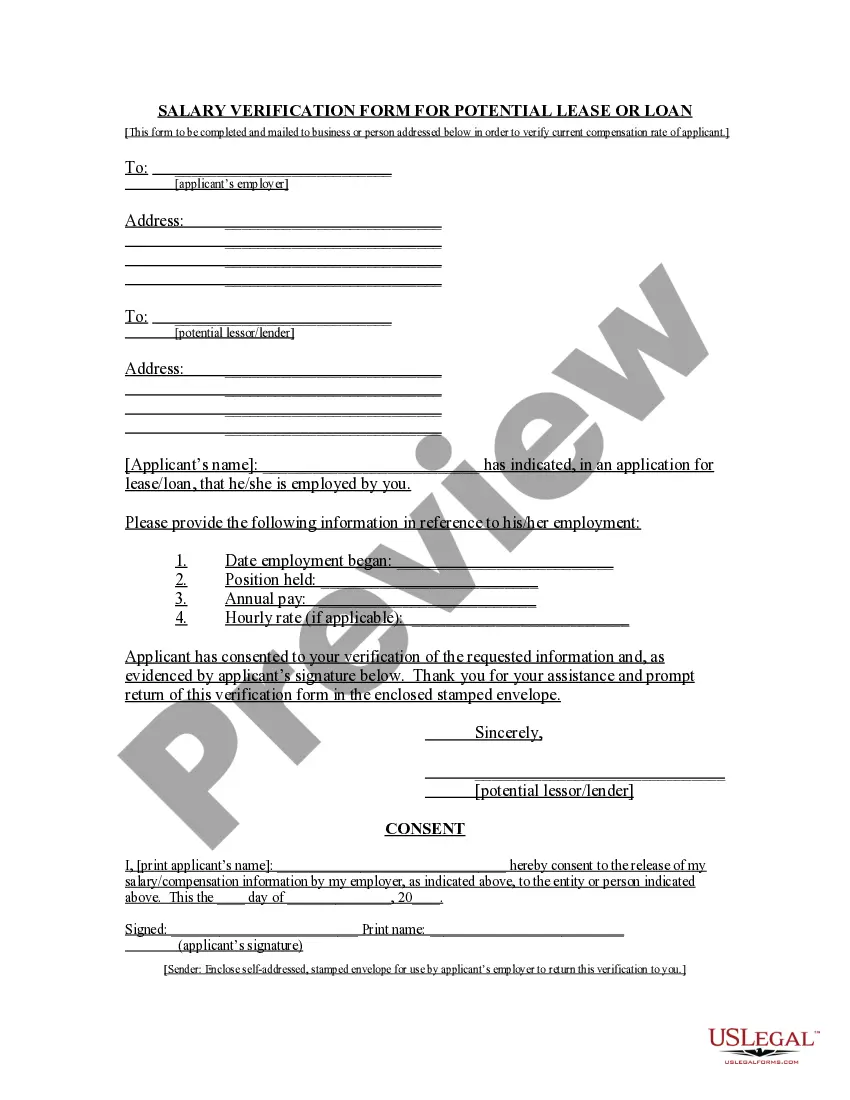

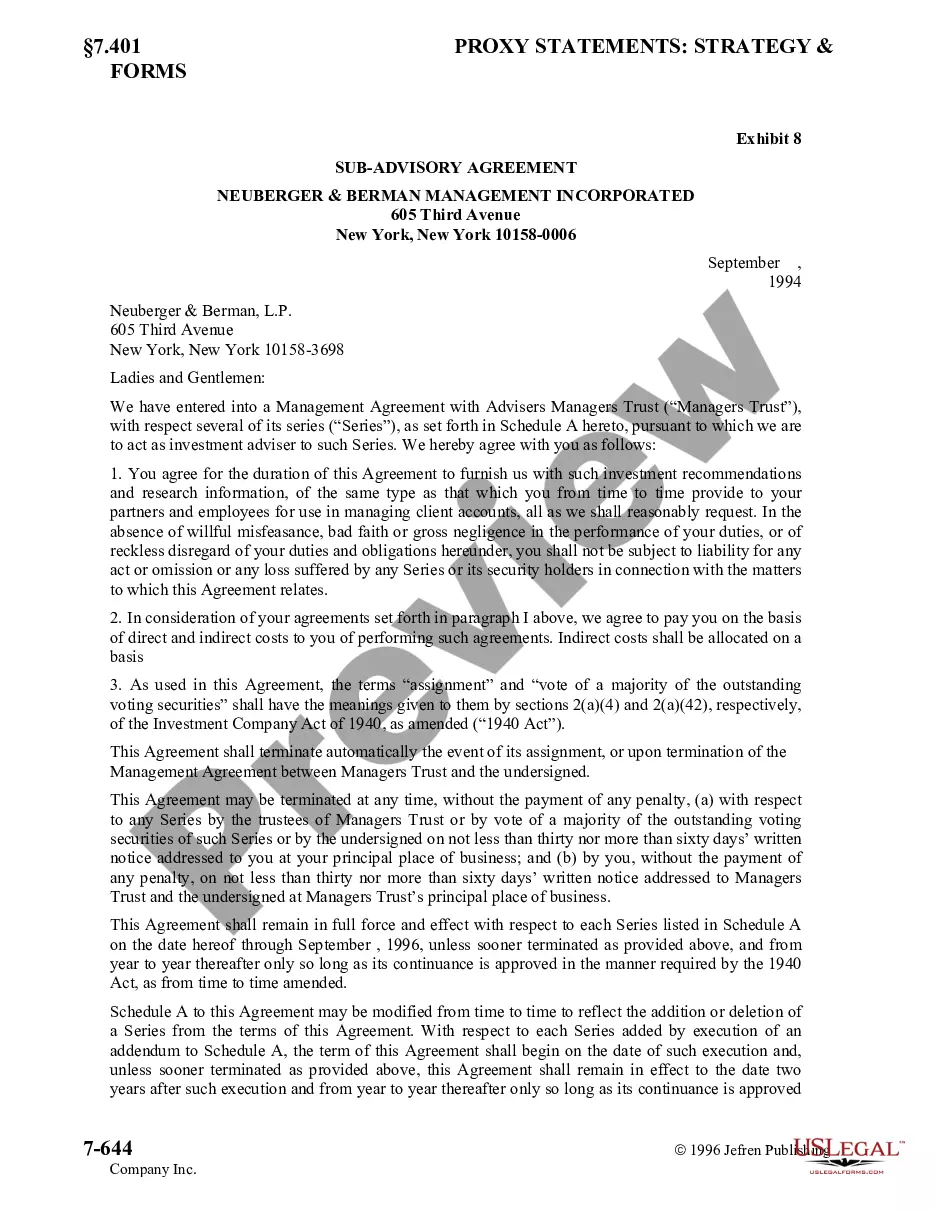

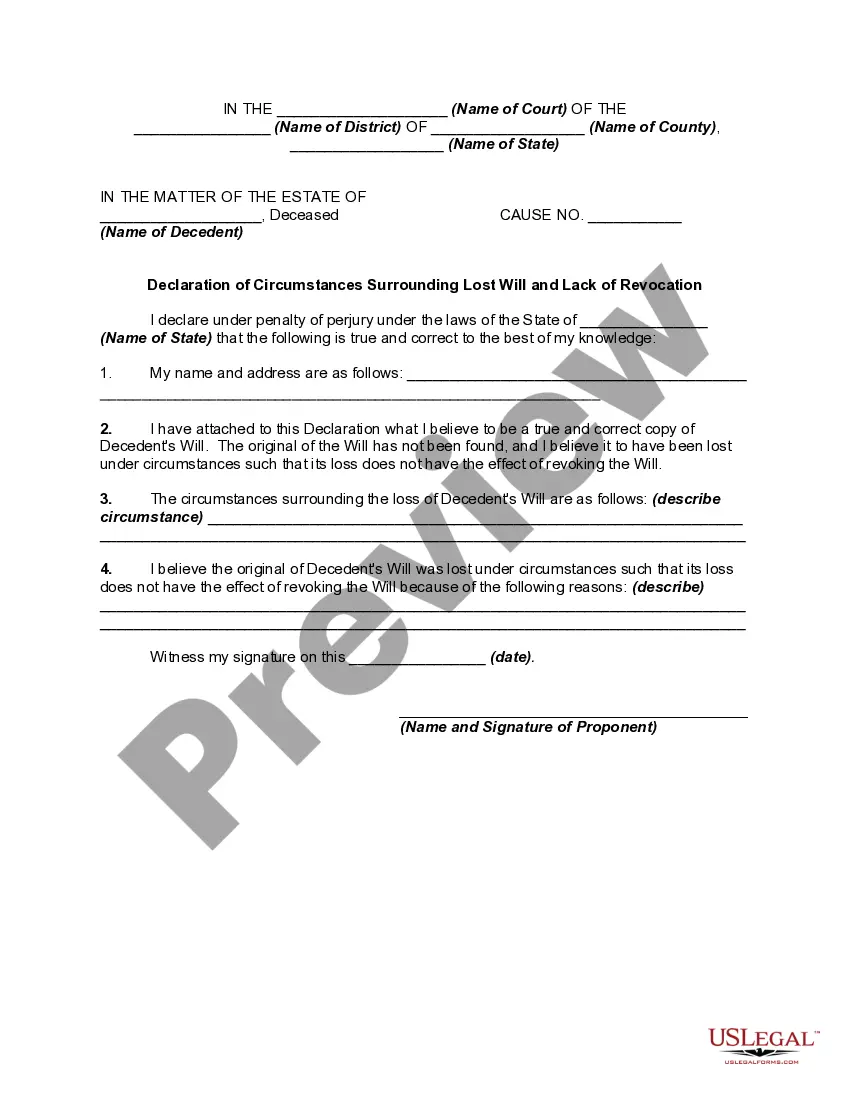

This office lease form is a tenant's letter of credit to the owner in the place of a security deposit. The letter of credit maintains effect at all times during the term of the lease following delivery thereof. A clean, unconditional and irrevocable letter of credit shall have an expiration date no earlier than the first anniversary of the date of issuance and shall provide that it shall be automatically renewed from year to year unless terminated by a bank by notice to the owner. The final expiration date of the letter of credit (including any renewals) shall be no earlier than sixty days after expiration date of lease.

Kentucky Tenant Letter of Credit in Lieu of a Security Deposit

Description

How to fill out Tenant Letter Of Credit In Lieu Of A Security Deposit?

Finding the right lawful file design could be a have a problem. Of course, there are a variety of themes available on the net, but how will you discover the lawful type you require? Utilize the US Legal Forms website. The support provides a large number of themes, like the Kentucky Tenant Letter of Credit in Lieu of a Security Deposit, that you can use for company and private needs. All of the varieties are inspected by professionals and meet up with federal and state specifications.

In case you are currently listed, log in in your profile and then click the Down load key to get the Kentucky Tenant Letter of Credit in Lieu of a Security Deposit. Use your profile to look through the lawful varieties you have ordered previously. Go to the My Forms tab of the profile and acquire an additional backup from the file you require.

