protection purposes.

Step-by-Step Guide

- Choose a Trustee: Select a trustee who will hold the title to the property in trust for the beneficiaries.

- Prepare the Deed: Draft the trust transfer deed document, stipulating the transfer terms and conditions.

- Signature Requirements: Ensure that all parties involved, including the grantor and trustee, sign the deed.

- Notarization: Have the deed notarized by a certified notary public to authenticate the signatures.

- Record the Deed: File the deed with the local county recorders office to make the transfer official and public.

Risk Analysis

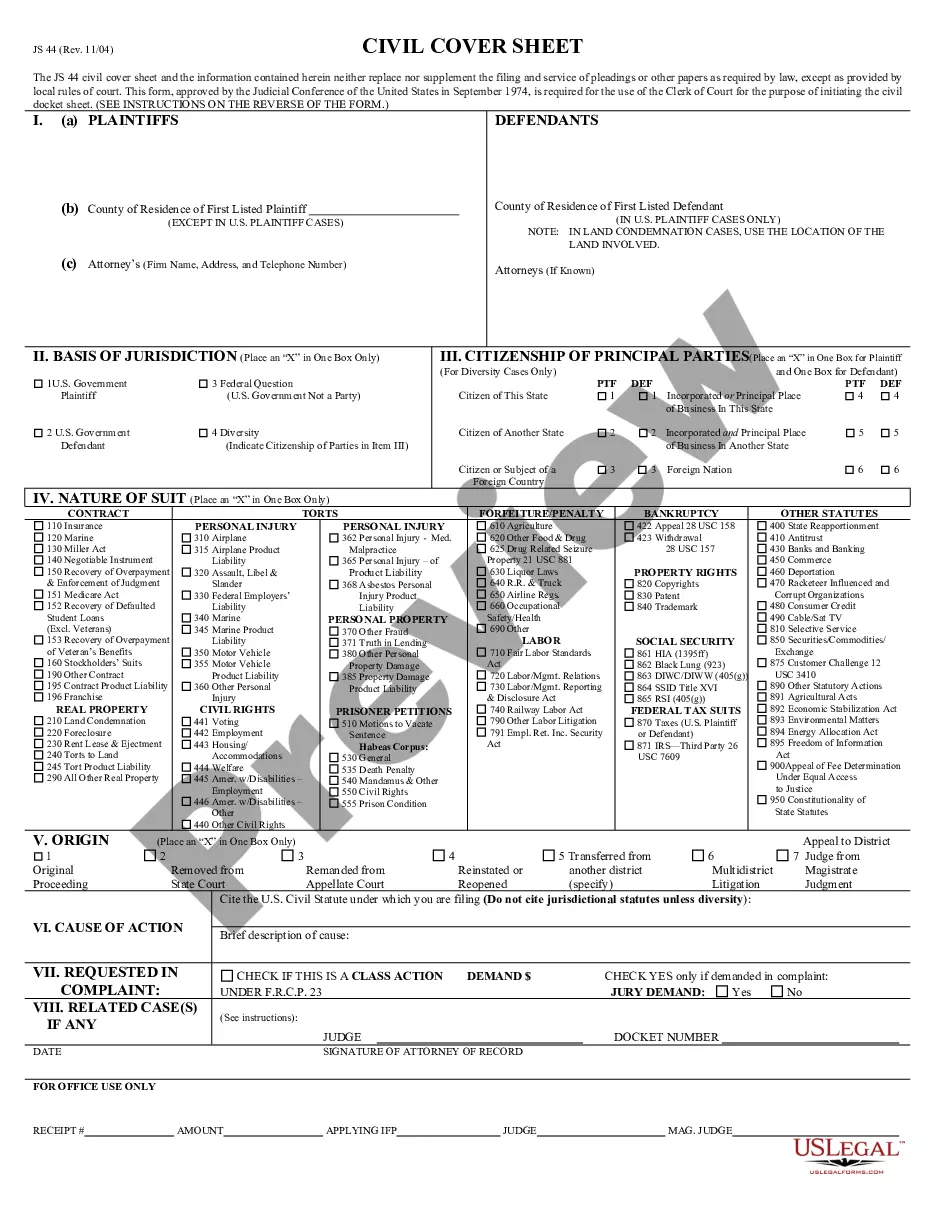

- Legal Risks: Improper execution of a trust transfer deed can lead to legal disputes over property ownership.

- Financial Risks: There may be tax implications or unanticipated costs associated with transferring property into a trust.

- Management Risks: The trustee must manage the property according to the terms of the trust, which could lead to complications if not properly managed.

Key Takeaways

- Using a trust transfer deed can help in asset protection and estate planning.

- It is crucial to involve legal professionals when drafting and executing a trust transfer deed to avoid common pitfalls.

- Ensure all legal requirements are met, including notarization and recording of the deed, for a smooth transfer process.

Pros & Cons

- Pros: Enhances privacy by not directly naming the beneficiary, provides flexibility in property management.

- Cons: Could be complex to set up, involves legal and administrative costs.

