Kentucky Amendment of common stock par value

Description

How to fill out Amendment Of Common Stock Par Value?

Are you presently in a situation in which you will need files for either enterprise or individual functions just about every working day? There are plenty of legal record web templates available on the net, but finding versions you can depend on is not easy. US Legal Forms gives 1000s of type web templates, such as the Kentucky Amendment of common stock par value, that are composed to meet federal and state requirements.

Should you be presently informed about US Legal Forms site and get a free account, just log in. After that, you can obtain the Kentucky Amendment of common stock par value template.

Should you not come with an account and would like to begin to use US Legal Forms, follow these steps:

- Find the type you want and ensure it is to the right area/area.

- Utilize the Review switch to review the form.

- Browse the information to ensure that you have chosen the right type.

- When the type is not what you`re looking for, use the Look for field to find the type that meets your requirements and requirements.

- Whenever you find the right type, click on Acquire now.

- Choose the pricing plan you desire, fill out the specified information to create your bank account, and pay for the transaction with your PayPal or charge card.

- Pick a handy file formatting and obtain your version.

Get every one of the record web templates you possess purchased in the My Forms menus. You can get a extra version of Kentucky Amendment of common stock par value any time, if required. Just click the necessary type to obtain or printing the record template.

Use US Legal Forms, by far the most considerable collection of legal kinds, in order to save time and steer clear of faults. The assistance gives professionally created legal record web templates that can be used for an array of functions. Generate a free account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

Issued Share Capital is the total value of shares that a company has issued to its shareholders. The value of Issued Share Capital can fluctuate based on the market value of the shares. Issued Share Capital is an important measure of a company's financial health and its ability to raise capital.

