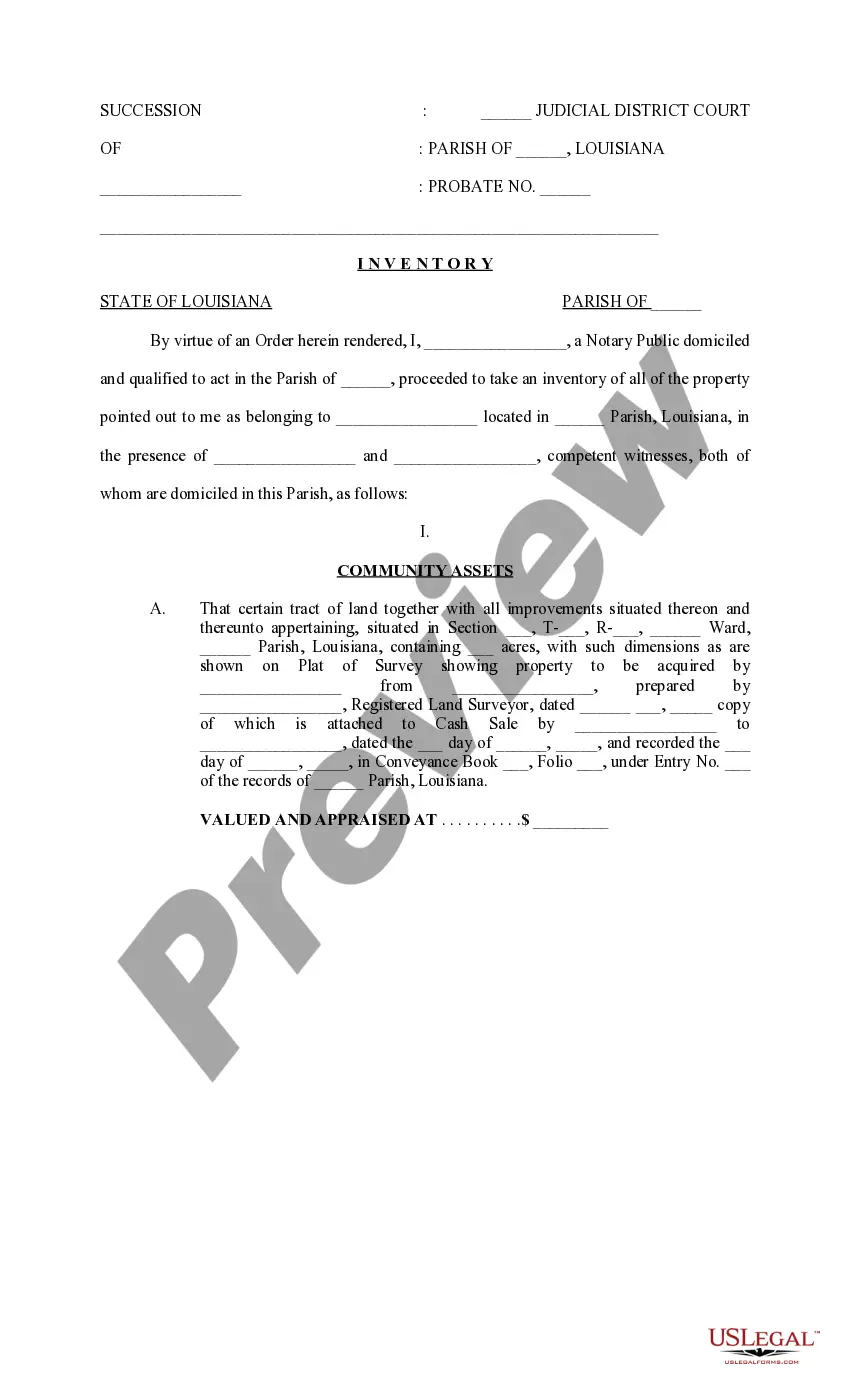

Louisiana Inventory, Probate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Inventory, Probate?

Locating Louisiana Inventory, Probate documents and completing them can be a task.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the appropriate sample tailored for your state within a few clicks. Our lawyers prepare all paperwork, so you merely need to fill them in.

It truly is quite simple.

