Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage

Definition and meaning

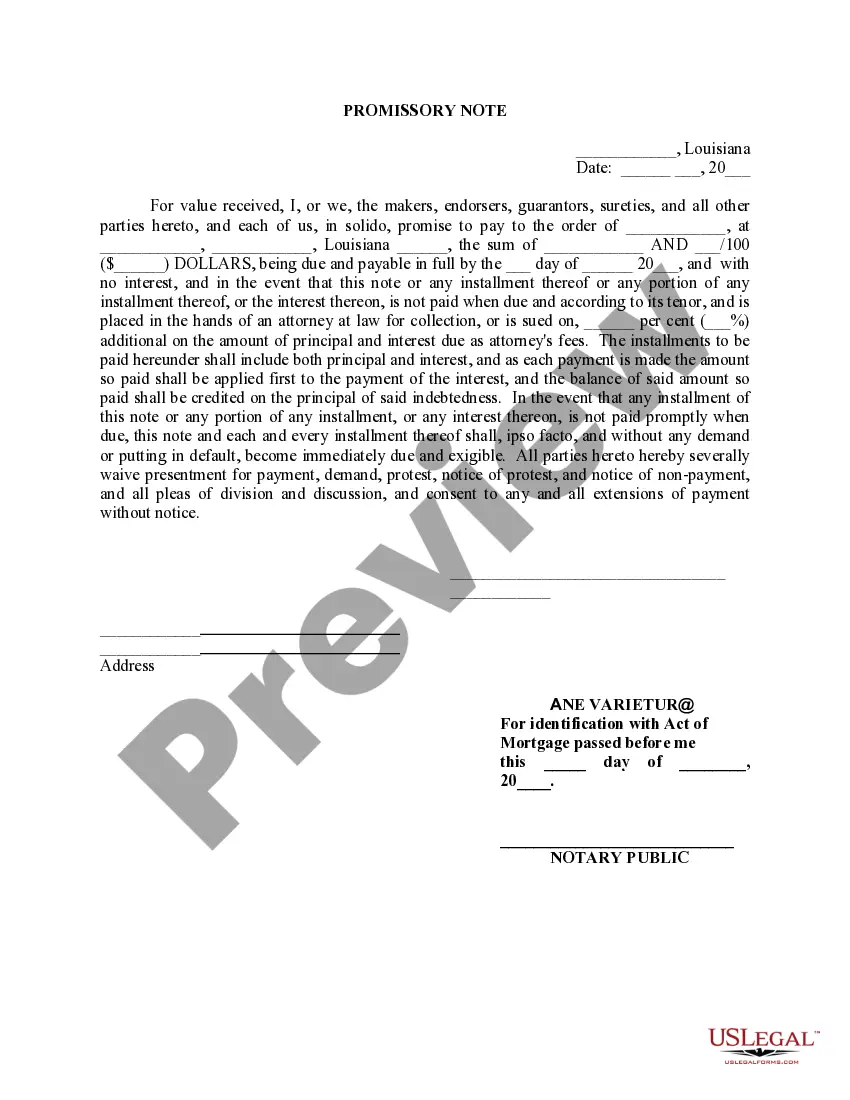

The Louisiana Promissory Note Ne Varietur is a formal document indicating a promise to pay a specified amount of money. The term 'ne varietur' signifies that the note is to be recognized as a permanent record for identifying the act of collateral mortgage. This document offers assurance to both the lender and borrower regarding repayment terms, ensuring that the obligations are clearly defined.

