Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage

Description

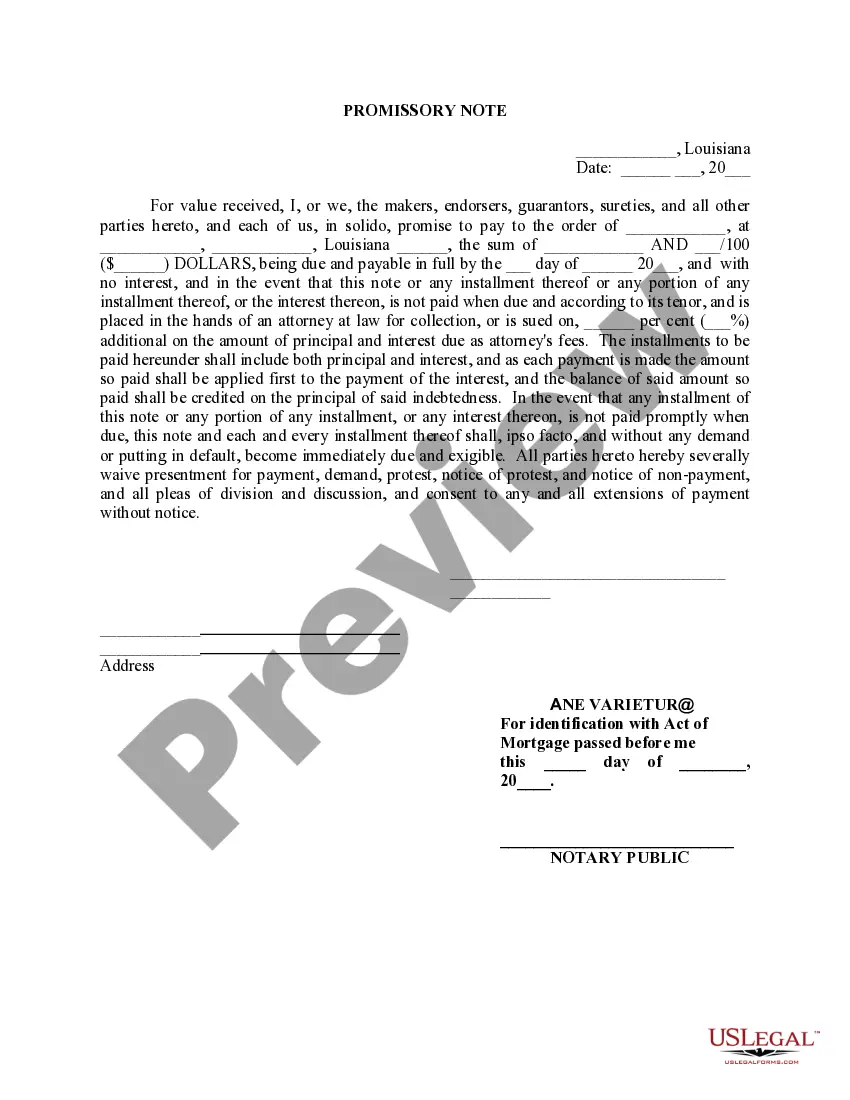

How to fill out Louisiana Promissory Note Ne Varietur, For Identification With Act Of Collateral Mortgage?

In search of Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage forms and filling out them can be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the appropriate template specifically for your state within a few clicks. Our attorneys draw up all documents, so you just have to fill them out. It really is that simple.

Log in to your account and return to the form's web page and save the document. All of your saved samples are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our comprehensive instructions on how to get your Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage template in a couple of minutes:

- To get an eligible example, check out its applicability for your state.

