UCC1 - Financing Statement - Kentucky - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Kentucky UCC1 Financing Statement

Description

How to fill out Kentucky UCC1 Financing Statement?

Searching for Kentucky UCC1 Financing Statement forms and completing them could be challenging.

To conserve time, expenses, and exertion, utilize US Legal Forms to locate the suitable template specifically for your state in just a few clicks.

Our attorneys prepare all documents, allowing you to just complete them. It truly is that easy.

Select your plan on the pricing page and create an account. Choose your payment method, either by credit card or through PayPal. Save the template in your desired file format. Now you can print the Kentucky UCC1 Financing Statement template or complete it using any online editor. Don’t be concerned about making errors, as your template can be utilized and submitted, and printed as many times as you like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the sample.

- All your downloaded templates are stored in My documents and are accessible anytime for future use.

- If you haven’t registered yet, you must sign up.

- Review our detailed instructions on how to obtain your Kentucky UCC1 Financing Statement template in a few minutes.

- To obtain an appropriate form, verify its relevance for your state.

- Examine the template using the Preview option (if it’s provided).

- If there’s a description, read it to understand the details.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

You received a Kentucky UCC1 Financing Statement because a creditor filed it to secure their interest in your collateral. This can happen in the context of loans or credit, where the creditor wants to ensure their claim is legally recognized. It's important to review this document carefully, as it affects your financial standing and obligations. To better understand your situation, consider checking uslegalforms for resources on managing UCC filings.

Why file a UCC-3 form? The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC 3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.