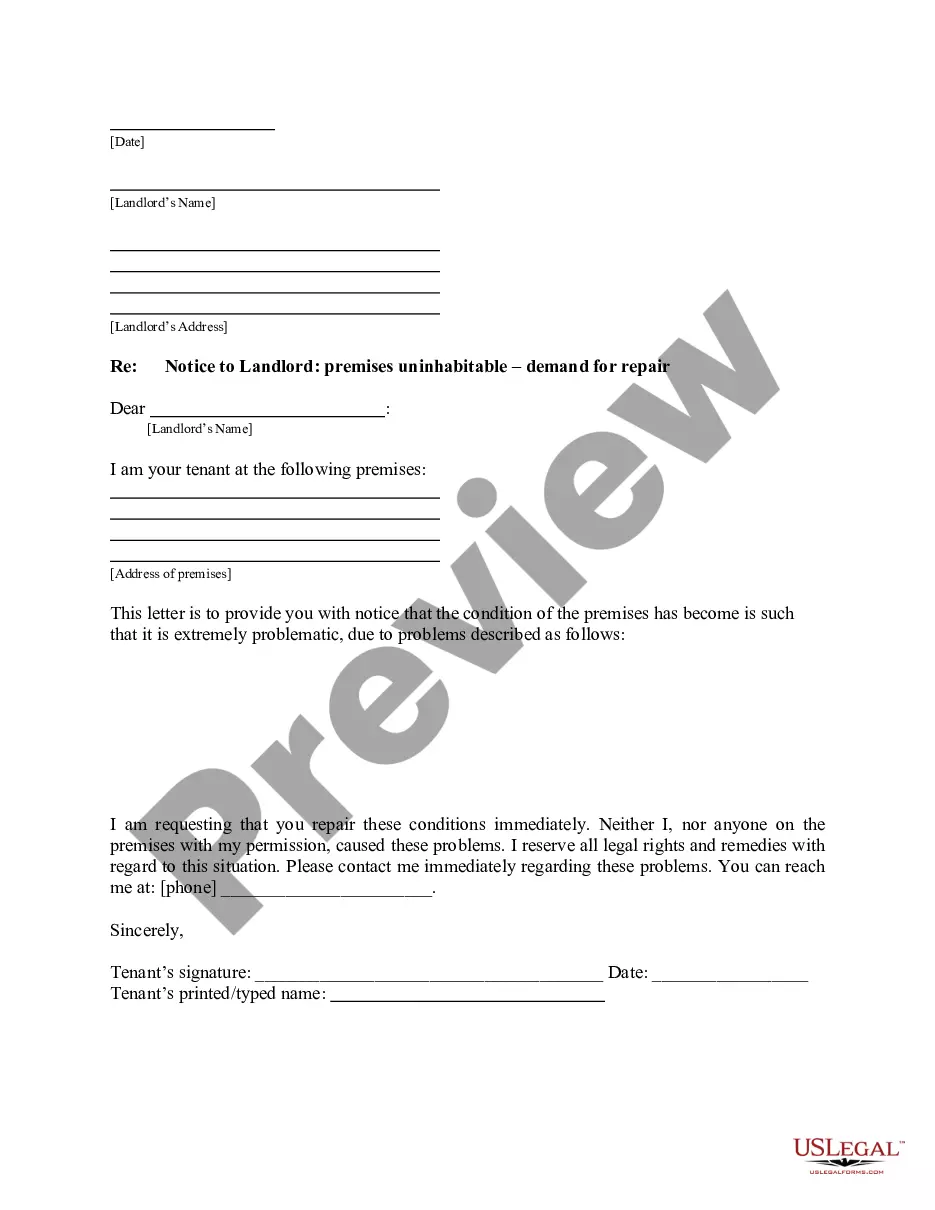

How to complete a form

To accurately complete the Louisiana Promissory Note Ne Varietur, follow these steps:

- Enter the full names and addresses of all parties involved.

- Specify the principal amount due in both numerals and words.

- Indicate the due date for repayment.

- Detail any applicable interest rates, if included.

- Provide information for attorney’s fees in the event of non-payment.

Ensure all parties sign and date the document in the designated spaces.

