Kentucky Approval of authorization of preferred stock

Description

How to fill out Approval Of Authorization Of Preferred Stock?

Are you presently in a position in which you need papers for sometimes business or individual purposes virtually every day? There are tons of legitimate document layouts available on the Internet, but finding ones you can depend on is not effortless. US Legal Forms provides a large number of type layouts, just like the Kentucky Approval of authorization of preferred stock, that are written to fulfill federal and state needs.

If you are previously familiar with US Legal Forms website and have an account, basically log in. Next, it is possible to down load the Kentucky Approval of authorization of preferred stock format.

Unless you provide an bank account and want to begin using US Legal Forms, adopt these measures:

- Find the type you want and make sure it is to the appropriate area/area.

- Make use of the Preview option to analyze the form.

- Read the outline to actually have chosen the right type.

- In case the type is not what you`re seeking, take advantage of the Lookup industry to get the type that meets your requirements and needs.

- Whenever you get the appropriate type, click on Buy now.

- Pick the costs program you would like, complete the required information to create your account, and buy the transaction making use of your PayPal or bank card.

- Decide on a practical file structure and down load your duplicate.

Get all the document layouts you may have purchased in the My Forms food selection. You can obtain a additional duplicate of Kentucky Approval of authorization of preferred stock anytime, if required. Just click on the needed type to down load or print the document format.

Use US Legal Forms, one of the most comprehensive selection of legitimate types, to conserve efforts and steer clear of blunders. The service provides professionally manufactured legitimate document layouts that you can use for an array of purposes. Create an account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

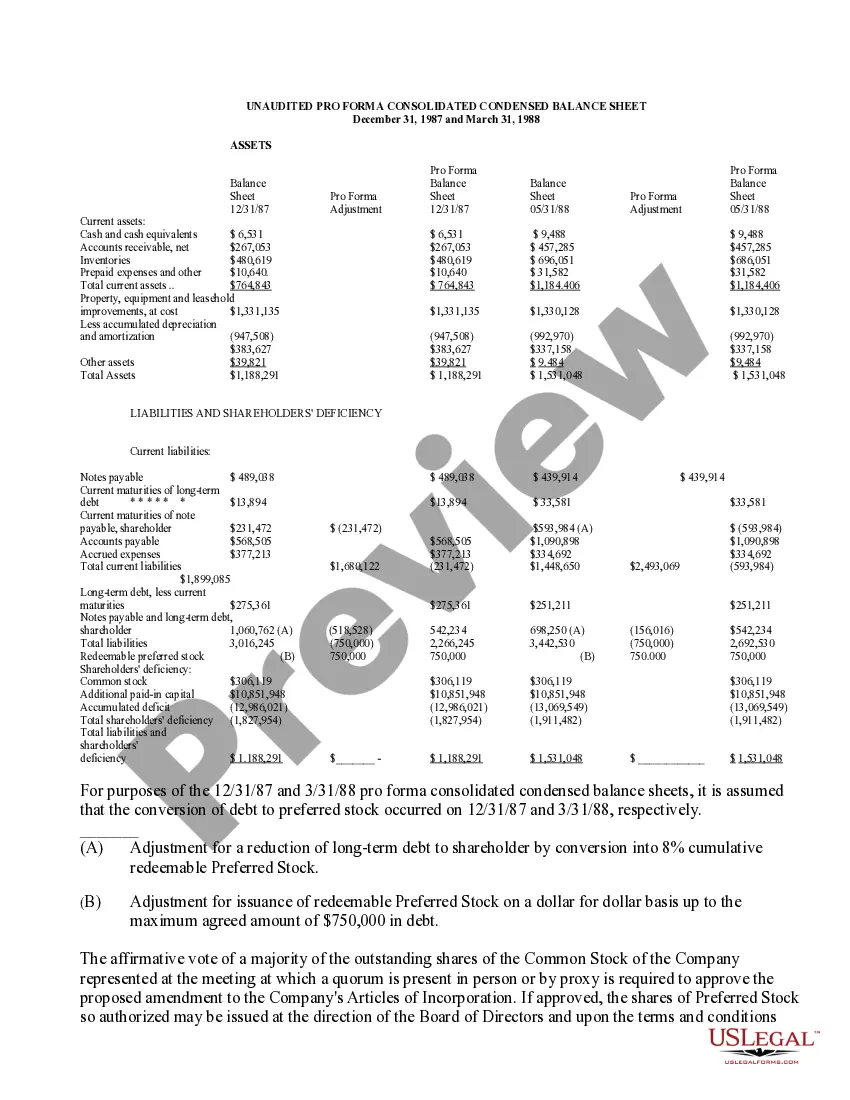

Stockholder approval is initially required to authorize a class of blank check preferreds, but the board thereafter has broad discretion to fix the terms of the issue. The preferred shares could be given special voting rights or be convertible to common stock, which is useful in a hostile takeover bid defense. Blank Check Preferred Stock: What it is, How it Works Investopedia ? Investing ? Stocks Investopedia ? Investing ? Stocks

The term ?blank cheque? frequently refers to a cheque that has been signed by an authorised cheque signer but does not include any additional information like date, payee or amount. In certain cases, it becomes essential to give a blank cheque to someone depending on the requirement or demand.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ... Stock issuance: how is it done and what is required? - DLA Piper ... dlapiperaccelerate.com ? knowledge ? stock... dlapiperaccelerate.com ? knowledge ? stock...

Blank check preferred stock refers to shares of a class of a firm's preferred stock authorized by its board of directors, but without further stockholder action.

A blank check company stock is a publicly-listed stock of a developmental-stage company with no established business plan or operations. These companies are often formed with the intent of either purchasing or merging with a private company.