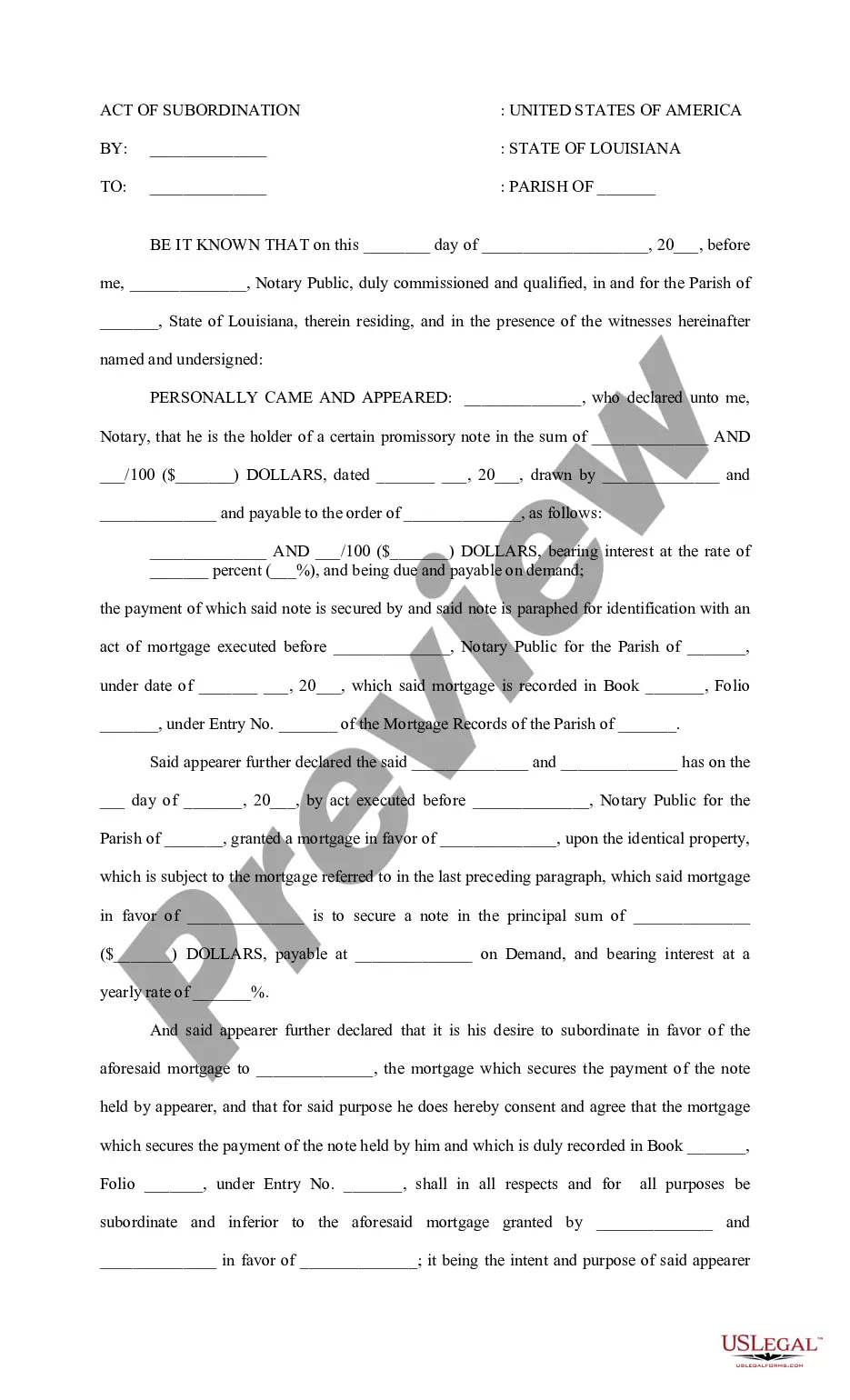

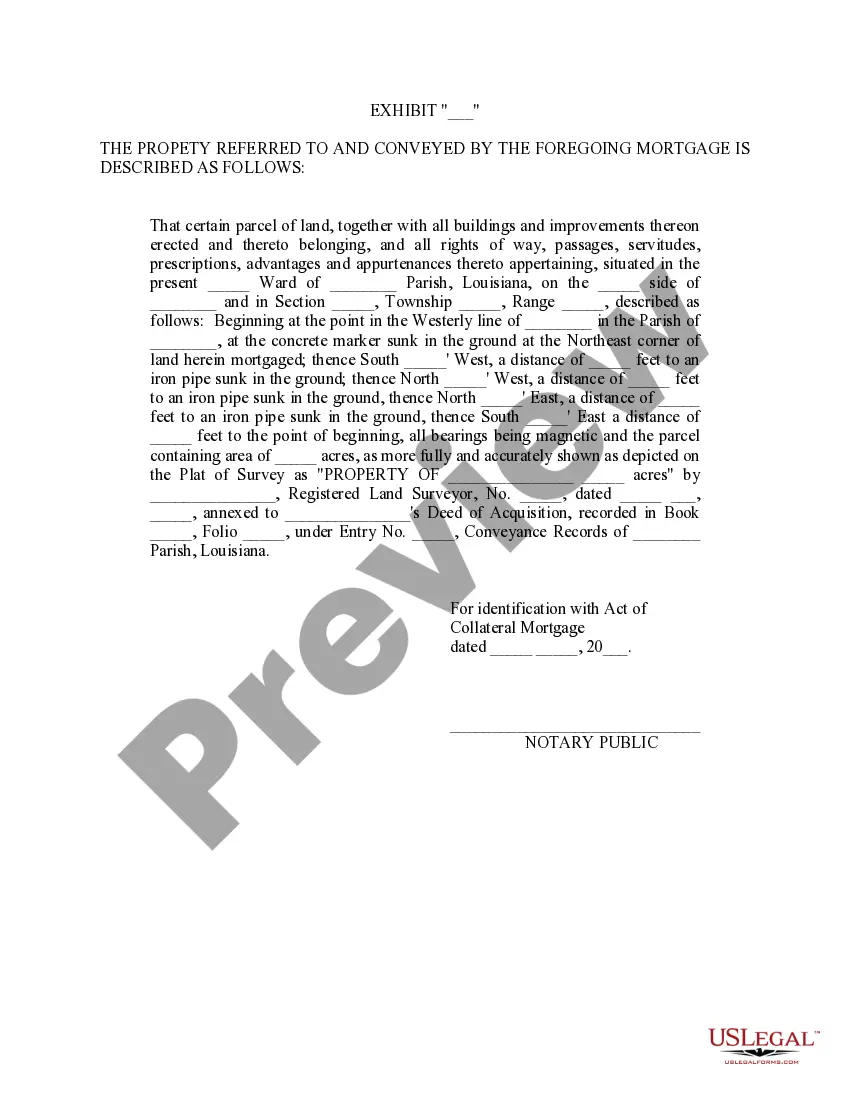

Louisiana Exhibit, Act of Collateral Mortgage

Description

How to fill out Louisiana Exhibit, Act Of Collateral Mortgage?

Attempting to locate Louisiana Exhibit, Act of Collateral Mortgage templates and completing them could prove to be challenging.

To conserve a significant amount of time, money, and effort, utilize US Legal Forms and discover the appropriate sample specifically for your state in just a few clicks.

Our legal experts prepare all documents, so you only need to complete them. It’s really that simple.

Choose your plan on the pricing page and create an account. Select your payment method, whether it’s via a credit card or PayPal. Download the sample in your preferred file format. You can now print the Louisiana Exhibit, Act of Collateral Mortgage form or fill it out using any online editor. Don’t fret about making errors, as your template can be used and submitted, and printed out as often as you wish. Try US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the sample.

- All your saved templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you should create an account.