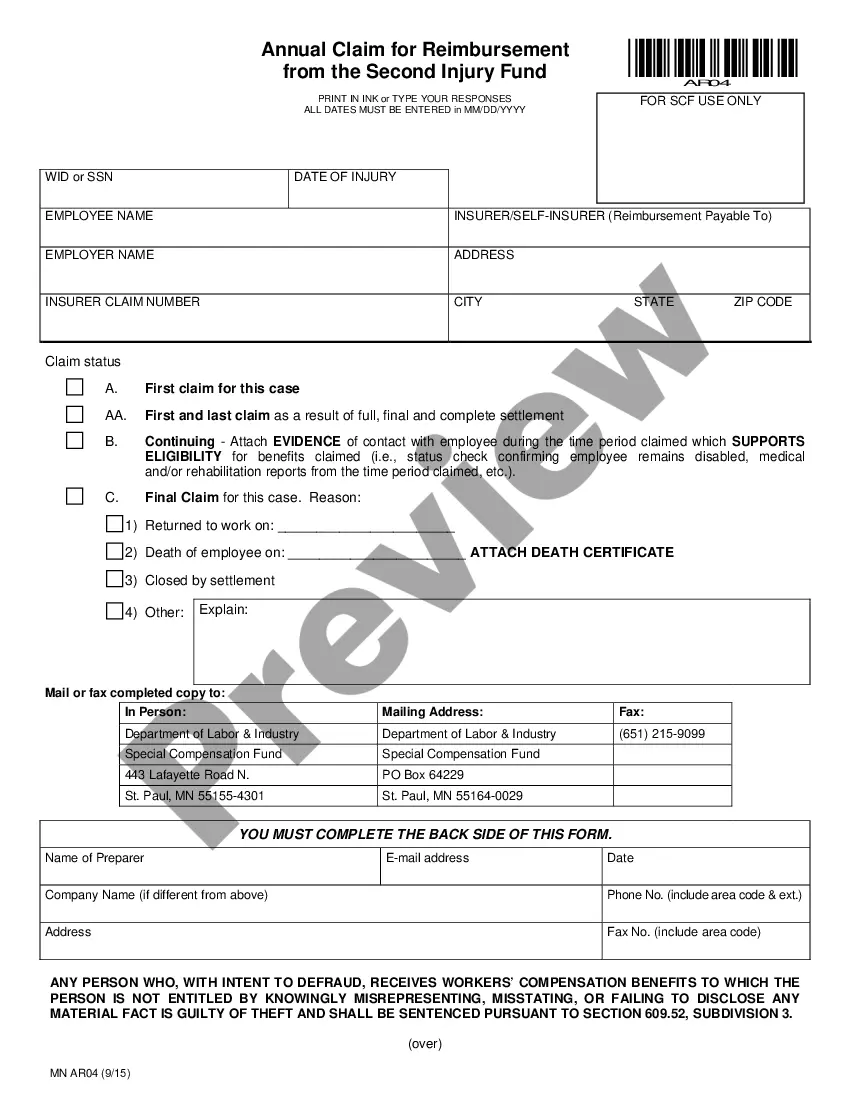

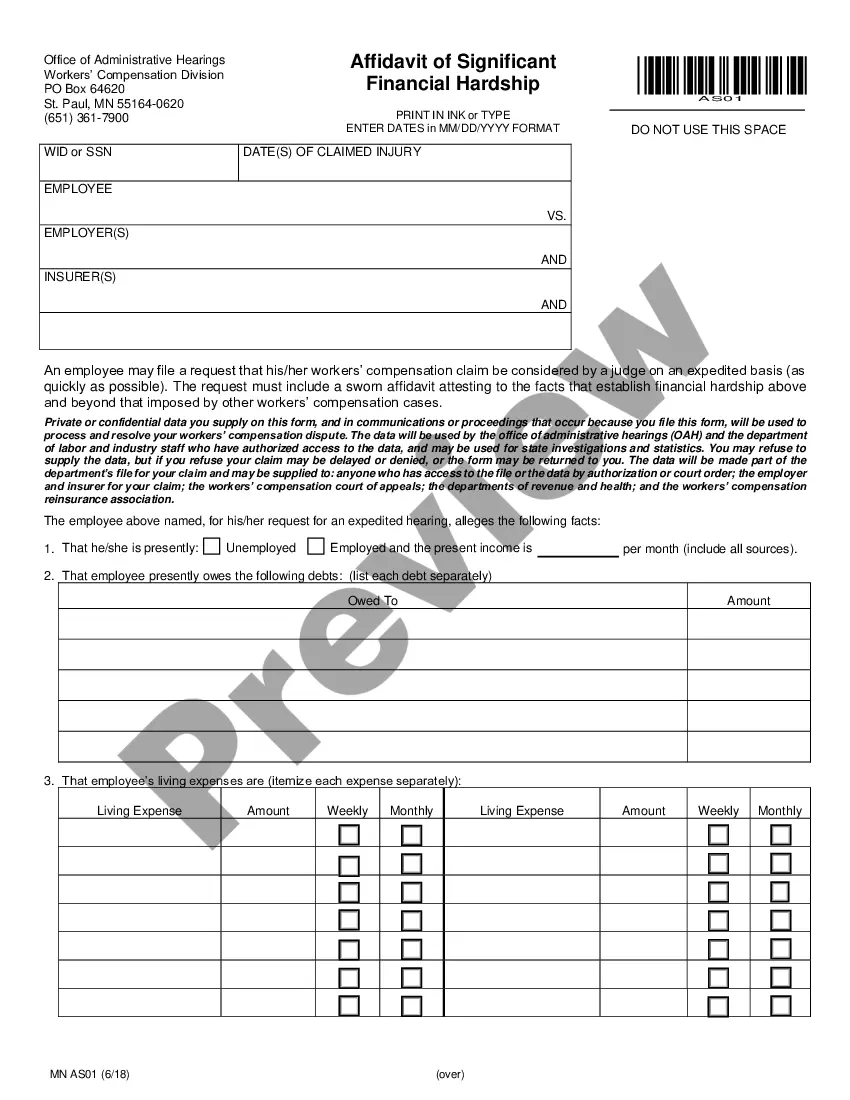

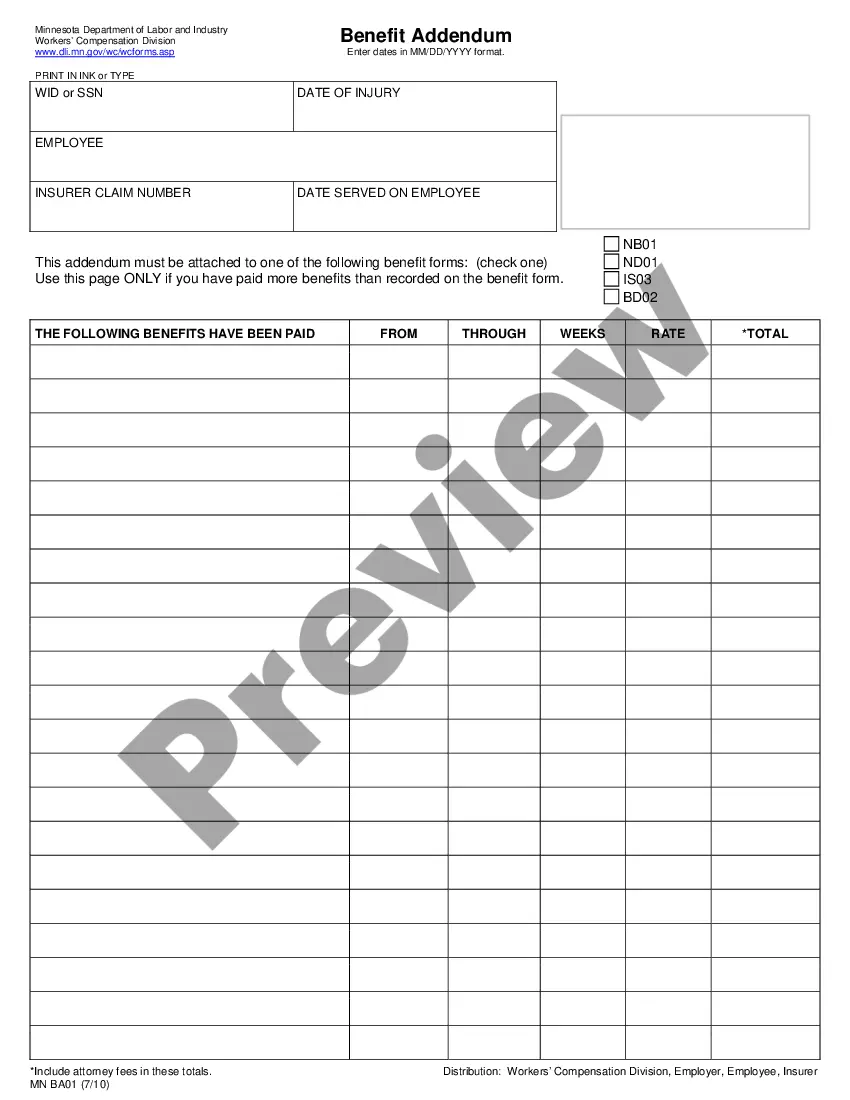

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.