Kentucky Accredited Investor Suitability

Description

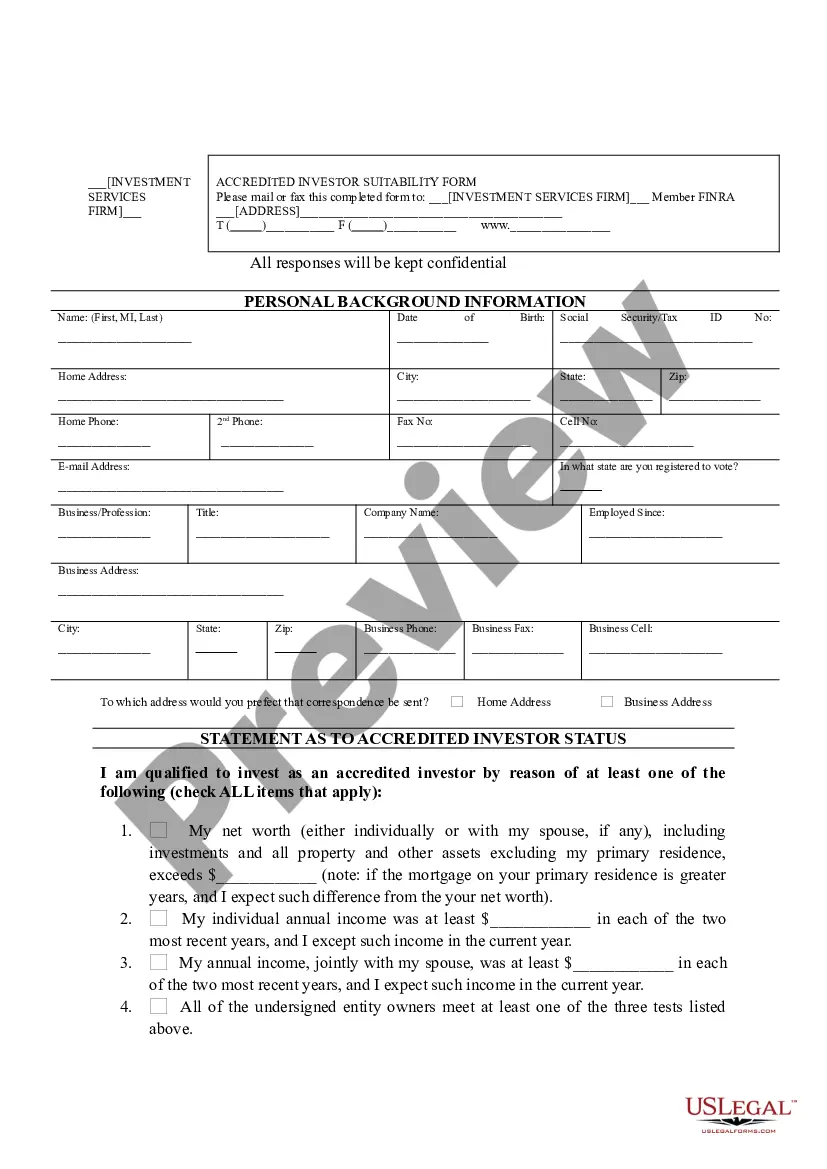

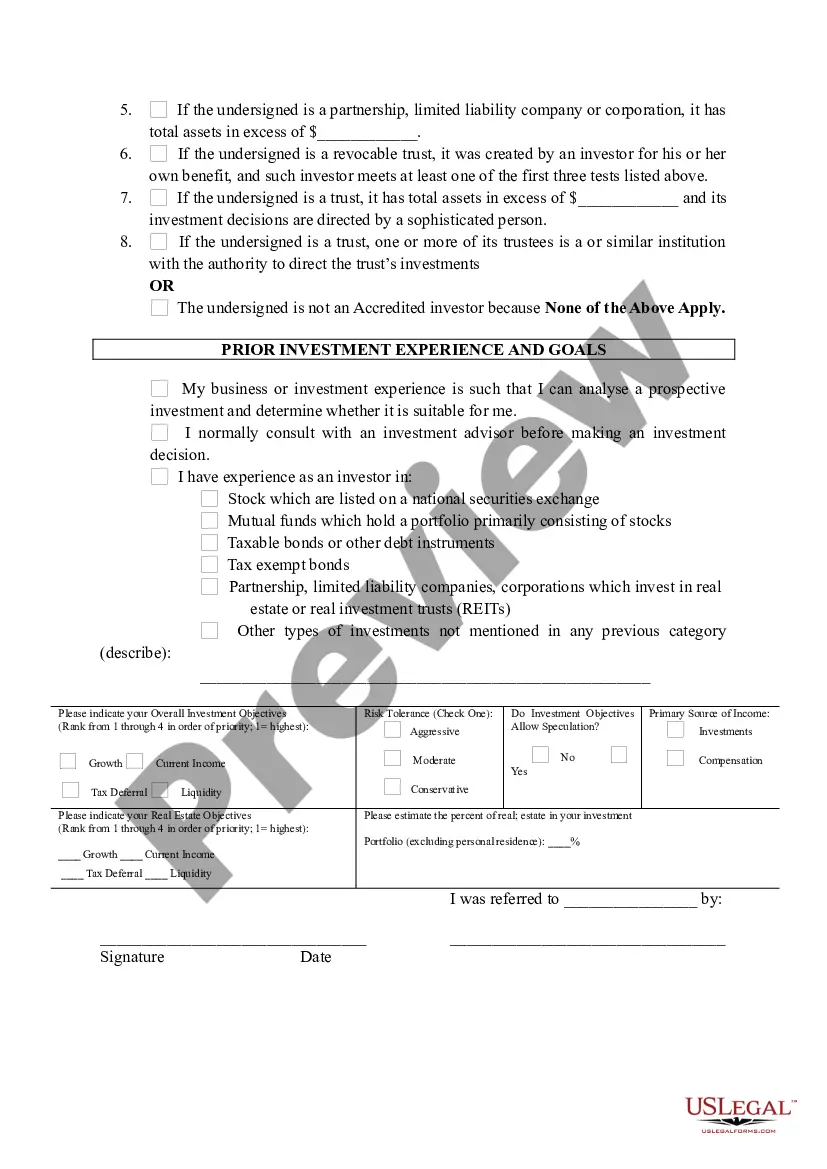

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

Finding the right lawful papers format might be a struggle. Obviously, there are a variety of templates available online, but how will you discover the lawful type you want? Make use of the US Legal Forms internet site. The support provides a large number of templates, such as the Kentucky Accredited Investor Suitability, that can be used for business and private demands. All of the types are inspected by specialists and meet state and federal requirements.

If you are already listed, log in to the profile and click on the Acquire button to obtain the Kentucky Accredited Investor Suitability. Use your profile to check with the lawful types you may have ordered previously. Visit the My Forms tab of the profile and acquire one more backup of the papers you want.

If you are a brand new customer of US Legal Forms, here are straightforward instructions for you to adhere to:

- Initial, make sure you have chosen the correct type to your town/area. You are able to look over the form making use of the Preview button and study the form information to make sure this is basically the right one for you.

- In the event the type does not meet your preferences, make use of the Seach discipline to find the proper type.

- When you are certain the form would work, go through the Purchase now button to obtain the type.

- Select the prices prepare you want and enter in the required information. Create your profile and pay for an order making use of your PayPal profile or credit card.

- Select the file file format and obtain the lawful papers format to the system.

- Total, edit and print and indicator the attained Kentucky Accredited Investor Suitability.

US Legal Forms is definitely the most significant collection of lawful types that you can find different papers templates. Make use of the service to obtain expertly-created files that adhere to condition requirements.

