Kentucky Self-Employed Technician Services Contract

Description

How to fill out Self-Employed Technician Services Contract?

Are you in a circumstance where you require documents for various organizational or personal tasks almost every day? There are numerous legal document templates accessible online, but acquiring forms you can rely on is not easy. US Legal Forms provides thousands of template options, such as the Kentucky Self-Employed Technician Services Contract, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Kentucky Self-Employed Technician Services Contract template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Obtain the form you need and ensure it is for the correct city/state. Utilize the Review button to examine the form. Check the details to make sure you have selected the right form. If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements. Once you find the appropriate form, simply click Get now. Choose the pricing plan you want, fill out the necessary information to process your payment, and complete the order using your PayPal or credit card. Select a convenient document format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Kentucky Self-Employed Technician Services Contract at any time, if needed. Click the required form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes.

- The service offers properly crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

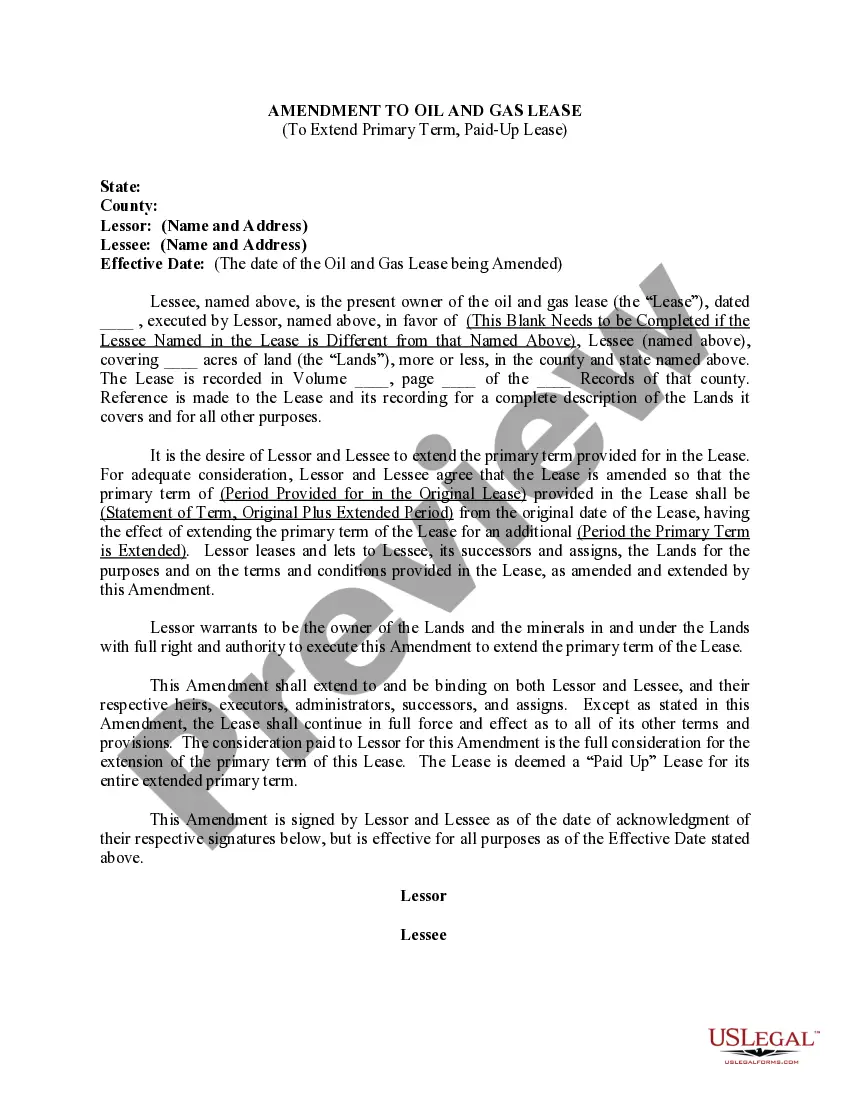

Legal requirements for independent contractors vary by state but generally include proper classification, tax obligations, and adherence to local regulations. In Kentucky, ensuring your Kentucky Self-Employed Technician Services Contract meets these requirements is vital for legal compliance. It is wise to consult with professionals or utilize platforms like uslegalforms to ensure you meet all necessary criteria.

