Kentucky Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Have you been within a situation the place you need to have files for sometimes organization or individual uses nearly every time? There are a lot of authorized document web templates accessible on the Internet, but discovering kinds you can depend on isn`t straightforward. US Legal Forms offers thousands of kind web templates, much like the Kentucky Clauses Relating to Dividends, Distributions, which can be composed in order to meet state and federal needs.

Should you be presently knowledgeable about US Legal Forms website and also have a free account, basically log in. After that, you are able to obtain the Kentucky Clauses Relating to Dividends, Distributions format.

If you do not provide an accounts and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you need and make sure it is for your proper city/state.

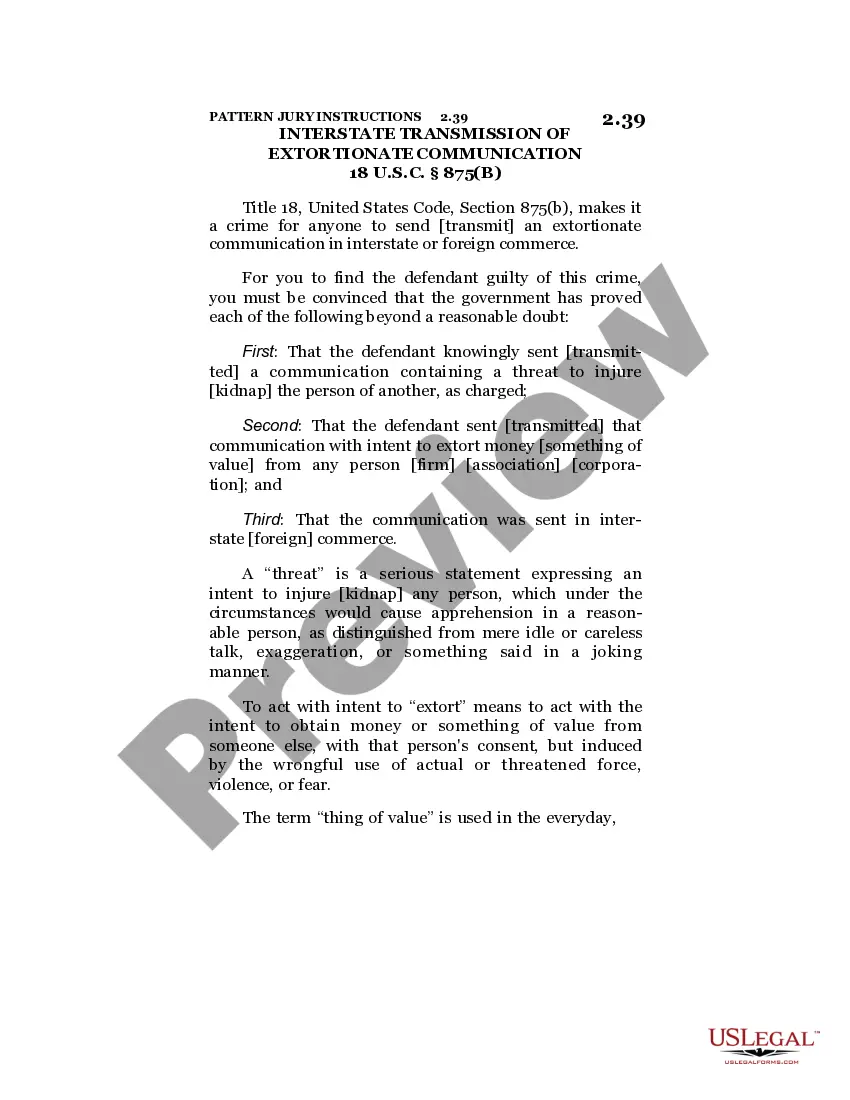

- Utilize the Review key to review the form.

- Browse the explanation to actually have selected the right kind.

- When the kind isn`t what you`re trying to find, make use of the Search area to find the kind that meets your needs and needs.

- Once you get the proper kind, simply click Get now.

- Opt for the costs prepare you want, submit the required info to create your bank account, and purchase the transaction utilizing your PayPal or credit card.

- Pick a practical data file format and obtain your duplicate.

Discover all of the document web templates you might have bought in the My Forms food list. You can aquire a more duplicate of Kentucky Clauses Relating to Dividends, Distributions at any time, if needed. Just go through the required kind to obtain or printing the document format.

Use US Legal Forms, the most extensive collection of authorized kinds, to save some time and prevent faults. The service offers expertly produced authorized document web templates which you can use for a variety of uses. Produce a free account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

A Kentucky Corporation and/or Limited Liability Company that is no longer operating is required to file a ?final? corporate and/or limited liability entity tax return in order for those tax accounts to be closed; other business tax accounts may be cancelled by utilizing the 10A104 Update to Business Information or ...

??????Register or Reinstate a Business Step 1: Legally Establish Your Business. ... Step 2: Obtain Your Federal Employer Identification Number (FEIN) from the IRS. ... Step 3: Register for Tax Accounts and the Commonwealth Business Identifier (CBI). ... Step 4: If necessary, complete the specialty applications below:

Ordinary dividends are taxed at the same rate as federal income taxes, or between 10% and 37%. State income taxes also may apply.

Kentucky law lowers personal income tax rates for 2023 and 2024 and removes triggers for future rate cuts. On February 17, 2023, Kentucky Governor Andy Beshear signed into law H.B.1, which lowers the state personal income tax rate to 4.5% retroactive to January 1, 2023, and to 4.0% effective January 1, 2024.

??Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Kentucky Tax Registration (10A100) - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application (10A100). Additional tax registrations may be required based on your industry, for more information visit the Kentucky Department of Revenue.