A Mississippi Mineral Deed is a legal document used to transfer the ownership of mineral rights from one party to another. It is also known as a mineral deed or mineral conveyance. This type of deed is commonly used to transfer subsurface rights for oil, gas, and other minerals from the owner of the surface land to a third party. The Mississippi Mineral Deed is filed with the county clerk's office in the county where the minerals are located. There are three types of Mississippi Mineral Deeds: 1. General Mineral Deed: This type of deed transfers all mineral rights, including oil, gas, and other minerals, from the surface owner to the third party. 2. Special Mineral Deed: This type of deed transfers some mineral rights, including oil, gas, and other minerals, from the surface owner to the third party. 3. Quitclaim Mineral Deed: This type of deed transfers all mineral rights, including oil, gas, and other minerals, from the surface owner to the third party with no warranties or guarantees.

Mississippi Mineral Deed

Description

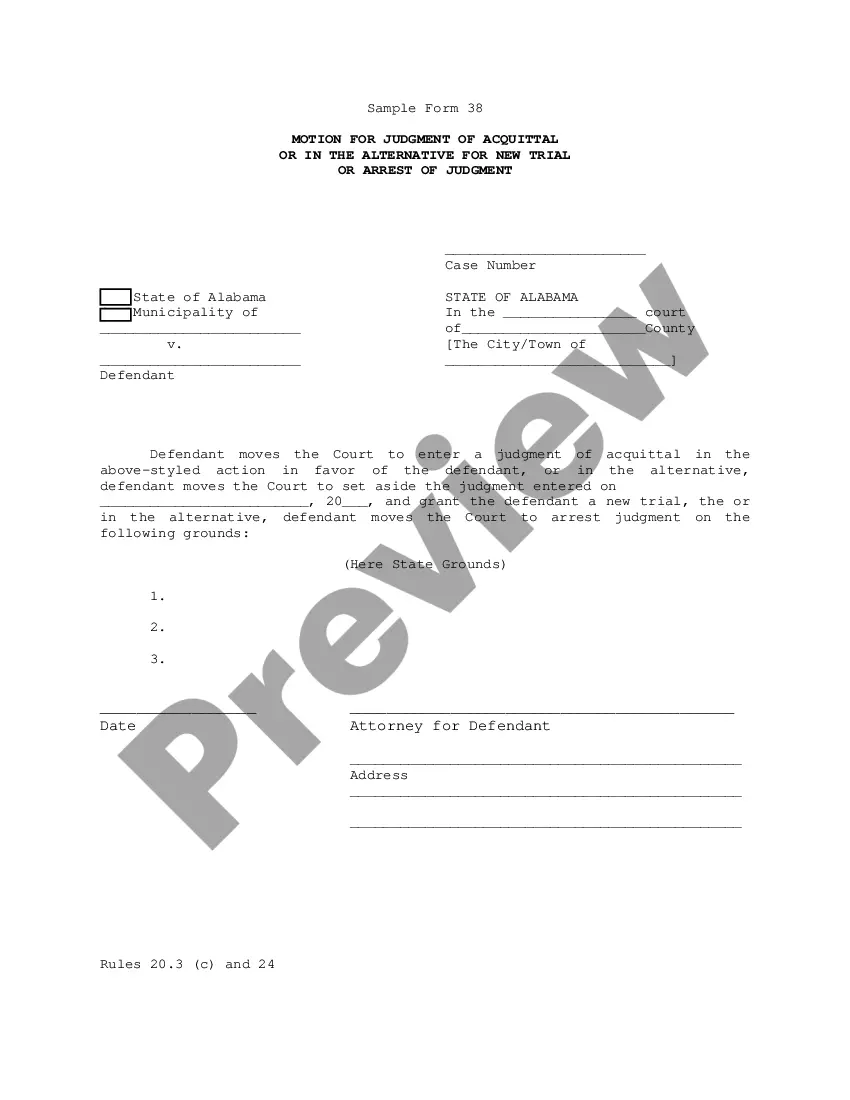

How to fill out Mississippi Mineral Deed?

If you’re looking for a method to properly finalize the Mississippi Mineral Deed without employing an attorney, then you’re in the perfect place.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every personal and commercial circumstance.

Decide the format in which you wish to save your Mississippi Mineral Deed and download it by clicking the appropriate button. Upload your template to an online editor to complete and sign it quickly or print it to prepare your hard copy manually. Another excellent feature of US Legal Forms is that you will never lose the documents you obtained - you can find any of your downloaded forms in the My documents section of your profile whenever you require it.

- Every document you find on our online service is crafted in accordance with federal and state laws, so you can be assured that your papers are in order.

- Follow these straightforward instructions on how to obtain the ready-to-use Mississippi Mineral Deed.

- Verify that the document displayed on the page aligns with your legal situation and state laws by reviewing its text description or browsing through the Preview mode.

- Key in the form title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the paperwork meets all requirements.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available for download immediately after.

Form popularity

FAQ

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

How to search for mineral rights records? County Records and Tax Assessor's Office and Documents. Conduct a title deed search at the county records office to find the owner history in the title deed.Loan Default History and Foreclosure.Royalty deeds.Use a title company to conduct a search.Online records search company.

Mississippi law allows mineral rights and land ownership to be separate. Some landowners may not be aware they don't own the mineral rights. Mineral ownership can be determined through a title search.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

? Summary. AN ACT TO PROVIDE THAT MINERAL ESTATES SEPARATED FROM THE SURFACE ESTATE SHALL REVERT TO THE OWNER OF THE SURFACE ESTATE AFTER TEN YEARS OF NONPRODUCTION; TO DEFINE NONPRODUCTION; AND FOR RELATED PURPOSES.

A lease bonus is a one-time payment the mineral rights owner receives when the lease is signed. Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.

A royalty is a fee that is imposed by local, state or federal governments on either the amount of minerals produced at a mine or the revenue or profit generated by the minerals sold from a mine. A royalty can be imposed as either a ?net? or ?gross? royalty.

With a mineral deed, the holder usually has responsibility for development and production of the extraction on the property. That risk comes with the potential reward of the majority of the profit that comes from it. With a royalty deed, the holder does not usually bear the risk of the development and production.