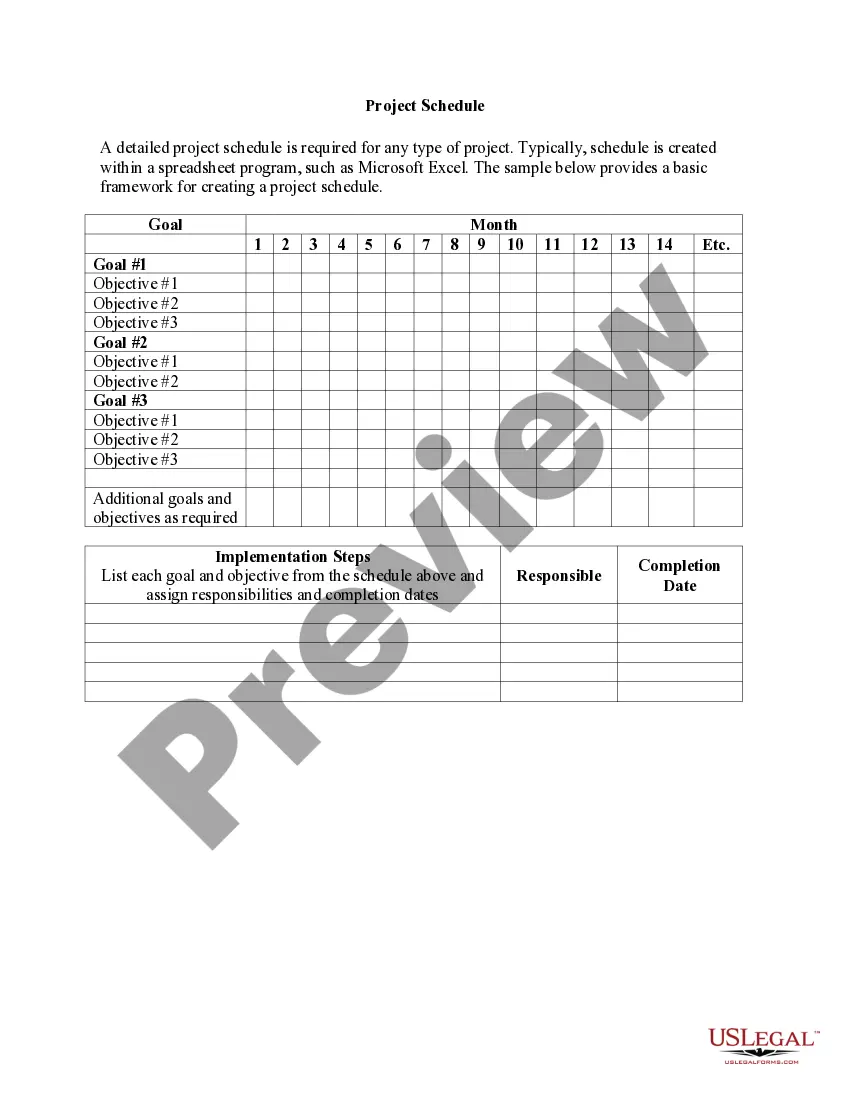

When writing a contract agreement for services, start by clearly defining the parties involved, the scope of work, and payment terms. Be sure to include deadlines, confidentiality clauses, and any specific conditions. Using a template for a Kentucky Self-Employed Technician Services Contract can simplify the process, ensuring you cover all necessary aspects.

In Kentucky, an independent contractor agreement defines the working relationship between a self-employed individual and a client. This agreement typically includes essential elements like scope of work, payment, and timelines. Ensuring that your Kentucky Self-Employed Technician Services Contract adheres to state laws can help avoid potential legal issues.

To exit an independent contractor agreement, review the terms outlined in the contract for any termination clauses. You may need to provide written notice to the other party, following the specified timeframe. If you are unsure, consider consulting a legal professional to navigate the process, especially if your contract involves a Kentucky Self-Employed Technician Services Contract.

The new federal rule for independent contractors focuses on clarifying the classification of workers to ensure proper benefits and protections. This rule impacts how independent contractors, including those involved in Kentucky Self-Employed Technician Services Contract, are treated under labor laws. It's essential to stay updated on these changes to maintain compliance and protect your rights.

An independent contractor agreement outlines the relationship between a contractor and a client, detailing the services to be provided, payment terms, and responsibilities. This agreement is crucial for protecting both parties’ interests, especially when executing a Kentucky Self-Employed Technician Services Contract. It helps clarify expectations and reduces the risk of disputes.

The Kentucky State Master Agreement is a centralized contract that establishes the terms and conditions for various services in Kentucky. This agreement serves as a framework for independent contractors, including those offering Kentucky Self-Employed Technician Services Contract. By utilizing this agreement, you can ensure compliance with state regulations while providing your services.

Self-employed individuals in Kentucky must meet specific legal requirements, such as registering their business and obtaining necessary licenses. Additionally, using a Kentucky Self-Employed Technician Services Contract can help you adhere to regulations and protect your rights. It is crucial to understand your obligations, including tax responsibilities and compliance with local laws.

Yes, contract workers are often considered self-employed, as they typically operate as independent contractors. They may use a Kentucky Self-Employed Technician Services Contract to define their relationship with clients. This contract outlines the scope of work, payment details, and other essential terms.

Working without a contract can lead to complications, such as unclear job expectations or payment issues. Without a Kentucky Self-Employed Technician Services Contract, you may find it challenging to prove the terms of your agreement. This situation can result in financial loss or disputes that could have been avoided.