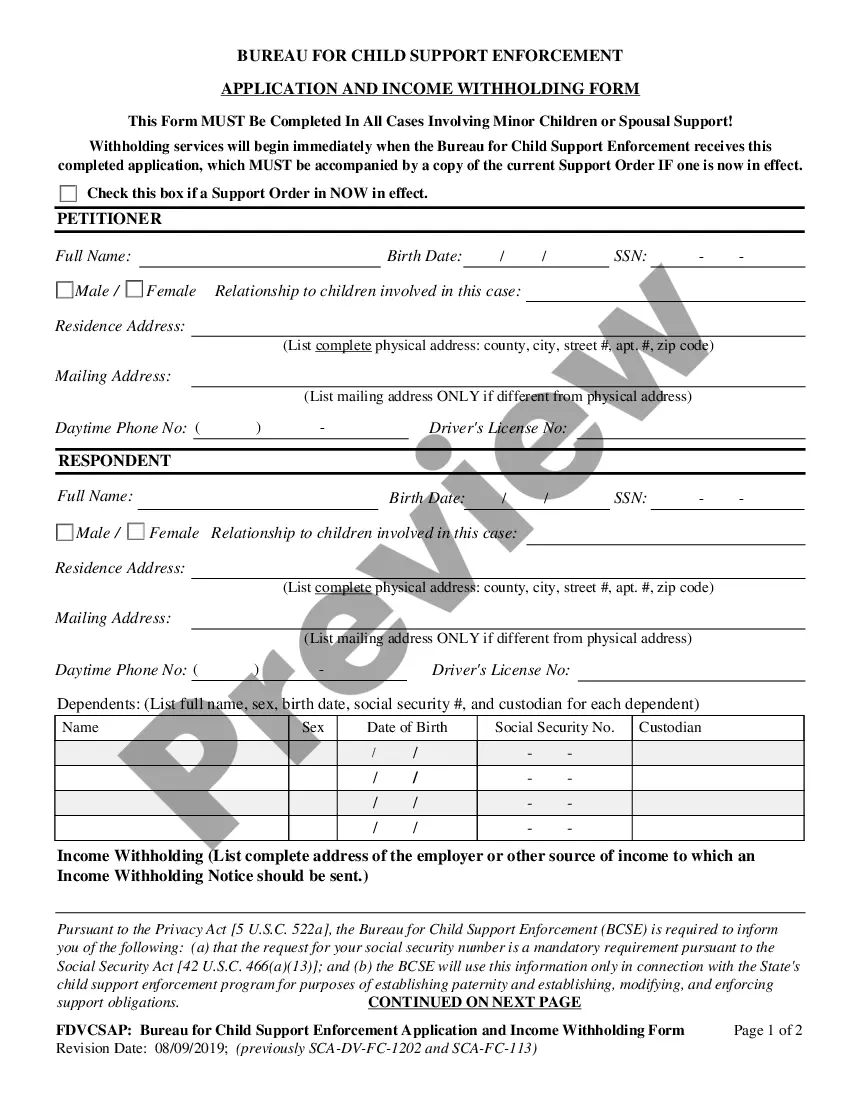

Who should use this form

This form is intended for individuals or entities involved in lending or borrowing arrangements in Louisiana. It is suitable for personal loans, business transactions, and property financing where a promissory note is necessary to formalize the agreement. Legal and financial professionals may also use it to document collateral mortgages effectively.

