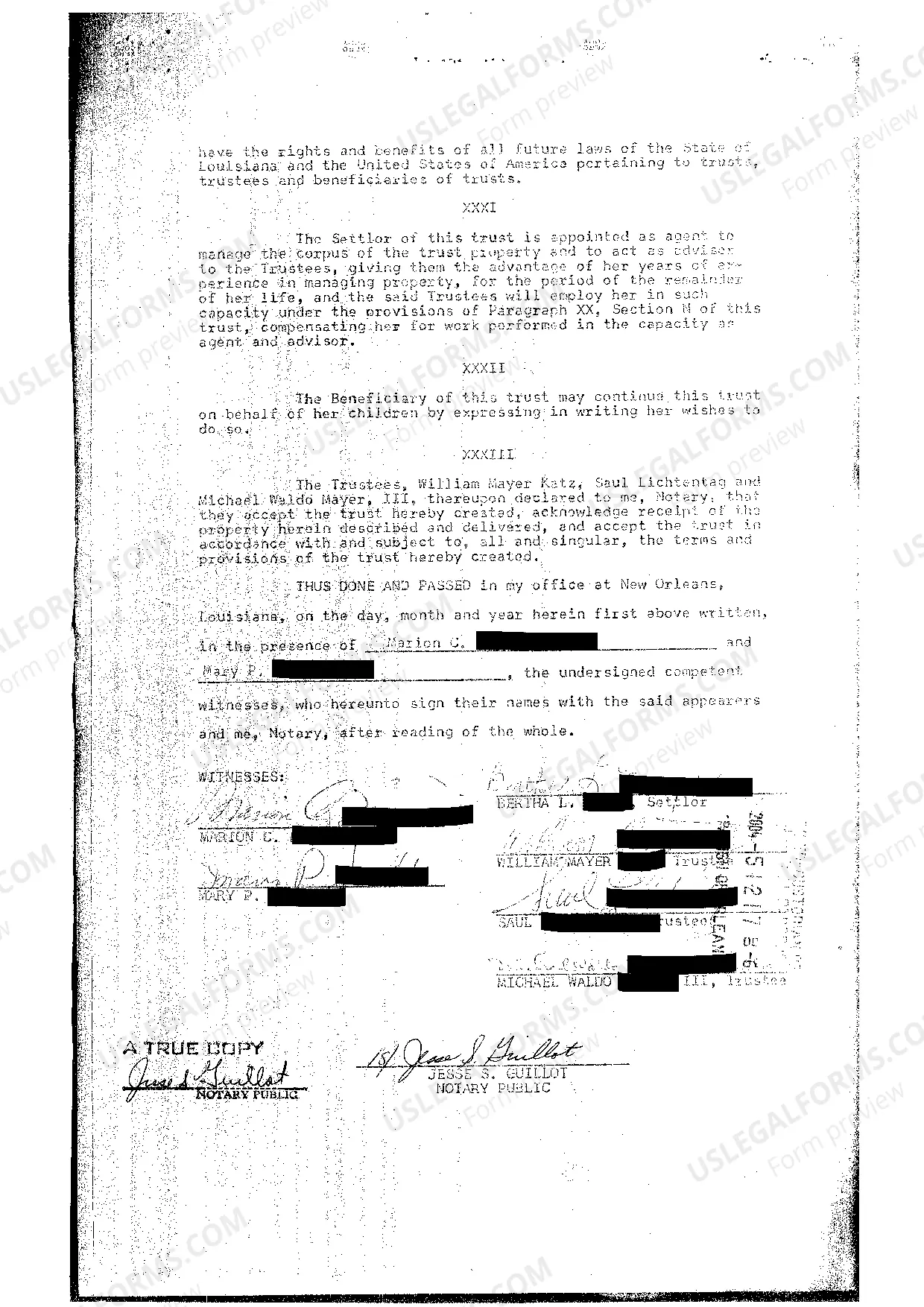

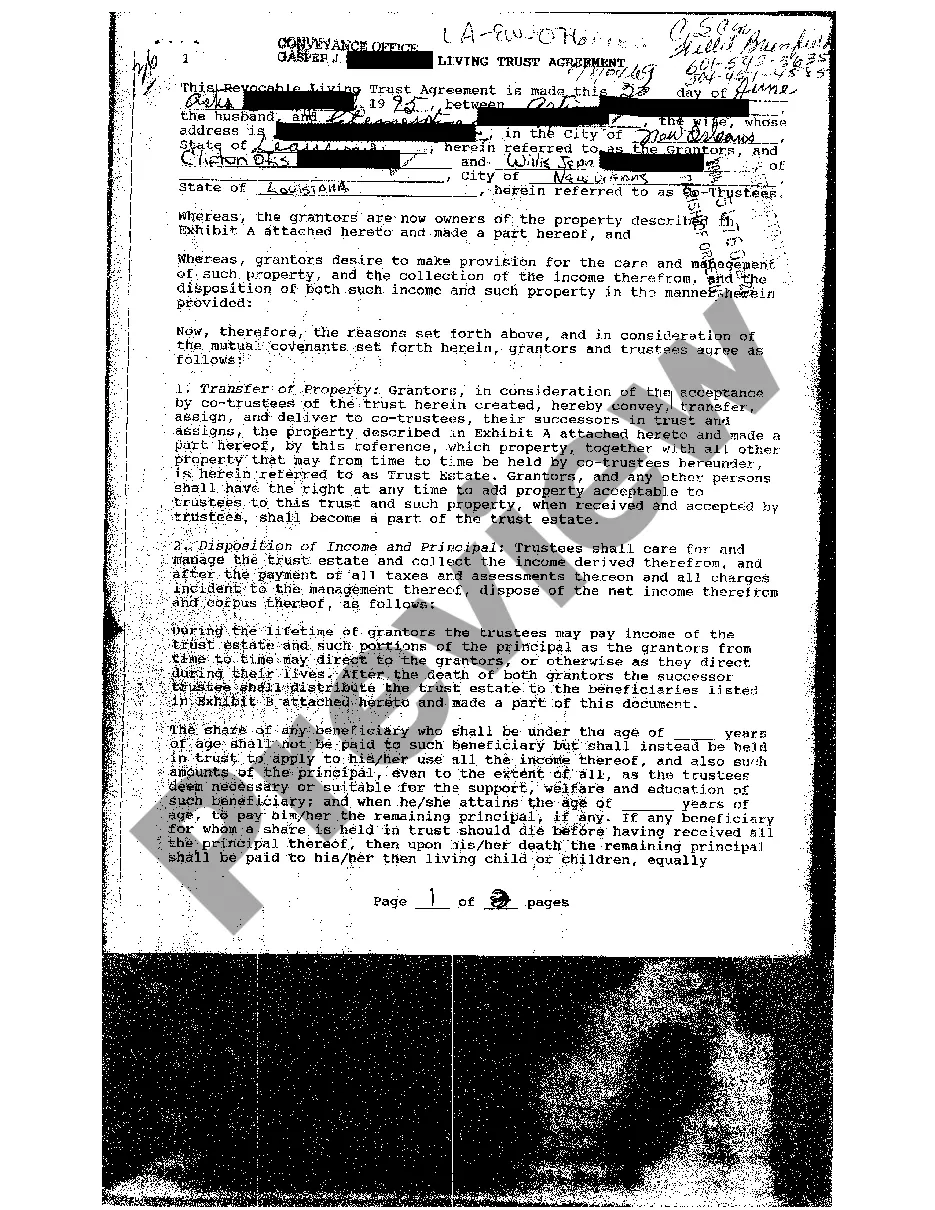

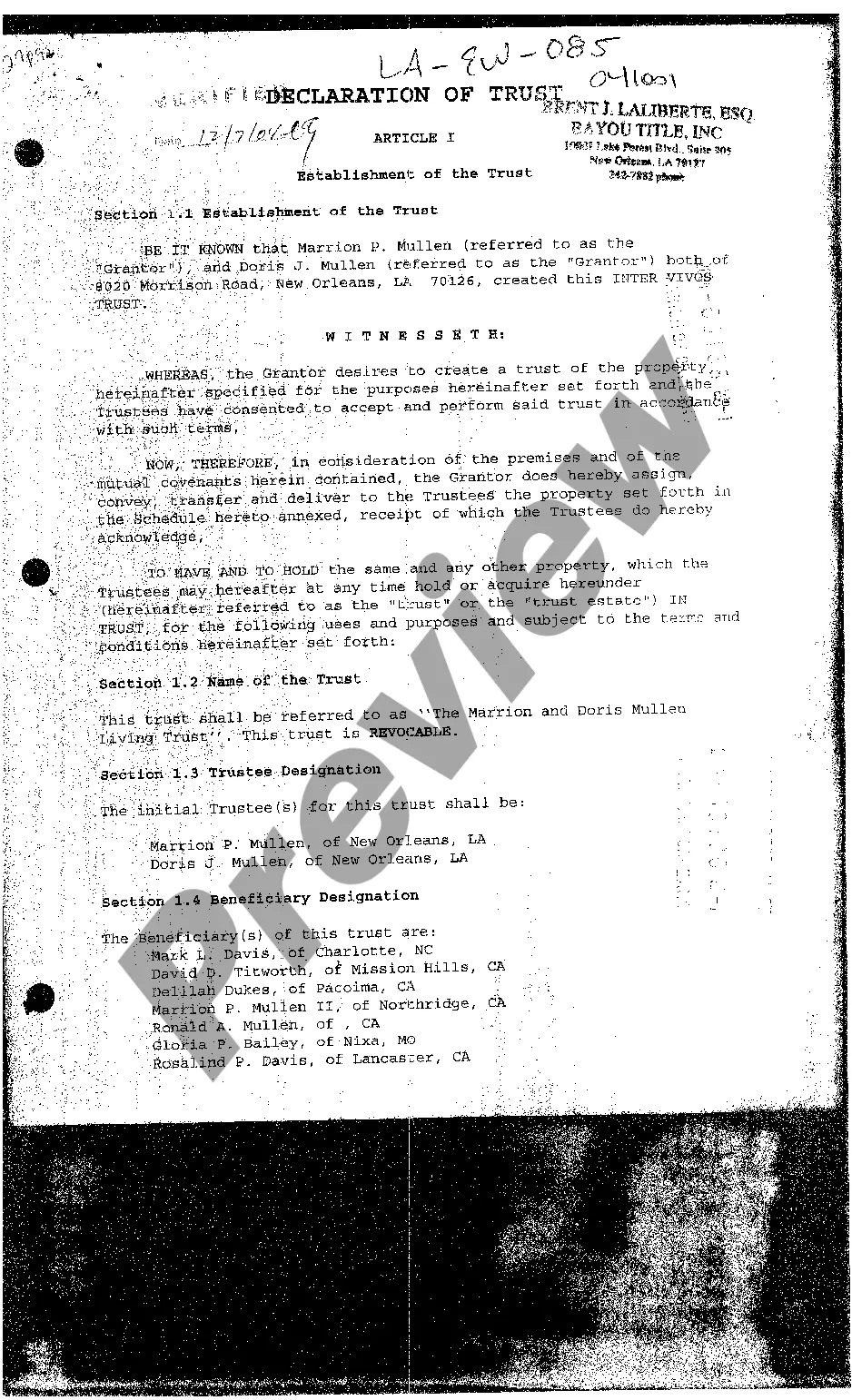

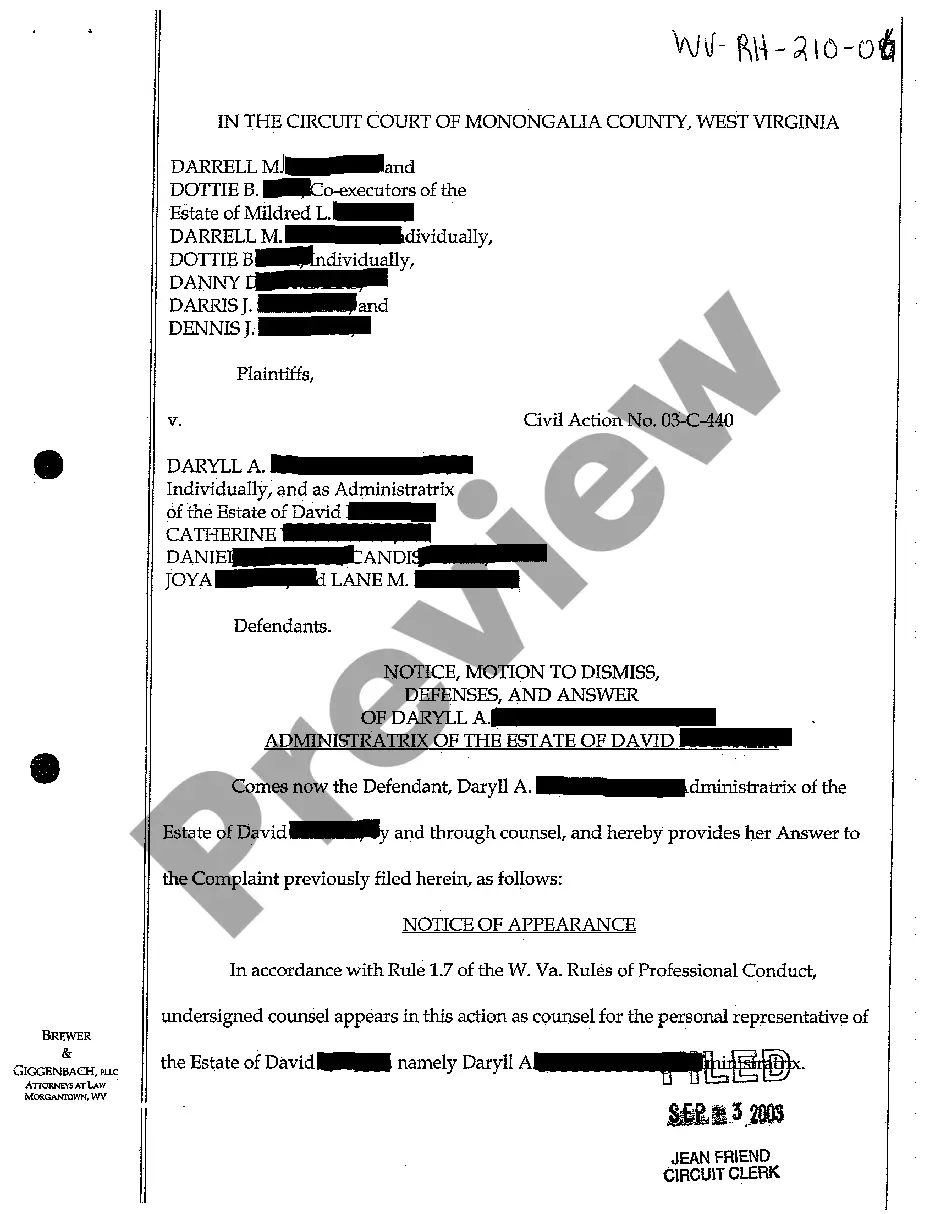

Louisiana Trust Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Trust Agreement?

We are pleased to present the most extensive repository of legal document collections, US Legal Forms. Here you can acquire any specimen including Louisiana Trust Agreement models and preserve them (as numerous as you wish/require). Create official documents in just a few hours instead of days or even weeks, without needing to spend a fortune on a lawyer.

Obtain the state-specific form in just a few clicks and feel assured knowing it was prepared by our state-certified legal professionals.