Form popularity

FAQ

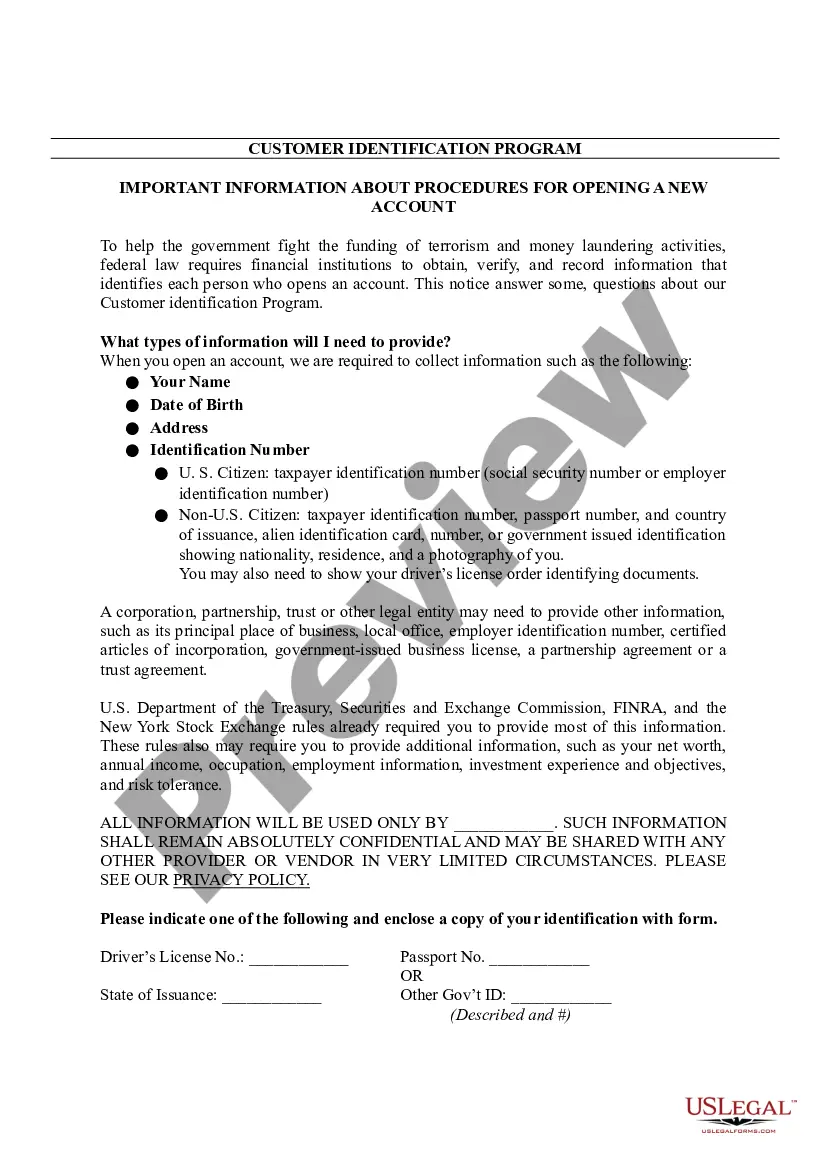

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

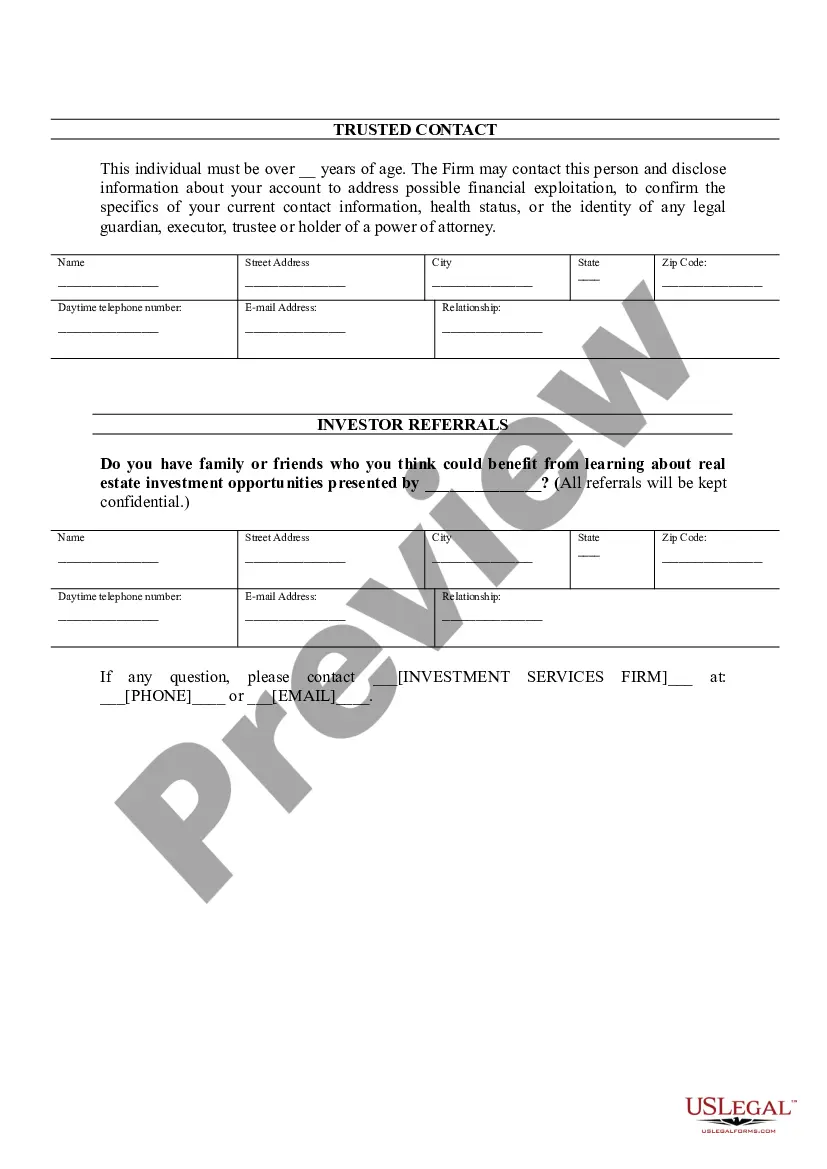

Investor suitability questions help gauge whether an investor and their Investing Account is a match for the types of deals that will launch on the Marketplace.

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

How Can I Invest Without Being Accredited? Buy-And-Hold Rental Properties. House Hacking. Fix-And-flips. BRRRR Strategy. Private Lending. Joint Venture Partnerships. Real Estate Crowdfunding. Private Real Estate Syndications.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...