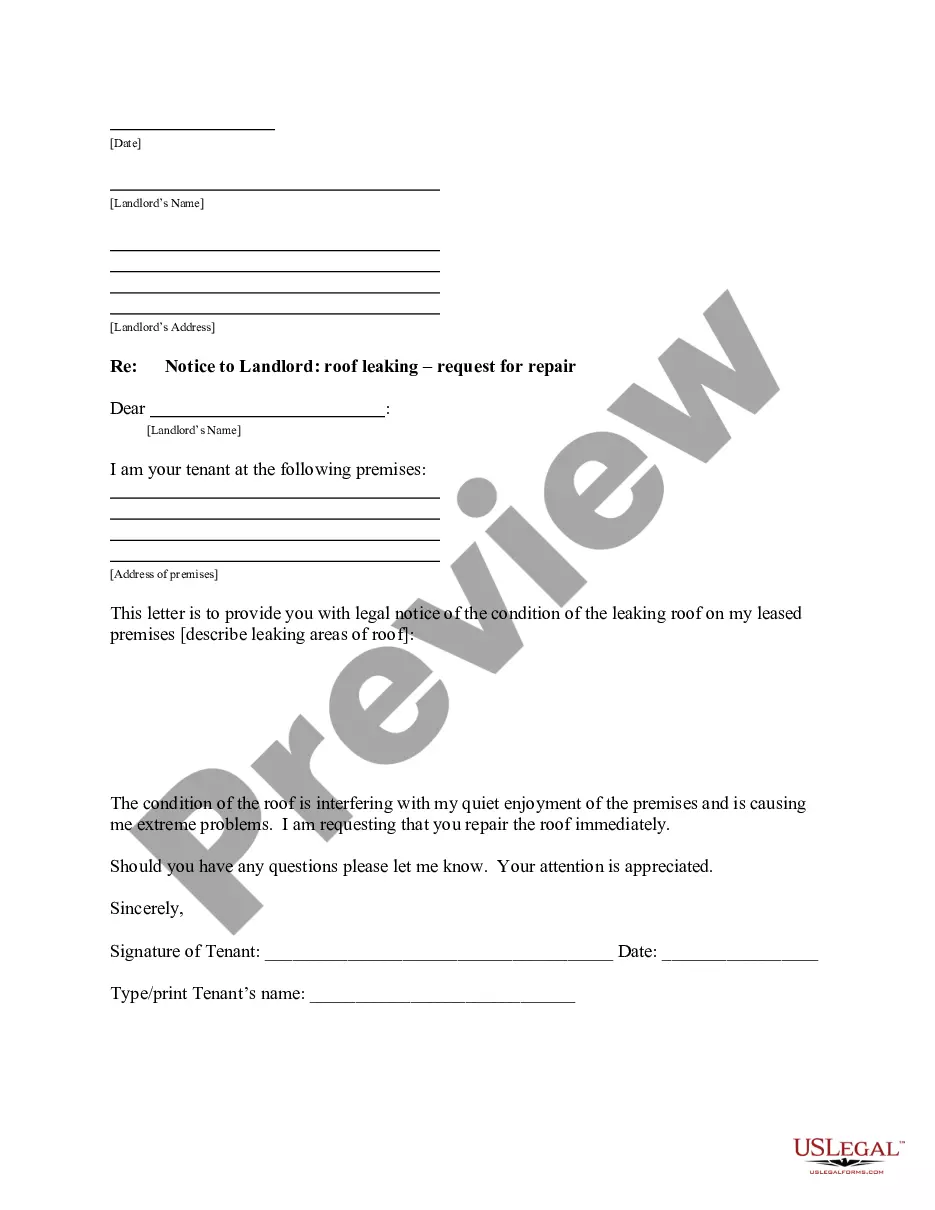

Key components of the form

The Louisiana Promissory Note Ne Varietur consists of several essential components:

- Principal Amount: The total amount that will be borrowed.

- Interest Rate: The rate applied to the principal amount, if any.

- Payment Schedule: Details on how and when payments must be made.

- Signatures: Required signatures from all parties involved.

- Notary Public: Certification of the document's authenticity.

Common mistakes to avoid when using this form

While completing the Louisiana Promissory Note, avoid these common mistakes:

- Failing to include all necessary parties' names and details.

- Omitting the due date or payment terms.

- Not providing clear amounts for principal and interest.

- Ignoring the requirement for a notarized signature.

Double-check all entries before finalizing the document to prevent issues during enforcement.

