Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

Kentucky Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

Description

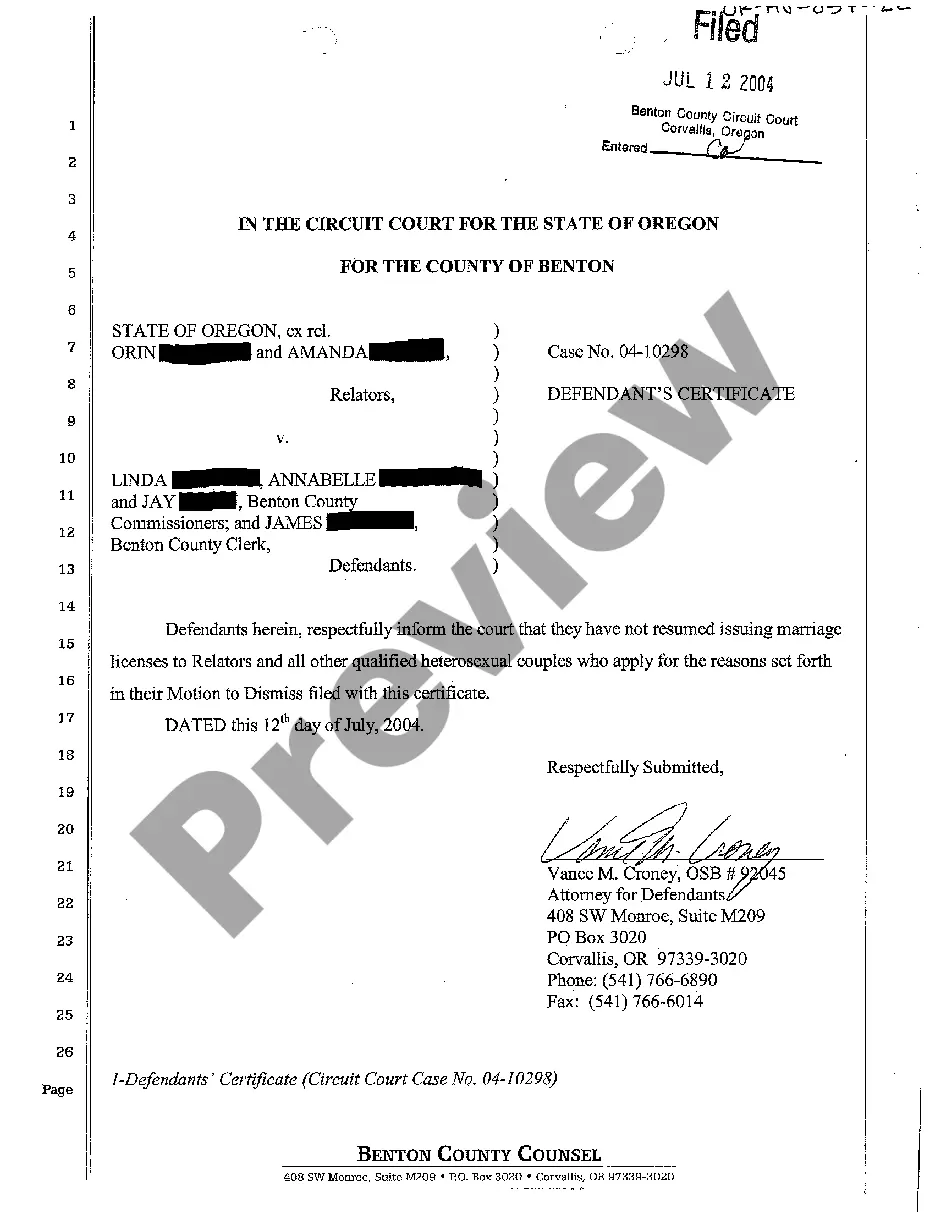

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

Are you within a position that you need to have documents for either enterprise or person purposes almost every day? There are plenty of lawful document web templates available on the net, but finding kinds you can trust isn`t easy. US Legal Forms gives a huge number of type web templates, such as the Kentucky Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5, which can be published to meet federal and state demands.

In case you are previously familiar with US Legal Forms site and also have an account, basically log in. Afterward, it is possible to down load the Kentucky Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 format.

Should you not provide an account and want to begin using US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for the proper city/area.

- Take advantage of the Preview button to review the form.

- Read the information to actually have selected the proper type.

- In case the type isn`t what you`re looking for, use the Look for discipline to discover the type that fits your needs and demands.

- If you find the proper type, click Acquire now.

- Pick the pricing strategy you desire, submit the required details to create your bank account, and pay money for the transaction utilizing your PayPal or bank card.

- Select a hassle-free paper format and down load your backup.

Locate each of the document web templates you may have purchased in the My Forms menu. You can aquire a extra backup of Kentucky Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 anytime, if needed. Just select the essential type to down load or print the document format.

Use US Legal Forms, probably the most extensive selection of lawful varieties, to save some time and avoid mistakes. The support gives expertly created lawful document web templates which you can use for a variety of purposes. Generate an account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

A structured settlement is an arrangement in which the settlement payment is paid out over time, rather than in a lump sum. This can help to avoid taxes on the settlement payment by spreading out the tax liability over a longer period of time.

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

§ 1.468B?1 Qualified settlement funds. If a fund, account, or trust that is a qualified settlement fund could be classified as a trust within the meaning of §301.7701?4 of this chapter, it is classified as a qualified settlement fund for all purposes of the Internal Revenue Code (Code).

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

Tax deduction A QSF enables the defendant (or insurer) to accelerate its tax deduction to the date that the settlement amount paid is to the Qualified Settlement Fund in exchange for a general release, rather than when each plaintiff, signs and is paid.

Legal settlements that are taxable (including previously deducted medical expenses related to physical injury or illness) are entered as miscellaneous (other) income. Interest earned on settlements is taxable income and should be entered as a Form 1099-INT.