Select your plan on the pricing page and set up your account. Choose whether to pay with a credit card or via PayPal. Download the form in your preferred file type. You can print the Louisiana Inventory, Probate template or complete it using any online editor. Don't be concerned about typing errors since your form can be used and submitted multiple times, and printed as many times as required. Experience US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- Your downloaded templates are stored in My documents and are available at all times for future use.

- If you haven’t signed up yet, you need to create an account.

- Review our thorough guidelines on how to obtain your Louisiana Inventory, Probate template in just a few minutes.

- To obtain a suitable form, verify its eligibility for your state.

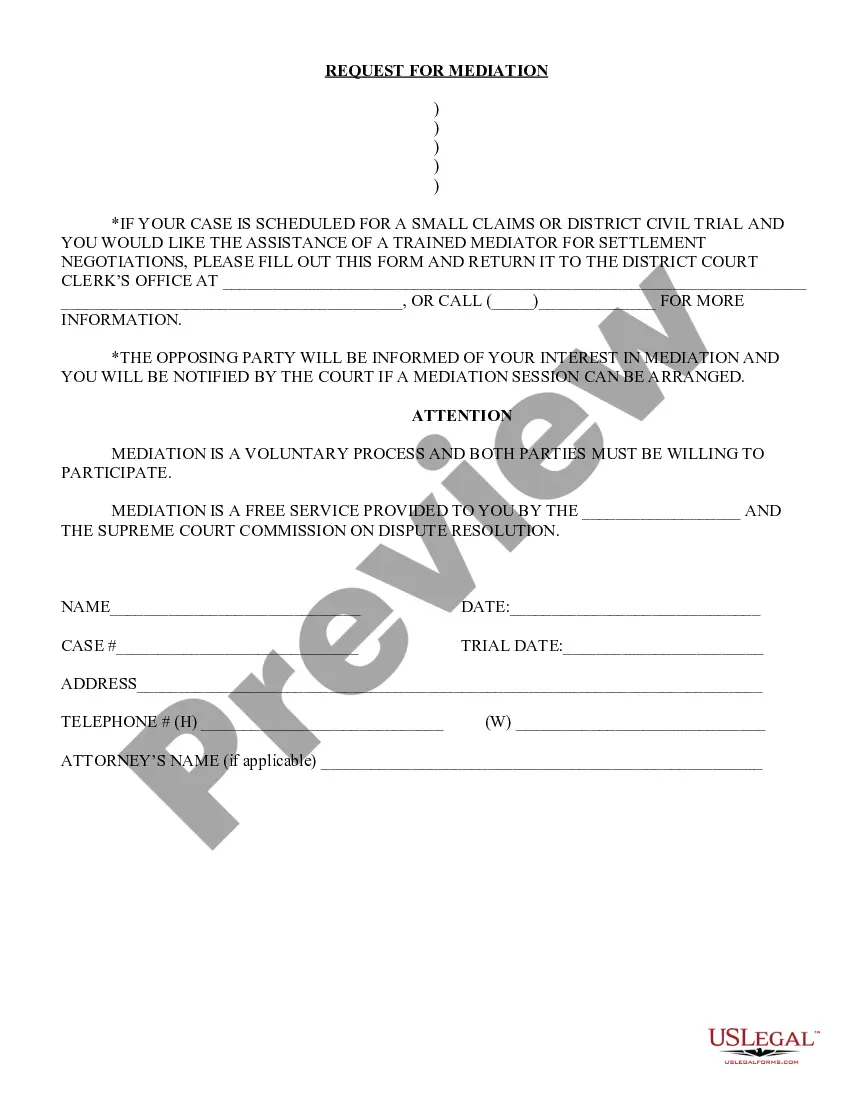

- Take a look at the sample using the Preview feature (if it’s available).

- If there’s a description, read it to understand the particulars.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

Real Estate, Bank Accounts, and Vehicles. Stocks and Bonds. Life Insurance and Retirement Plans. Wages and Business Interests. Intellectual Property. Debts and Judgments.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

When assets are being valued for probate, the valuation should be as at the date of death. For property, this will be what the market value at that time is; for personal possessions, it will be what they will fetch on the open market at the date of your death, and so on.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.