Best Practices

- Engage a seasoned real estate or trust attorney for guidance and drafting of the deed.

- Clearly define the trust terms and trustee responsibilities to prevent future disputes.

- Regularly review and update the deed as necessary to reflect any changes in law or family circumstances.

Common Mistakes & How to Avoid Them

- Not Using a Qualified Attorney: Always use a legal professional experienced in trust and estate law to avoid critical errors.

- Failing to Properly Record the Deed: Ensure the deed is recorded promptly and correctly at the county recorders office to avoid invalidation.

How to fill out Louisiana Trust Transfer Deed?

Greetings to the most extensive legal document repository, US Legal Forms. Here, you can discover any template including Louisiana Trust Transfer Deed forms and retain them (as many as you need). Create formal documents in several hours, rather than days or weeks, without having to spend a fortune on a lawyer or attorney.

Obtain your state-specific template in just a few clicks and feel assured knowing it was prepared by our state-certified attorneys.

If you’re already a subscribed client, simply Log Into your account and click Download beside the Louisiana Trust Transfer Deed you need. As US Legal Forms is an online service, you’ll typically have access to your saved documents, regardless of the device you’re using. Locate them in the My documents section.

Print the document and complete it with your/your business’s information. Once you’ve filled out the Louisiana Trust Transfer Deed, submit it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re completely protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If you haven’t registered for an account, what are you waiting for.

- Review our guidelines below to get started.

- If this is a state-specific template, verify its legality in your state.

- Review the description (if available) to ensure it’s the correct template.

- Explore additional content using the Preview feature.

- If the template fulfills all your criteria, click Buy Now.

- To set up an account, choose a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

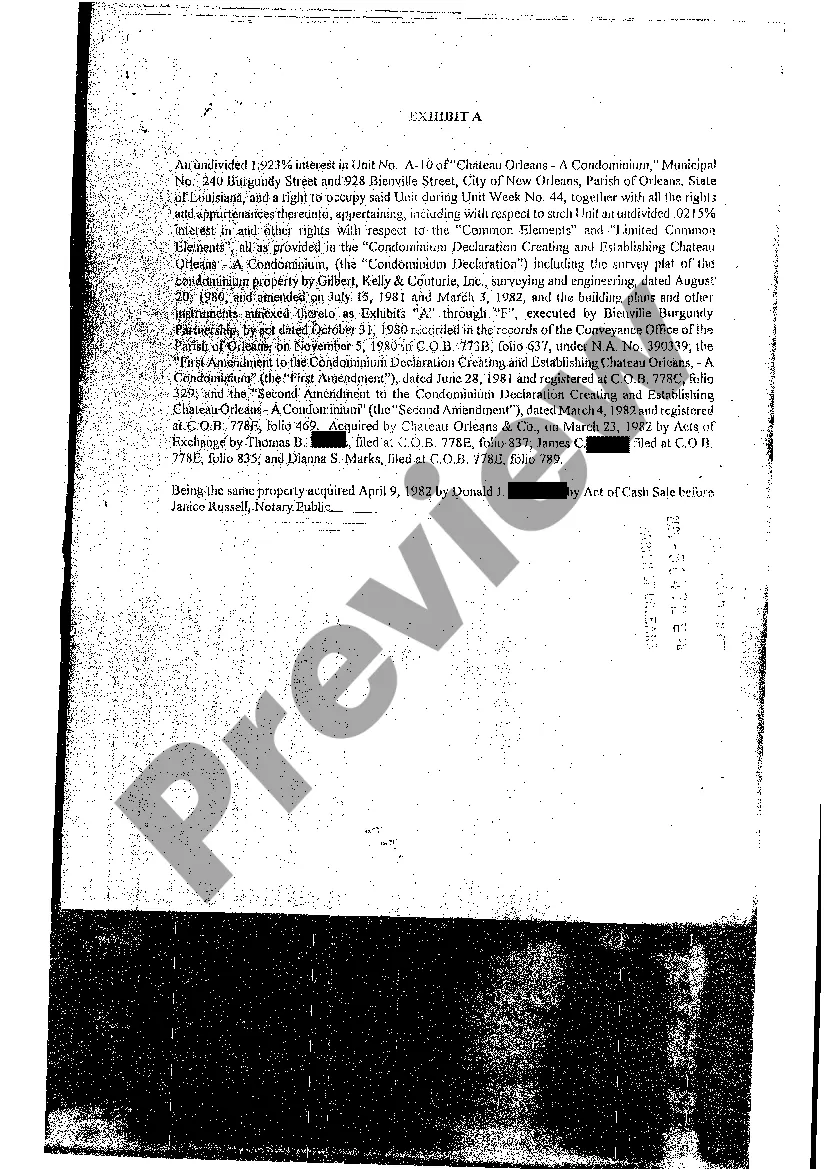

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Property ownership in Louisiana is voluntarily transferred by a contract through the owner and the transferee. A transfer of real (immovable) property can be made by authentic act or by an act under private signature duly acknowledged (CC1839 Art. 1839).

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.