Indiana General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability

What is this form?

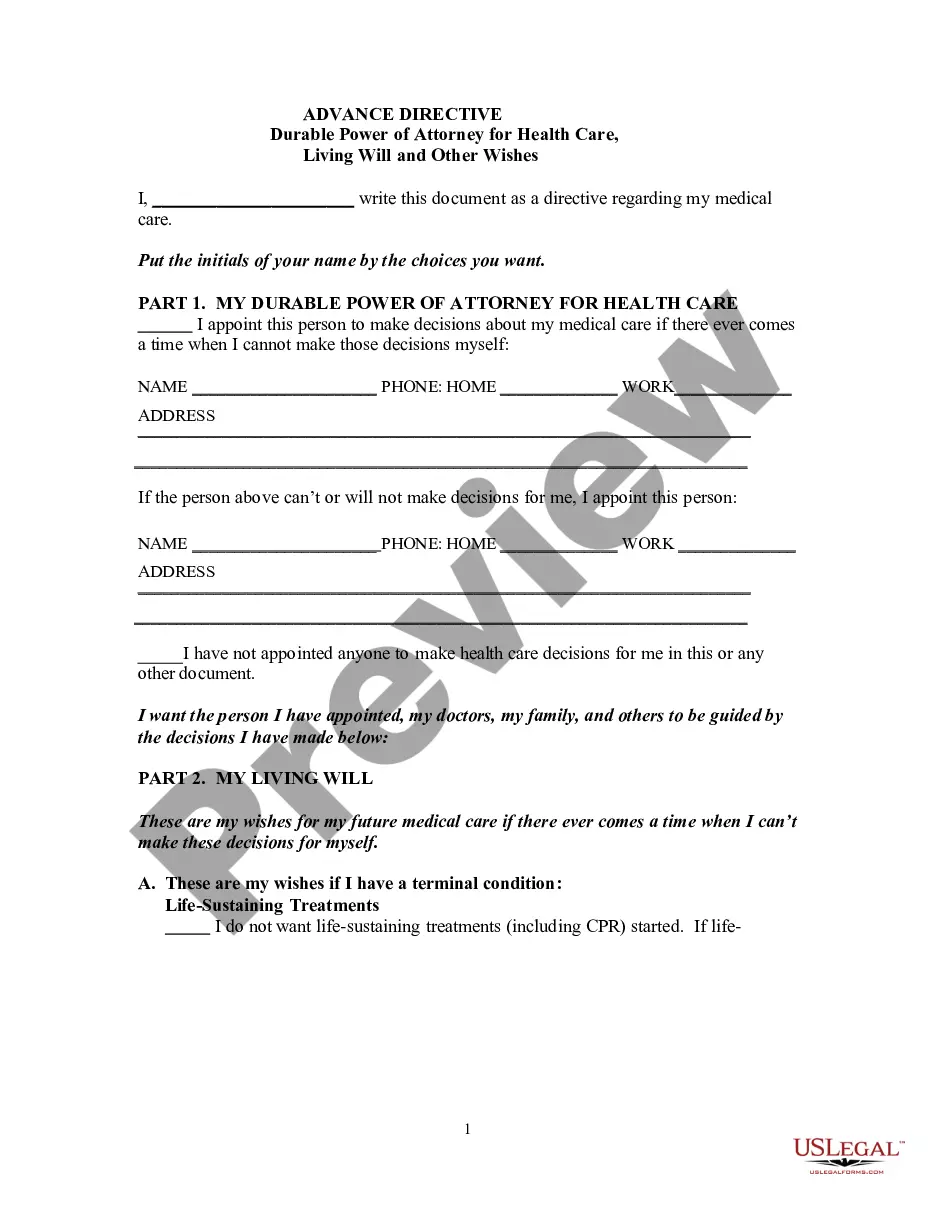

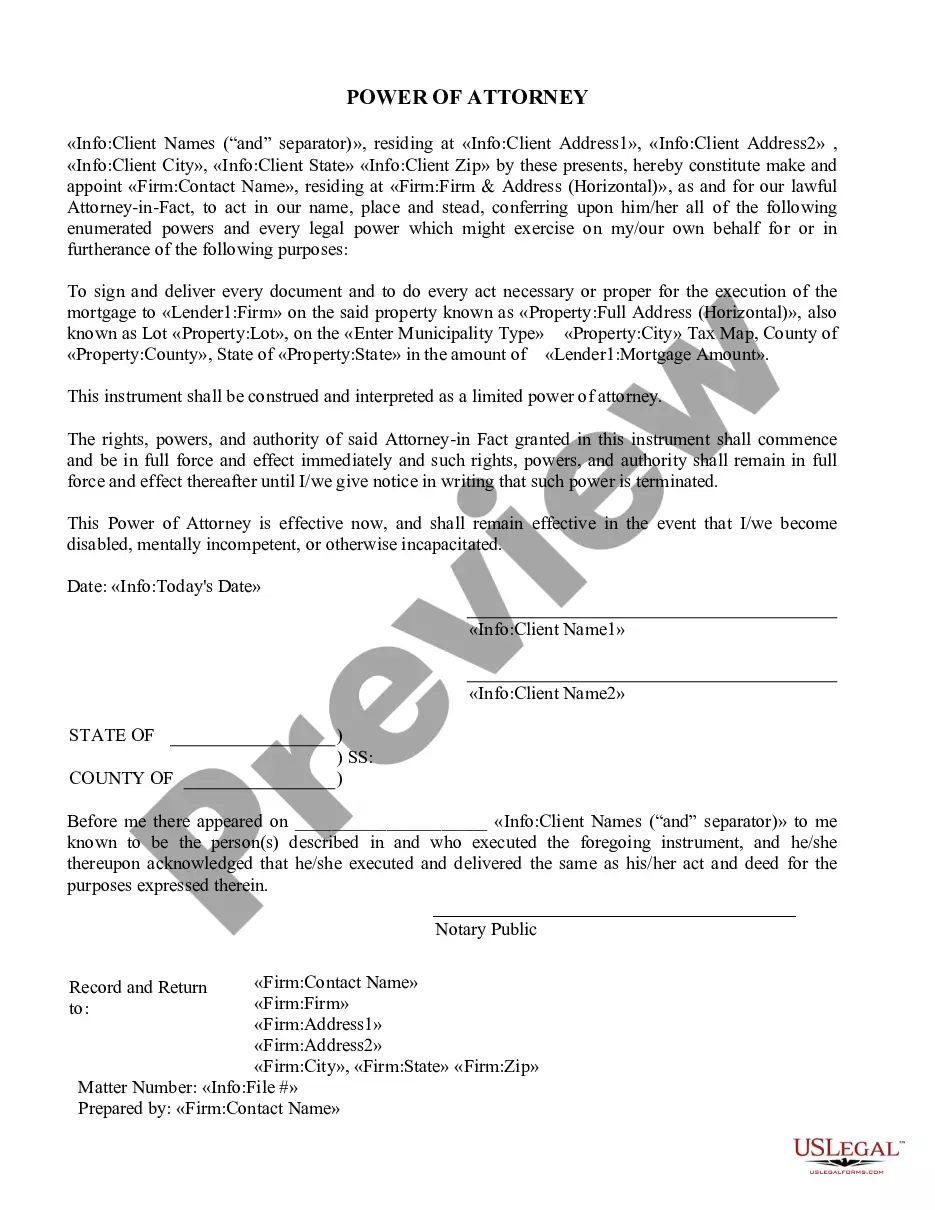

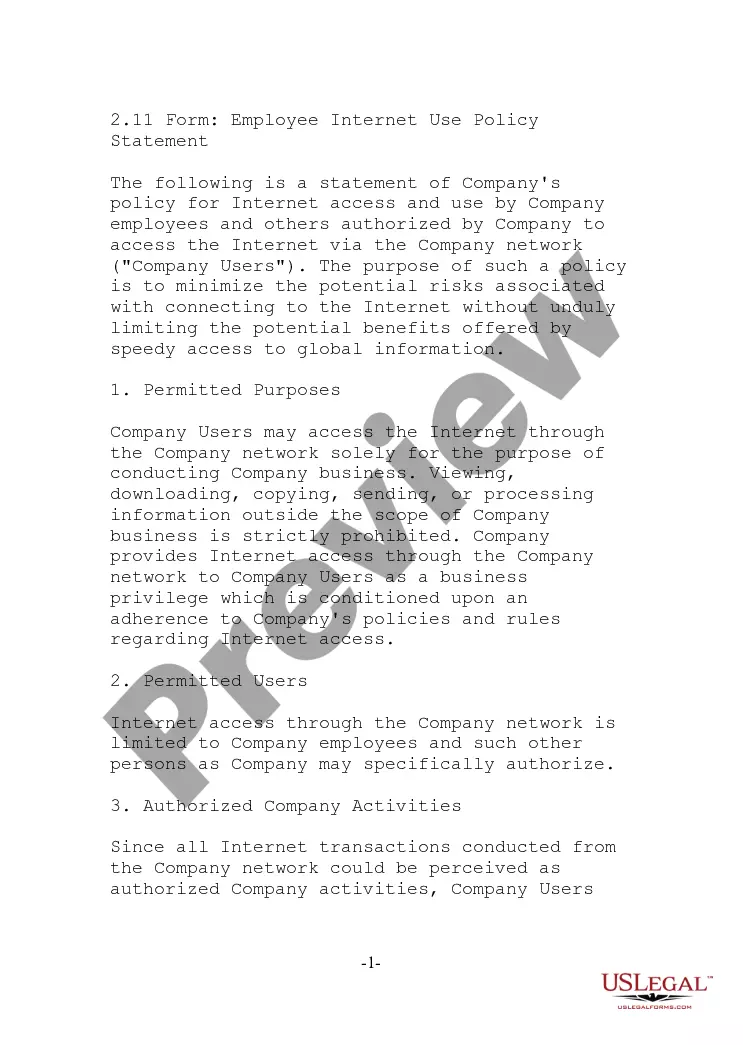

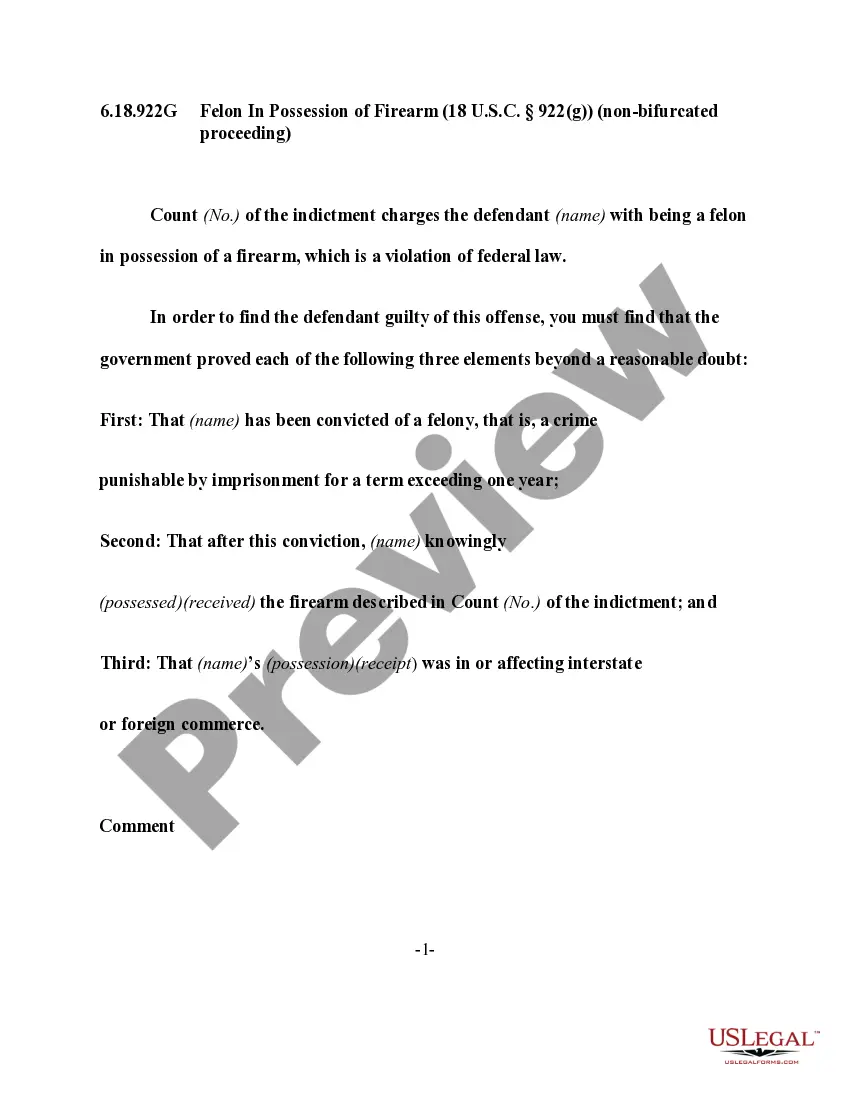

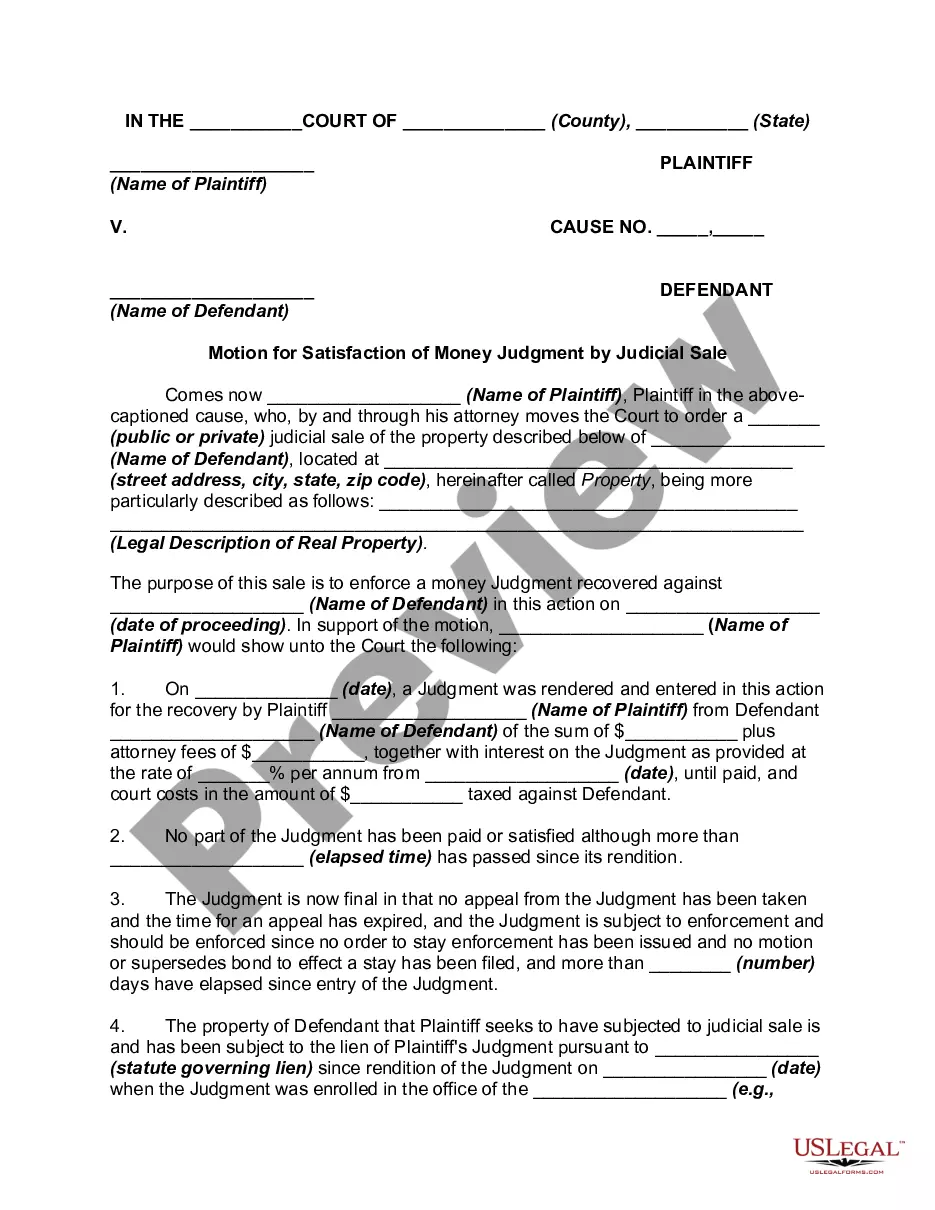

The General Durable Power of Attorney for Property and Finances Effective upon Disability is a legal document that allows an individual (the principal) to appoint