Kentucky Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

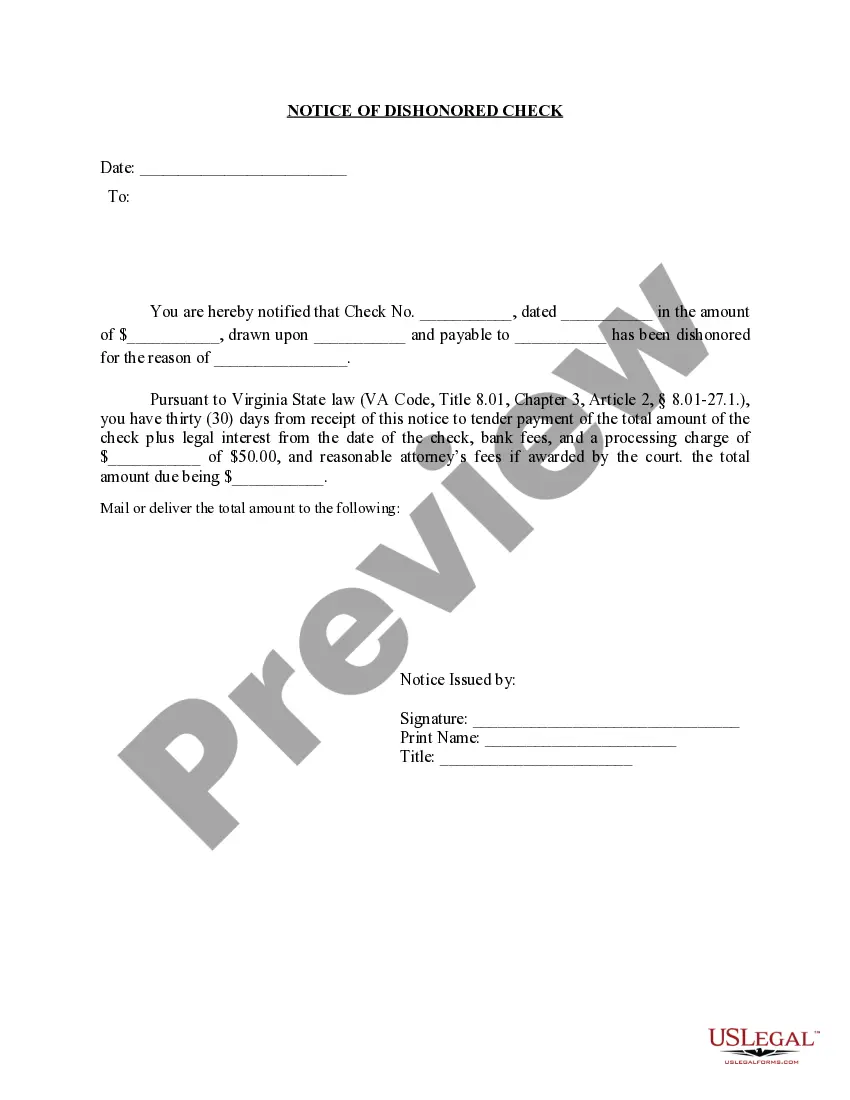

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

If you want to full, download, or produce legal file templates, use US Legal Forms, the most important variety of legal varieties, which can be found online. Use the site`s easy and hassle-free research to get the files you require. Various templates for organization and person reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Kentucky Stock Appreciation Rights Plan of The Todd-AO Corporation in a couple of click throughs.

In case you are previously a US Legal Forms customer, log in in your profile and then click the Obtain option to get the Kentucky Stock Appreciation Rights Plan of The Todd-AO Corporation. You may also accessibility varieties you in the past downloaded from the My Forms tab of your own profile.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for your appropriate town/land.

- Step 2. Use the Preview choice to look through the form`s information. Do not forget to learn the information.

- Step 3. In case you are unhappy with all the type, take advantage of the Research area towards the top of the display screen to get other variations in the legal type web template.

- Step 4. Once you have located the shape you require, click on the Purchase now option. Choose the pricing prepare you like and include your qualifications to sign up for an profile.

- Step 5. Procedure the transaction. You should use your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Find the structure in the legal type and download it on your gadget.

- Step 7. Full, edit and produce or indication the Kentucky Stock Appreciation Rights Plan of The Todd-AO Corporation.

Every legal file web template you purchase is the one you have permanently. You possess acces to every single type you downloaded in your acccount. Go through the My Forms portion and choose a type to produce or download once more.

Remain competitive and download, and produce the Kentucky Stock Appreciation Rights Plan of The Todd-AO Corporation with US Legal Forms. There are many expert and status-distinct varieties you may use to your organization or person demands.

Form popularity

FAQ

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

Stock appreciation rights do expire. The expiration period varies from plan to plan. Once your rights expire, they are worthless. There are often special rules for terminated, retired, and deceased employees.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Rights are similar to Stock Options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a SAR vests, an employee can exercise it at any time prior to its expiration.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.