If you are already a registered user, simply Log In to your account and select Download next to the Louisiana Trust Agreement you require. Since US Legal Forms is an online service, you'll always have access to your downloaded documents, regardless of the device you’re using. Locate them under the My documents section.

Print the document and fill it with your or your business’s information. Once you’ve finalized the Louisiana Trust Agreement, present it to your attorney for validation. It’s an additional step but a crucial one to ensure you are completely safeguarded. Join US Legal Forms today and access a vast array of reusable templates.

- If you haven’t created an account yet, what are you waiting for.

- Follow our guidelines below to initiate.

- If this is a state-specific form, verify its relevance for your state.

- Read the description (if available) to ascertain if it’s the correct template.

- Explore more content with the Preview feature.

- If the document fulfills all your requirements, simply click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account for registration.

- Store the template in the desired format (Word or PDF).

Form popularity

FAQ

Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

A trust agreement is a document that allows you (the trustor) to legally transfer the ownership of specific assets to another person (trustee) to be held for the trustor's beneficiaries.Assets controlled in the trust. Powers and limitations for the trustee. Compensation for the trustee.

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

Both are useful estate planning devices that serve different purposes, and both can work together to create a complete estate plan. One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it.

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

Because an LLC and a trust both provide significant benefits to the owner of real property, a smart investor should consider using both a LLC and a trust to adequately protect himself and his property. Utilizing both a trust and a LLC creates the best combination of liability protection and favorable estate planning.