Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you wish to finalize, obtain, or produce official record templates, utilize US Legal Forms, the most extensive compilation of legal documents available online.

Leverage the site's user-friendly and straightforward search function to find the documents you need.

Various templates for business and personal applications are categorized by types and jurisdictions, or keywords.

Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have located the form you want, click on the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

- Employ US Legal Forms to access the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and then click the Download button to get the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- You may also reach forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure that you have selected the form for the appropriate city/state.

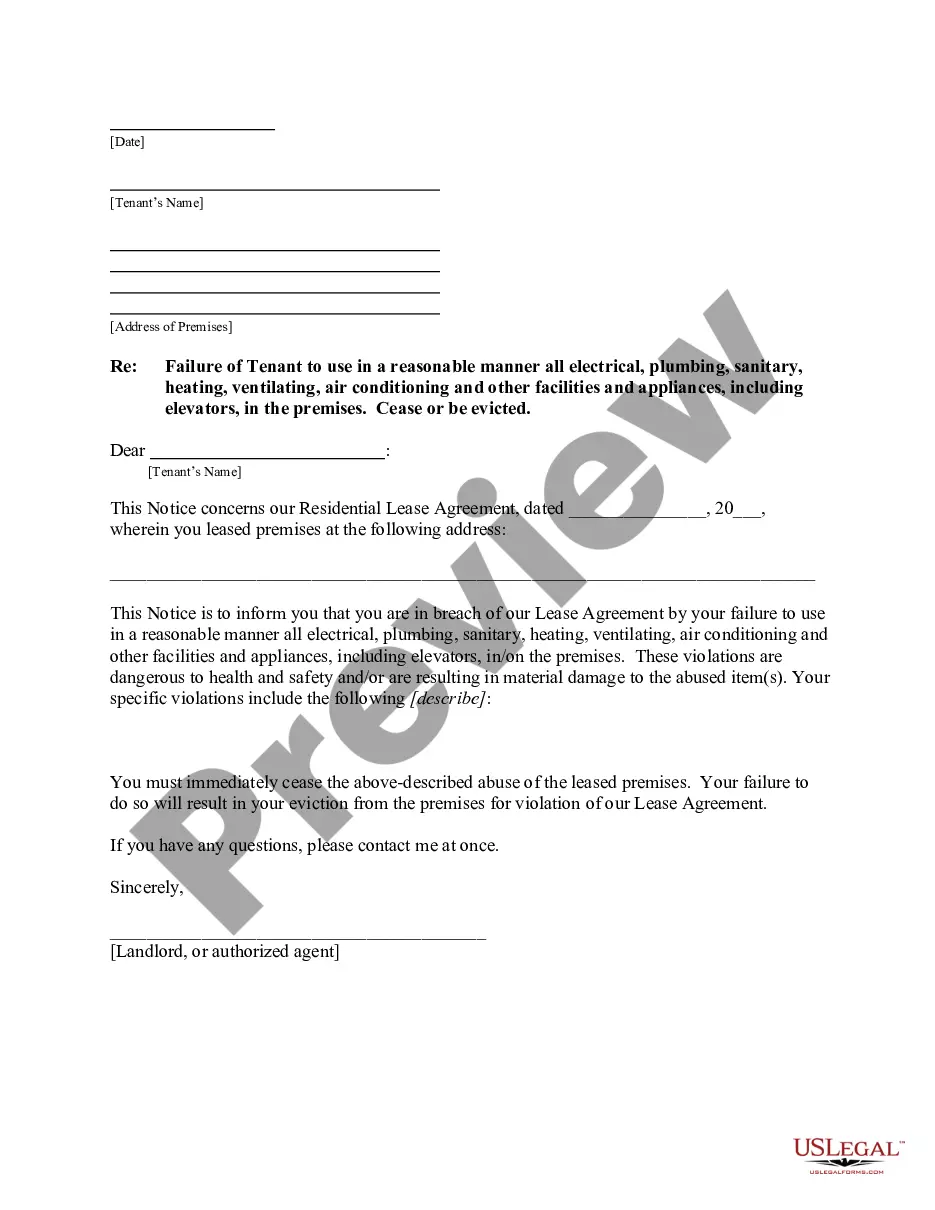

- Step 2. Utilize the Review feature to examine the form’s details. Be sure to read the information thoroughly.

Form popularity

FAQ

To get approved for loan modification, you need to provide comprehensive documentation about your financial situation. This includes income verification, current debts, and hardship letters explaining your difficulty with payments. Familiarizing yourself with the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form will help you put together a complete application that meets lender requirements.

Obtaining a small estate affidavit in Kentucky involves filling out the appropriate forms and submitting them to the court. You will need to ensure all required documents are included, such as a death certificate and property details. The Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form serve as a valuable resource to guide you through this process.

To prepare a small estate affidavit in Kentucky, you will need several key documents. These include a death certificate, a list of assets and liabilities, and proof of the value of the estate, ensuring everything is below the $30,000 limit. For assistance, refer to the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form to streamline the process.

Yes, generally anyone can fill out a small estate affidavit in Kentucky as long as they meet the necessary legal requirements. However, it is advisable to consult with legal experts, especially when dealing with the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Proper completion ensures a smoother process in estate handling.

To convert a mobile home to real property in Kentucky, you must complete a few essential steps. First, you should titling the mobile home as real property with the county property assessor. Additionally, follow the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form to ensure all paperwork is properly filed.

The threshold for affidavits in Kentucky concerning small estates is currently set at $30,000. This means that estates valued below this amount can use a small estate affidavit to expedite the process of transferring property. Utilizing the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form can simplify this transition.

In Kentucky, a small estate is typically defined as an estate with a value below $30,000. This threshold applies to the combined value of all assets owned by the deceased, excluding certain types of property like real estate. Understanding this definition is crucial when you are looking into the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

To amend a mortgage, you need to contact your lender to discuss the changes you wish to make. Typically, this involves completing specific forms and providing documentation that supports your request. Depending on the nature of the amendment, your lender may require a formal loan modification application. Utilizing the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form will help you manage all necessary documentation efficiently.

In real estate, RMA refers to Request for Mortgage Assistance, a critical form used in the mortgage process. Homeowners submit this request when they experience difficulty managing their mortgage payments. The RMA provides lenders with insight into the homeowner's financial situation, allowing them to offer potential solutions. To navigate this process successfully, follow the Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form for a seamless experience.

The RMA mortgage form is a document used by homeowners to request assistance from their mortgage lender. This form typically gathers information on the homeowner's financial status, including income, expenses, and reasons for hardship. Accurately completing the RMA is crucial for the lender to assess your eligibility for loan modification. The Kentucky Instructions for Completing Request for Loan Modification and Affidavit RMA Form can guide you in filling out the RMA effectively.