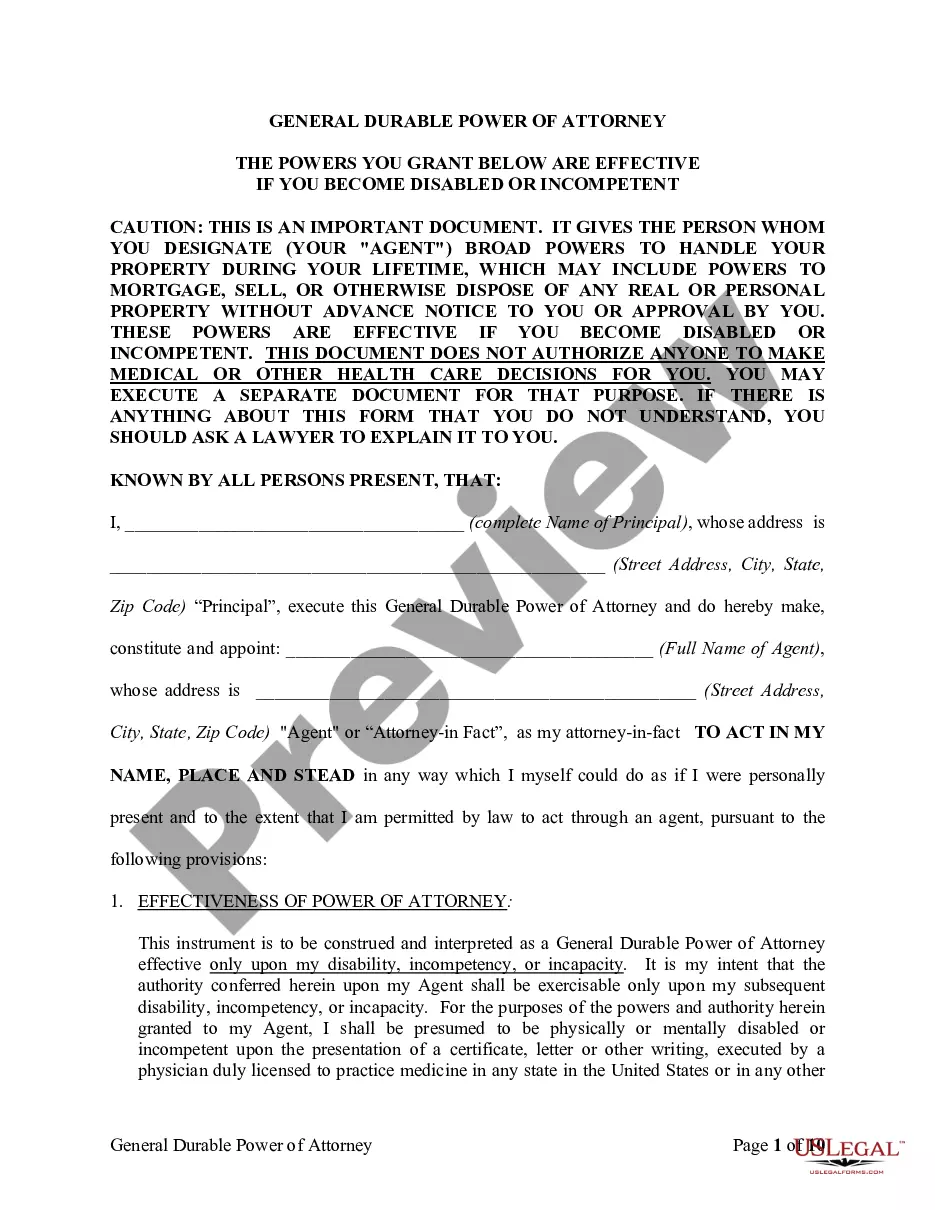

What documents you may need alongside this one

When utilizing the Louisiana Promissory Note Ne Varietur, it's advisable to have the following documents on hand:

- Identification for all parties involved.

- Prior agreements related to the loan.

- Any collateral documents if the note is secured by property.

- Proof of income or other financial statements for the borrower.

These documents may be necessary for a comprehensive review during the notarization process.

Form popularity

FAQ

A secured promissory note is an obligation to pay that is secured by some type of property.The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Who must sign the promissory note? A loan agreement is signed by both parties but only the borrowing party needs to sign a promissory note. A witness need not sign but the note can be notarized as evidence that the borrower did sign the document.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.If the note is lost, then the owner of the loan might have a problem.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.