Kentucky Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

US Legal Forms - one of many most significant libraries of lawful forms in the States - offers a wide array of lawful papers layouts you can obtain or print out. Making use of the website, you will get a huge number of forms for company and specific functions, sorted by types, suggests, or keywords.You will find the newest variations of forms like the Kentucky Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors within minutes.

If you currently have a monthly subscription, log in and obtain Kentucky Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors in the US Legal Forms collection. The Download button will appear on each and every form you look at. You have accessibility to all previously delivered electronically forms from the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, allow me to share easy guidelines to help you started off:

- Be sure you have selected the proper form for the city/state. Select the Preview button to check the form`s content. Read the form information to actually have selected the correct form.

- In case the form doesn`t satisfy your specifications, use the Search industry on top of the screen to discover the one which does.

- When you are satisfied with the shape, affirm your decision by visiting the Get now button. Then, select the costs plan you want and supply your credentials to sign up on an account.

- Procedure the transaction. Use your bank card or PayPal account to finish the transaction.

- Select the file format and obtain the shape in your gadget.

- Make modifications. Complete, edit and print out and signal the delivered electronically Kentucky Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

Each format you included with your bank account lacks an expiration particular date and is the one you have permanently. So, if you want to obtain or print out an additional version, just proceed to the My Forms segment and click about the form you want.

Get access to the Kentucky Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors with US Legal Forms, by far the most substantial collection of lawful papers layouts. Use a huge number of skilled and status-specific layouts that meet up with your small business or specific needs and specifications.

Form popularity

FAQ

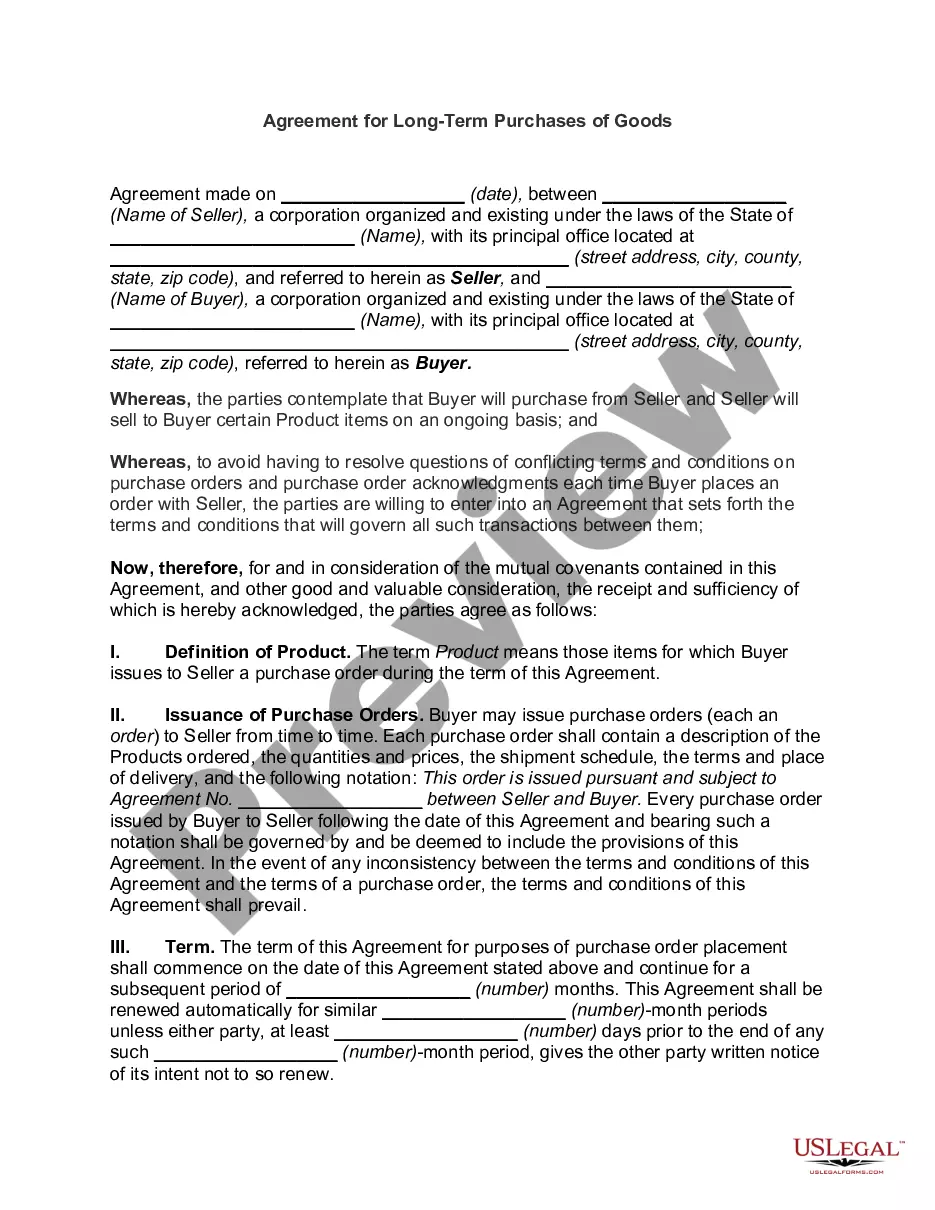

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Scope of a share purchase agreement The parties to the agreement. Information on the company selling shares. Purchase price of the shares. Title. Timetable for completion. Warranties. Restrictions following completion. Confidentiality requirements.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.