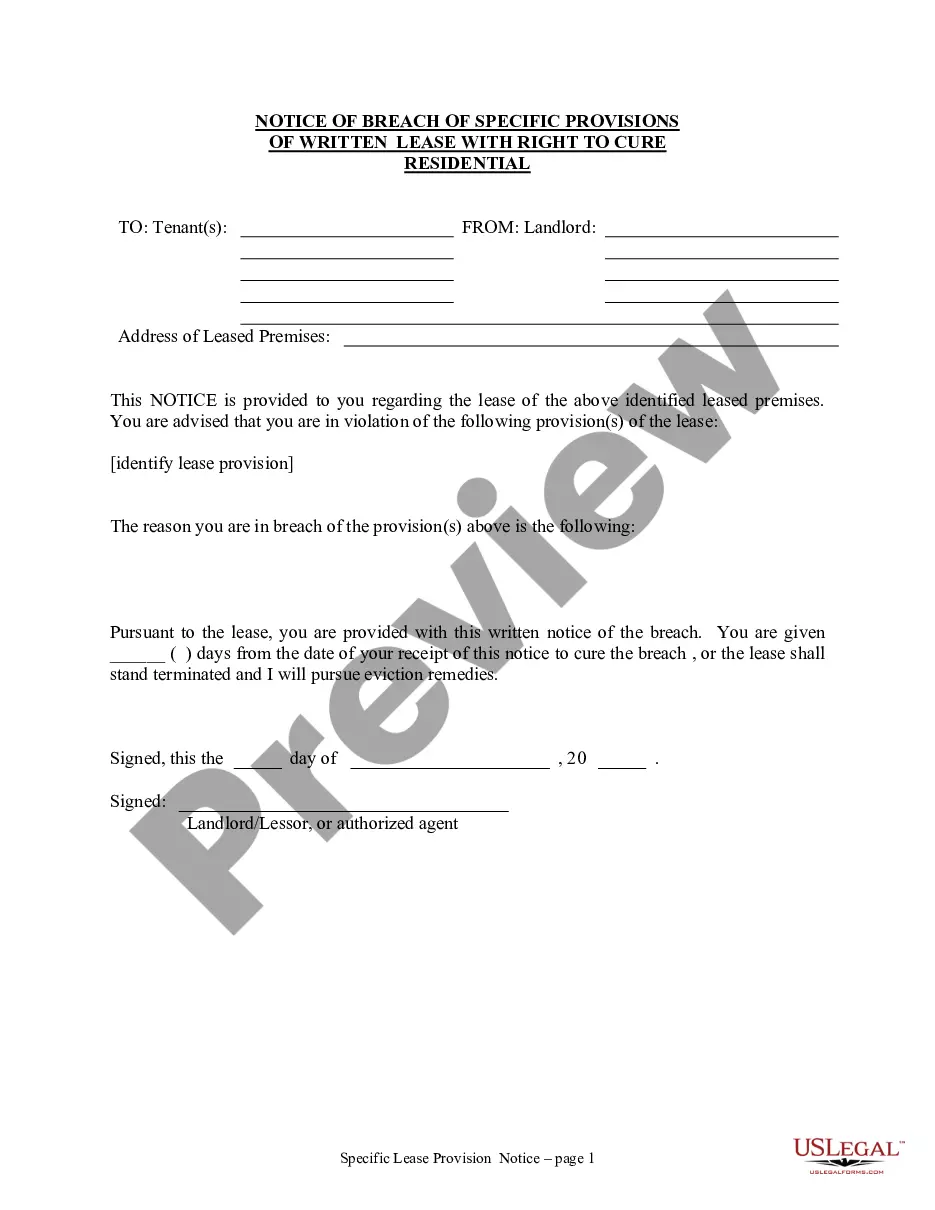

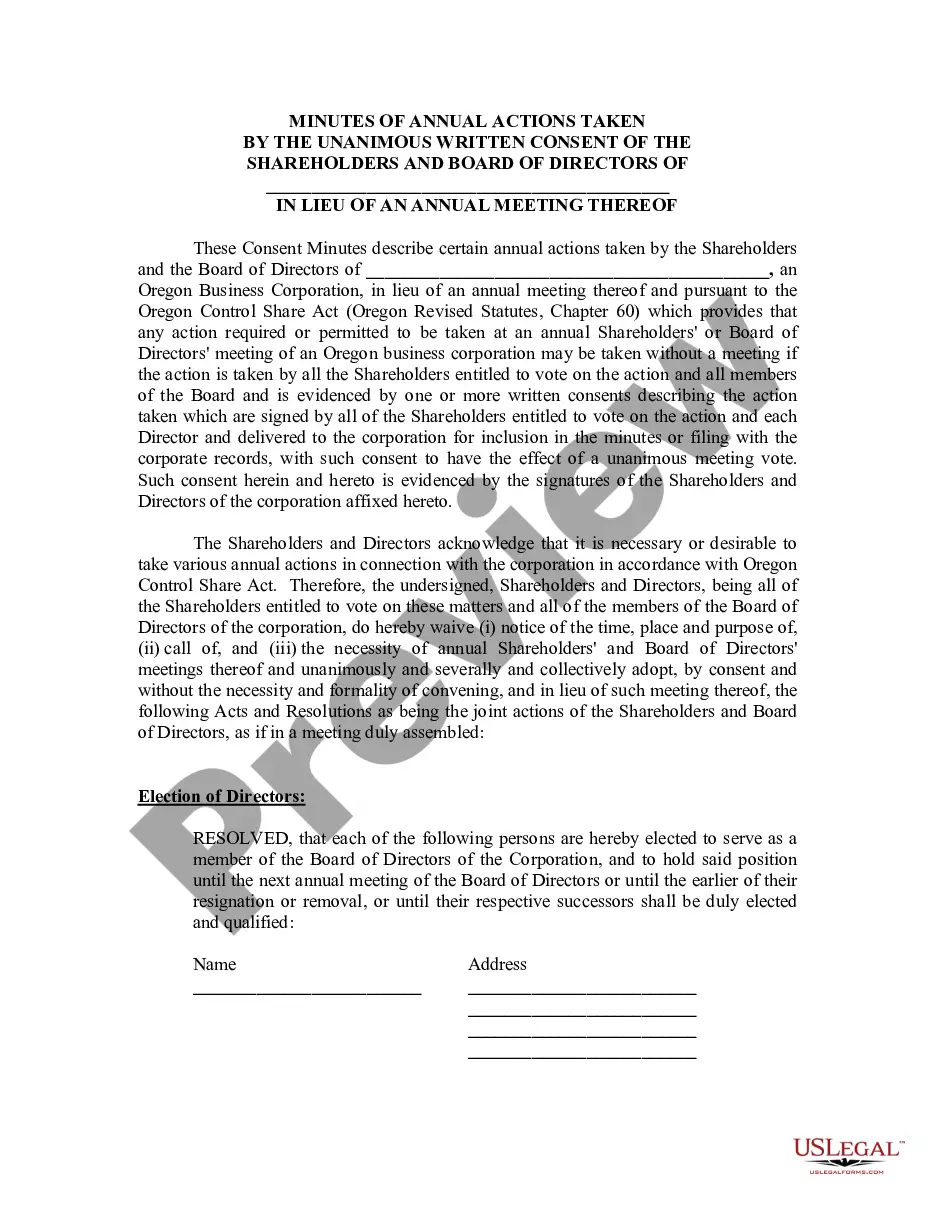

- Have a look at the example utilizing the Preview option (if it’s available).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and create an account.

- Select you wish to pay with a credit card or by PayPal.

- Save the sample in the preferred file format.

Now you can print the Louisiana Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage form or fill it out using any online editor. No need to worry about making typos because your template can be employed and sent away, and published as many times as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

A secured promissory note is an obligation to pay that is secured by some type of property.The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Who must sign the promissory note? A loan agreement is signed by both parties but only the borrowing party needs to sign a promissory note. A witness need not sign but the note can be notarized as evidence that the borrower did sign the document.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.If the note is lost, then the owner of the loan might have a problem.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.