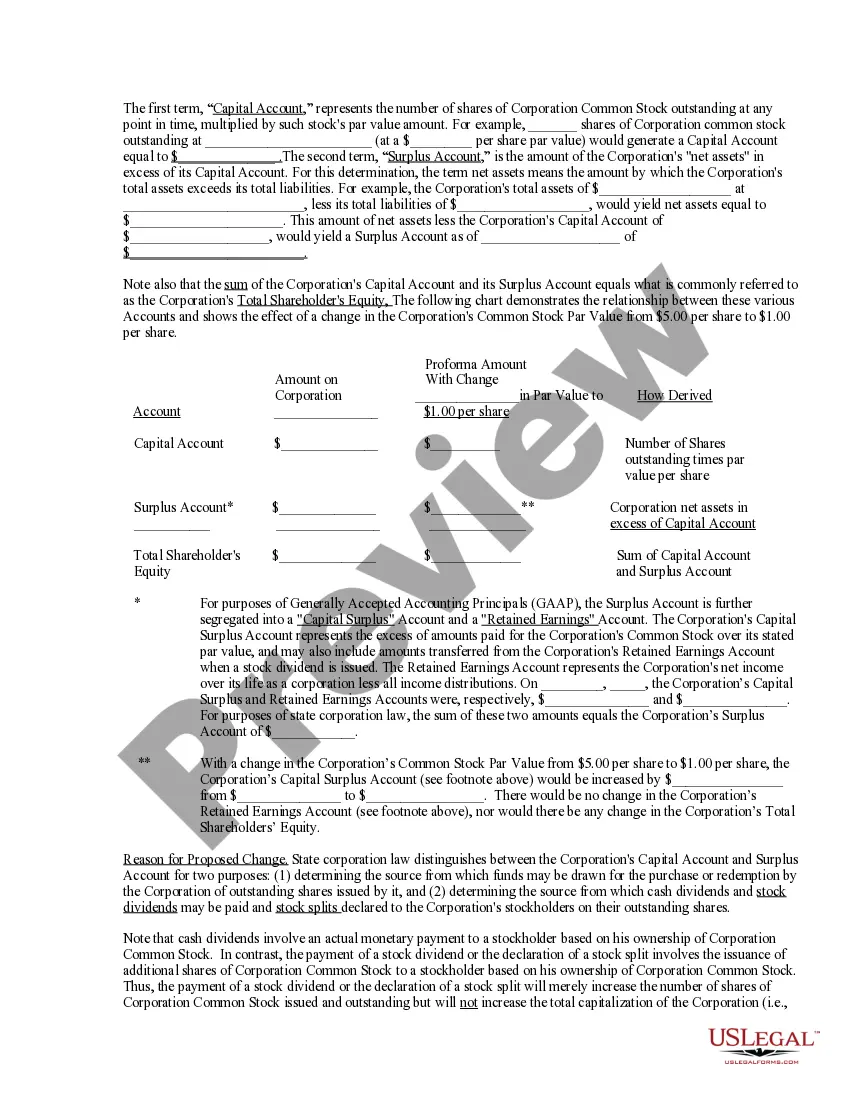

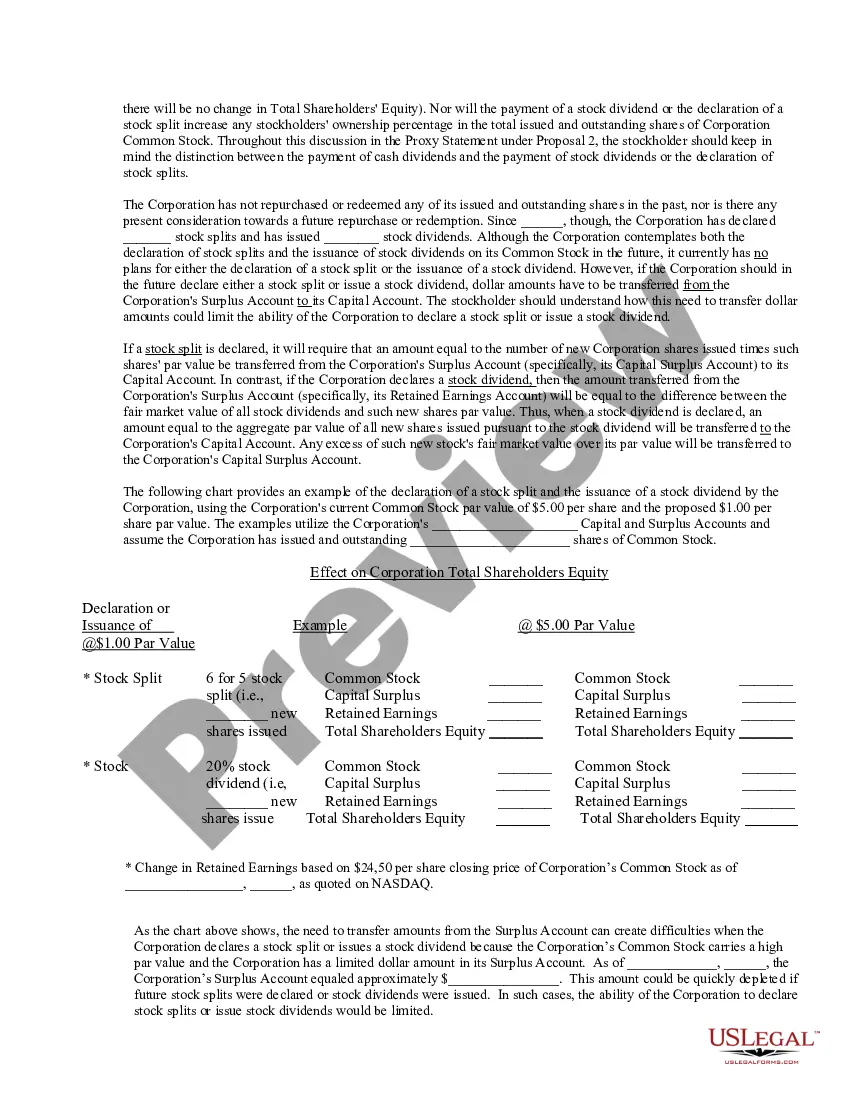

If you already have par value and you want to raise or lower it, things are a bit more complicated. Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

Share valuation is a technique of determining the actual worth of a company using quantitative techniques. Analysts use the company's financial information, such as current earnings and cashflows, assets, capital structure, and future cashflows, to determine the company's current value.

A change in par value usually occurs when a company's stock is split. The par value is typically listed on stock certificates and usually does not represent the stock's actual value.

The total value of the shares a company elects to sell to investors is called its issued share capital.

Understanding Authorized Shares The number of shares represents the authorized shares. The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

The value of the issued shares is determined at the time they are issued and the value does not change, in relation to the issuing corporation after that time.

A par value for a stock is its per-share value assigned by the company that issues it and is often set at a very low amount such as one cent. A no-par stock is issued without any designated minimum value.

You may need a special resolution to change your company's share structure. This includes if you: change the number of shares the company has and their total value - this is your 'share capital' (the part of your company's money that comes from shares) change how your shares are distributed.

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.