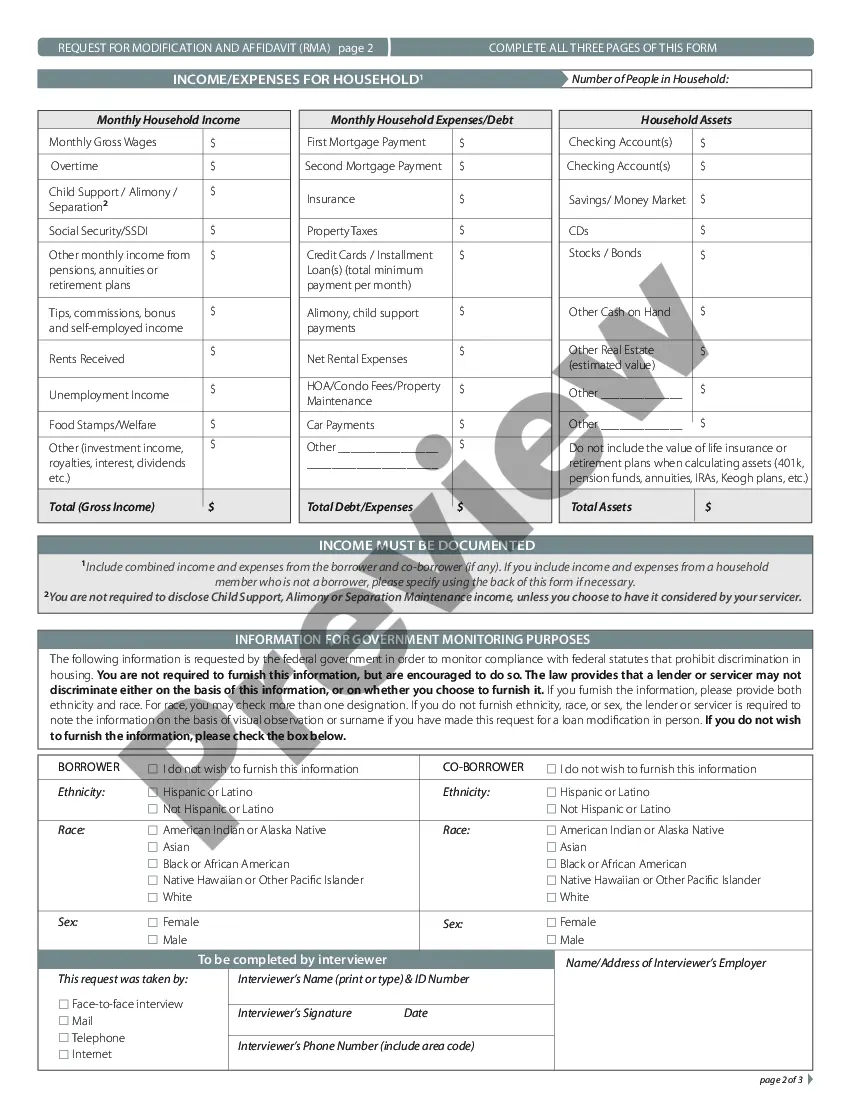

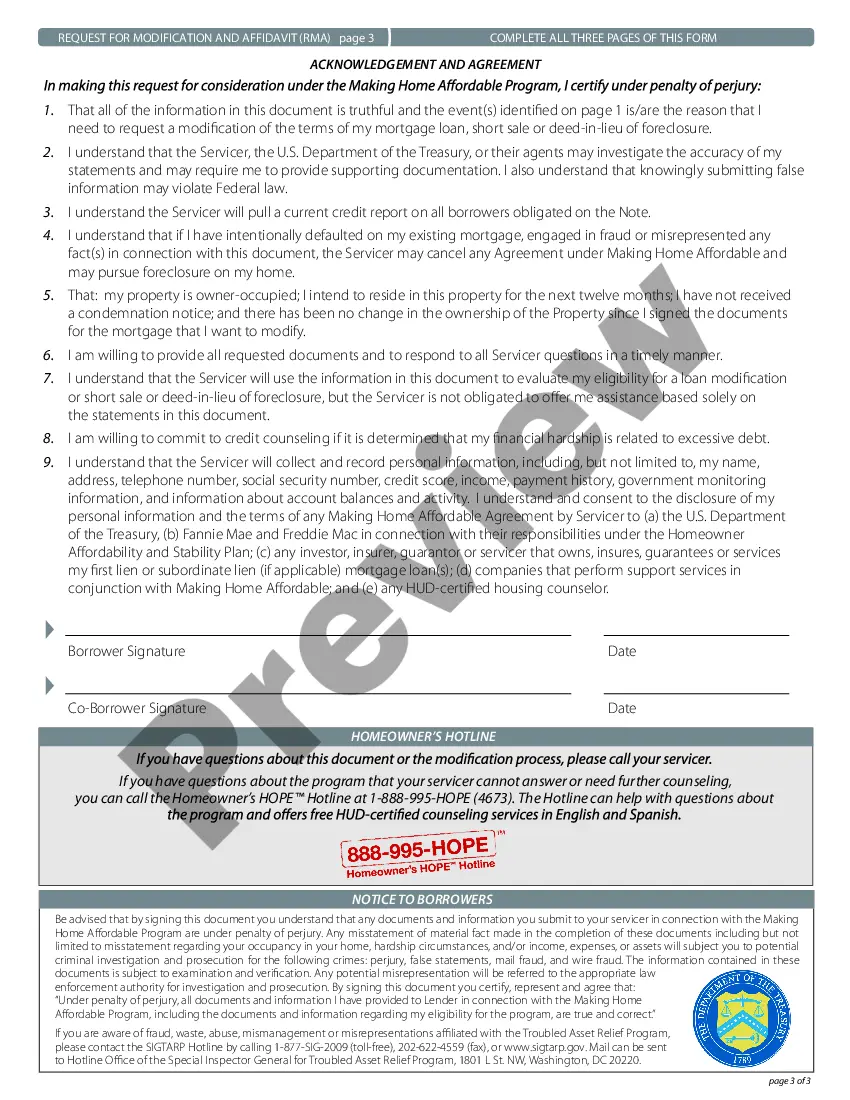

Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad array of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Kentucky Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP in just a few minutes.

If you already have an account, Log In and retrieve the Kentucky Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Kentucky Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP. Each form you added to your account does not expire and is yours indefinitely. So, if you need to obtain or print another copy, simply navigate to the My documents section and click on the form you require. Access the Kentucky Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP with US Legal Forms, the largest collection of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure to choose the appropriate form for your city/state.

- Click the Review button to examine the form’s content.

- Check the description of the form to confirm that you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

To qualify for a loan modification under the HAMP, you generally need to demonstrate financial hardship, such as a loss of income or a significant increase in expenses. Your mortgage must be a first lien against your primary residence, and you must be in default or at risk of defaulting on your loan. The Kentucky Request for Loan Modification RMA under HAMP outlines specific criteria that must be met, but leveraging services like UsLegalForms can help clarify these requirements and streamline your application process.

Getting approved for a loan modification can vary based on your individual circumstances, but the Kentucky Request for Loan Modification RMA under HAMP aims to simplify the process for eligible homeowners. Factors such as your income, debts, and mortgage status determine your eligibility. While the application can seem daunting, using a platform like UsLegalForms can provide you with the necessary resources and guidance. This can increase your likelihood of approval by ensuring you submit the correct documentation.

The Home Affordable Modification Program (HAMP) is a government initiative designed to help struggling homeowners modify their mortgage loans. Under this program, eligible borrowers can request a loan modification to achieve a more manageable monthly payment. The Kentucky Request for Loan Modification RMA under HAMP allows residents to access these benefits, potentially preventing foreclosure and stabilizing their financial situation. By applying for this program, you can find relief through reduced interest rates or extended loan terms.

To apply for a loan modification, begin by gathering your financial documents, such as income statements and monthly expenses. Next, reach out to your loan servicer to express your interest in the Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. They will guide you through the application process and provide you with the necessary forms to complete. Consider using USLegalForms for easy access to helpful resources and sample documents to streamline your application.