someone else (the agent) to manage their financial affairs and property matters only when the principal becomes disabled, incapacitated, or incompetent. This Durable Power of Attorney specifically does not grant the agent authority over health care decisions, setting it apart from other types of power of attorney forms that might cover both financial and medical decisions.

Main sections of this form

- Identification of the principal and agent, including names and addresses.

- Definition of the powers granted to the agent, covering financial, property, and banking matters.

- Conditions under which the power of attorney becomes active, specifically upon the principal's disability or incapacity.

- Provisions for managing real and personal property, including selling, renting, or mortgaging.

- Options to specify additional powers or limitations for the agent.

- Signatures of the principal, witnesses, and notary for validation.

Jurisdiction-specific notes

When using this form, it is important to consider that specific laws may vary by state regarding the execution and enforcement of a General Durable Power of Attorney. Ensure compliance with local regulations to validate the document.

When to use this form

This form is necessary when an individual wants to ensure that their financial and property affairs can be managed by a trusted person in the event they become mentally or physically incapacitated. Situations include severe illness, accidents, or any condition that might impede decision-making abilities.

Who should use this form

- Individuals who wish to appoint an agent for their financial matters in case of disability.

- Persons who want to ensure their property is managed according to their wishes while they are incapacitated.

- Anyone seeking a flexible approach to financial management in their absence without involving healthcare decisions.

