Kentucky General Partnership for Business

Description

How to fill out General Partnership For Business?

Are you currently in a situation where you require documentation for either business or personal reasons consistently.

There are numerous legal document templates available online, but locating ones you can trust isn't simple.

US Legal Forms provides thousands of template forms, such as the Kentucky General Partnership for Business, that are designed to meet federal and state regulations.

Once you find the right form, click Get now.

Select the pricing plan you want, fill in the necessary information to create your account, and process your payment using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Kentucky General Partnership for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

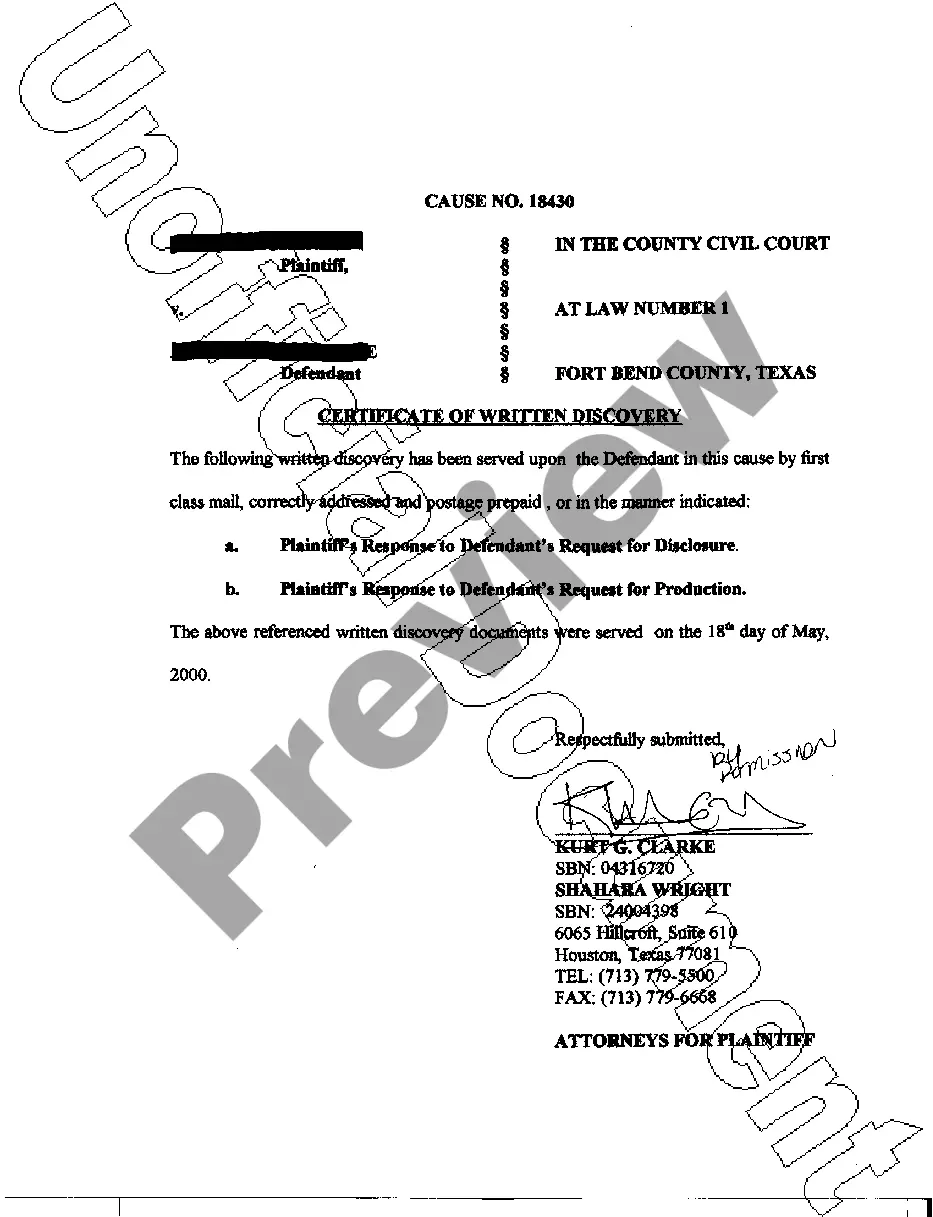

- Use the Review button to confirm the form.

- Check the description to make sure you have selected the appropriate form.

- If the form isn’t what you’re looking for, make use of the Lookup section to find the form that meets your needs and requirements.

Form popularity

FAQ

Anyone who wishes to establish a business entity in Kentucky must consider filing for a Kentucky General Partnership for Business. This includes individuals who want to collaborate with one or more partners while sharing profits and responsibilities. It's essential to file the appropriate paperwork to formalize the partnership and protect your interests.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

A general partnership is a business entity made of two or more partners who agree to establish and run a business.

Are you looking to run a business with one or more partners in the state of Kentucky? The simplest way to do this is to form a Kentucky general partnership, which at its core is essentially just a handshake agreement between two (or more) people to operate a business together.

If you operate an in state (established under the laws of the Commonwealth of Kentucky) general partnership under its real name, no registration of the business name is required in the Commonwealth of Kentucky.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Partnerships must create a Kentucky Form 4562, Schedule D and Form 4797 by converting federal forms.