HAMP modification refers to the process of altering your mortgage terms through the Home Affordable Modification Program. This could include lowering your interest rate, extending the loan term, or changing your payment structure. By submitting a Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you may find a solution that suits your financial situation. It's a proactive step to avoid foreclosure and regain control over your mortgage.

As of now, the HAMP program is set to expire, but it is essential to stay informed about any potential extensions or new programs that could arise. The Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP played a significant role in supporting homeowners since its launch. While its future remains uncertain, you can explore alternative mortgage assistance programs that may be available in 2025. Consulting with a knowledgeable professional can help you understand your options.

HAMP stands for the Home Affordable Modification Program, a federal program aimed at assisting struggling homeowners. This initiative creates a pathway for homeowners facing financial hardships to modify their existing mortgages. By utilizing the Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, homeowners can potentially lower their monthly payments and avoid foreclosure. It represents a lifeline for many who are facing difficulties in managing their mortgage.

A HAMP loan modification is a program designed to help homeowners modify their mortgage loans to make them more affordable. The Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP allows eligible homeowners to reduce their monthly payments based on their income and financial situation. This program typically offers lower interest rates and extended loan terms. However, not every homeowner qualifies, so it's important to consult with a professional.

A mortgage loan modification can be a beneficial option if you're struggling to keep up with payments. By entering a Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you may secure lower monthly payments. This can provide the financial relief you need while keeping your home. However, it's crucial to assess your overall financial situation before making a decision.

Applying for a loan modification typically involves contacting your lender to express your interest. You may need to provide financial documentation, such as income statements and monthly expenses. The Kentucky Request for Loan Modification RMA Under Home Affordable Modification Program HAMP outlines the steps to streamline this process. Platforms like uslegalforms can guide you through the required paperwork and increase your chances of approval.