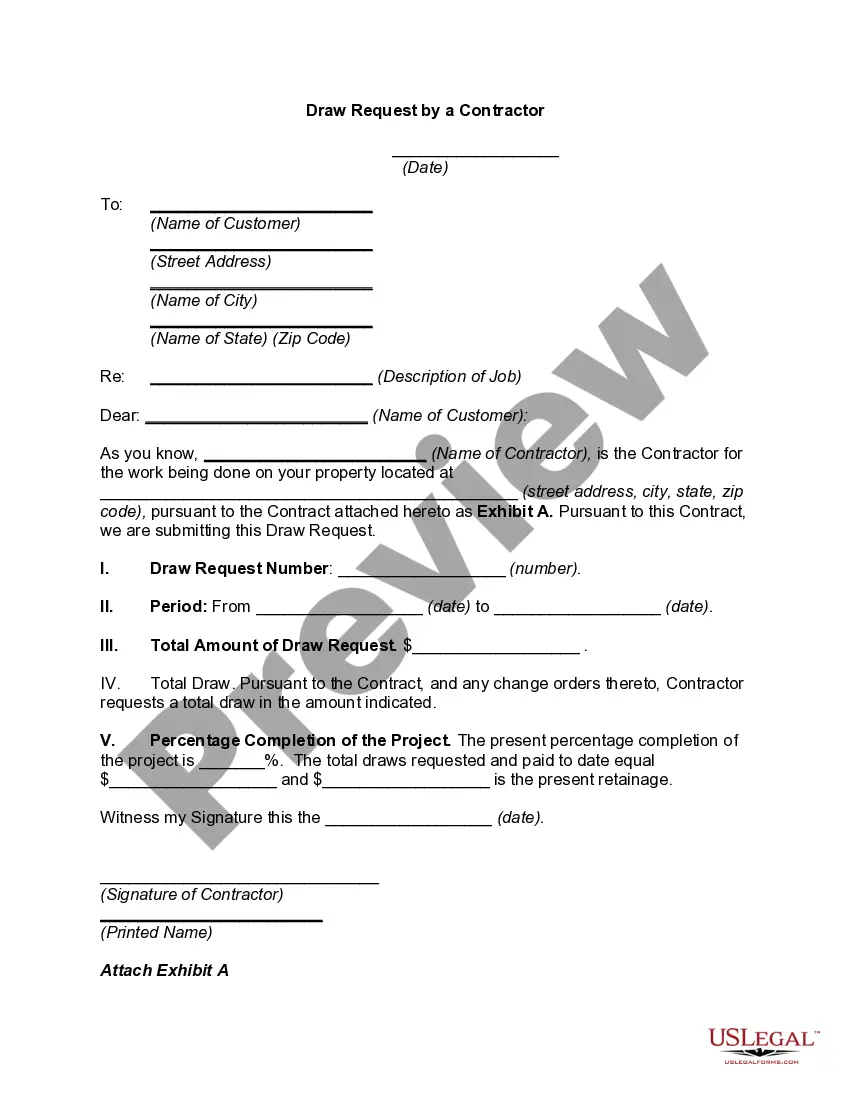

Steps to complete this form

- Identify the principal by writing their full name and address at the top of the form.

- Designate the agent by entering their full name and address where indicated.

- Specify the powers being granted by marking the appropriate clauses in the form.

- Sign and date the form in the presence of witnesses, and ensure that a notary public is available if required.

- Distribute copies to the agent and any relevant parties, such as financial institutions.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes to avoid

- Failing to clearly specify the powers granted, which can lead to limitations in the agent's authority.

- Not having the document properly witnessed or notarized, which can invalidate the form.

- Choosing an unreliable agent who may not act in the principal's best interests.

- Not reviewing the form regularly to ensure it still meets the principal's needs.

- Overlooking state-specific requirements that could affect the enforceability of the document.

Benefits of completing this form online

- Convenient access to legal forms from home without the need for an attorney visit.

- Editability allows for personal customization to meet specific needs and circumstances.

- Immediate download provides a fast solution for urgent legal needs.

- Access to resources and support during the completion process can help clarify terms and conditions.

Form popularity

FAQ

1. About the Power of Attorney. A Durable Power of Attorney may be the most important of all legal documents.It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A financial power of attorney (POA) is a legal document that grants a trusted agent the authority to act on behalf of the principal-agent in financial matters.This kind of POA is also referred to as a general power of attorney.

In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.(Ordinary, or "nondurable," powers of attorney automatically end if the person who makes them loses mental capacity.)

In California and in many other states, there are POA forms specific to healthcare, and medical decisions are excluded from the general durable POAs. This means you can designate one person to be your agent for health decisions, and another for financial or legal decisions.

If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

Non-Durable Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Medical Power of Attorney. Springing Power of Attorney. Create Your Power of Attorney Now.

A limited or special power of attorney may also be restricted to a specific time period.Financial Power of Attorney: Also called a durable power of attorney for finances, this gives the person of your choice the authority to manage your financial affairs should you become incapacitated.