- Refer to our detailed instructions to obtain the Louisiana Exhibit, Act of Collateral Mortgage form in a matter of minutes.

- To acquire a valid sample, confirm its eligibility for your state.

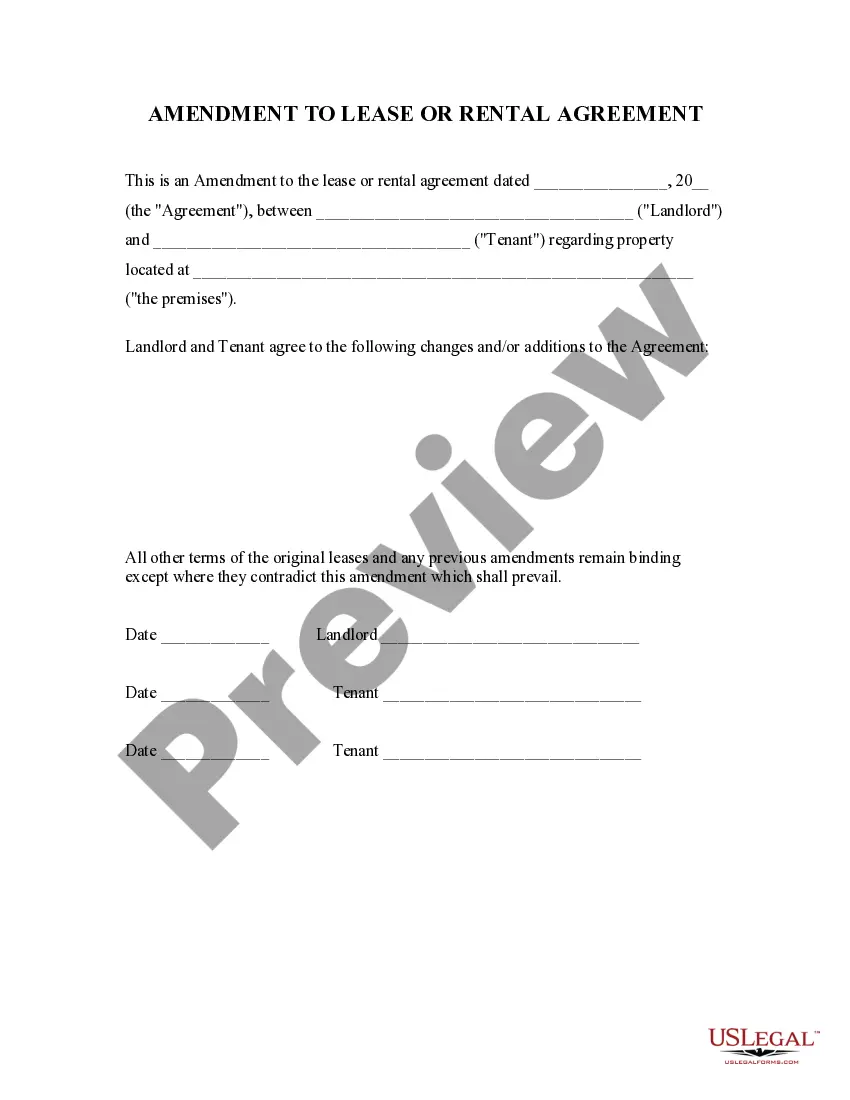

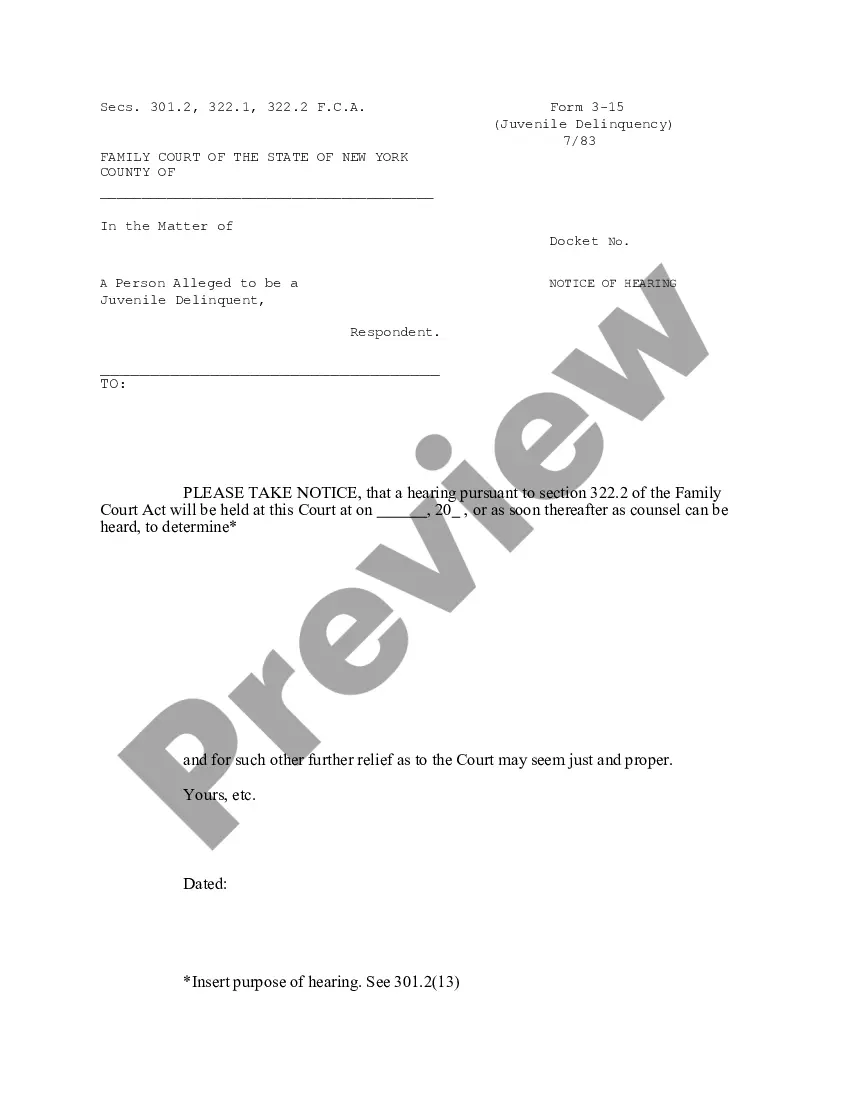

- Use the Preview feature to view the example (if available).

- If there’s a description, read it to understand the details.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

Collateral documents include any documents granting a security interest in collateral by the borrower, parent or subsidiary in favor of the lender and all other documents required to be executed or delivered pursuant to those documents. Collateral documents do not include guaranties.

Collateral is a property or other asset that a borrower offers as a way for a lender to secure the loan. For a mortgage, the collateral is often the house purchased with the funds from the mortgage.For a loan to be considered secure, the value of the collateral must meet or exceed the amount remaining on loan.

Collateral mortgages are pushed heavily by the banks because they benefit the banks. Collateral mortgages tie you to your bank and block taking out other equity in your property; they also give the bank extra power to demand the full balance or begin foreclosure much more quickly.

When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

With a conventional charge, only the amount of the home loan is registered against the property.With a collateral charge, on the other hand, an amount higher than the home loan can be registered against the property.

A collateral mortgage is a readvanceable mortgage product, meaning that your lender can lend you more money as your property value increases without having to refinance your mortgage.

A collateral mortgage is a type of mortgage product that is re-advanceable, which means the lender can loan you more funds as the value of your home increases without the need to refinance your home loan.

According to Experian, in the most basic terms, collateral is an asset.In the event the borrower becomes incapable of making payments, the lender can seize the collateral to make up for their financial loss. A mortgage, on the other hand, is a loan specific to housing where the real estate is the collateral.