In case you are a new end user of US Legal Forms, listed below are straightforward directions that you should stick to:

- Very first, make certain you have chosen the right type for the town/area. You can look through the shape making use of the Preview key and study the shape outline to make certain this is the best for you.

- In the event the type does not meet up with your expectations, make use of the Seach area to get the correct type.

- Once you are positive that the shape is suitable, select the Get now key to get the type.

- Select the prices plan you would like and type in the required info. Design your profile and pay money for your order utilizing your PayPal profile or Visa or Mastercard.

- Choose the data file formatting and download the lawful file design in your gadget.

- Comprehensive, edit and print and indication the attained Kentucky Tenant Letter of Credit in Lieu of a Security Deposit.

US Legal Forms is the greatest collection of lawful varieties in which you can see various file themes. Utilize the service to download skillfully-manufactured files that stick to status specifications.

Form popularity

FAQ

In many cases, a letter of credit is better for both parties since it frees up cash resources for the tenant while providing the landlord with potentially more protection in the event of a default or bankruptcy.

Some contracts may require a financial commitment from the buyer such as a security deposit. In such cases, instead of depositing the money, the buyer can provide the seller with a financial bank guarantee using which the seller can be compensated in case of any loss.

One of the primary benefits of using a letter of credit as opposed to a cash security deposit is that a letter of credit allows the commercial tenant to retain money in their account. They are extremely popular with Landlords since they are backed by a major bank.

A Bank Guarantee is an alternative to providing a deposit or bond directly to a supplier or vendor. It is an unconditional undertaking given by the bank, on behalf of our customer, to pay the recipient of the guarantee the amount of the guarantee on written demand.

Landlords routinely accept a security deposit in the form of a letter of credit in lieu of cash upon execution of a lease agreement as security for the performance by a tenant of all obligations on the part of such tenant thereunder.

Security Deposit (KRS 383.580) Landlords must keep security deposits in a separate account. Tenants must be notified of the location of the account and the account number. If a landlord fails to maintain a separate account, the landlord is not allowed to keep any portion of the security deposit.

Importantly, a security deposit cannot be non-refundable and if it is not called upon during the lease it must be returned to the lessee once the lease term expires. A bank guarantee is a tripartite agreement between a lessor, lessee and a third party (such as a lessee's bank).

In many cases, a letter of credit is better for both parties since it frees up cash resources for the tenant while providing the landlord with potentially more protection in the event of a default or bankruptcy.