Kentucky Personal Representative Request Form

Description

How to fill out Personal Representative Request Form?

US Legal Forms - one of the most notable libraries of legal documents in the USA - provides a broad selection of legal form templates that you can download or print. By using the site, you will obtain a multitude of forms for business and personal uses, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Kentucky Personal Representative Request Form in a matter of seconds.

If you possess a subscription, Log In and download the Kentucky Personal Representative Request Form from the US Legal Forms collection. The Download option will appear on each form you view. You have access to all previously downloaded forms from the My documents tab of your account.

Retrieve the format and download the form onto your device.

Make amendments. Fill out, edit, print, and sign the downloaded Kentucky Personal Representative Request Form.

- If you would like to use US Legal Forms for the first time, here are simple steps to help you get started.

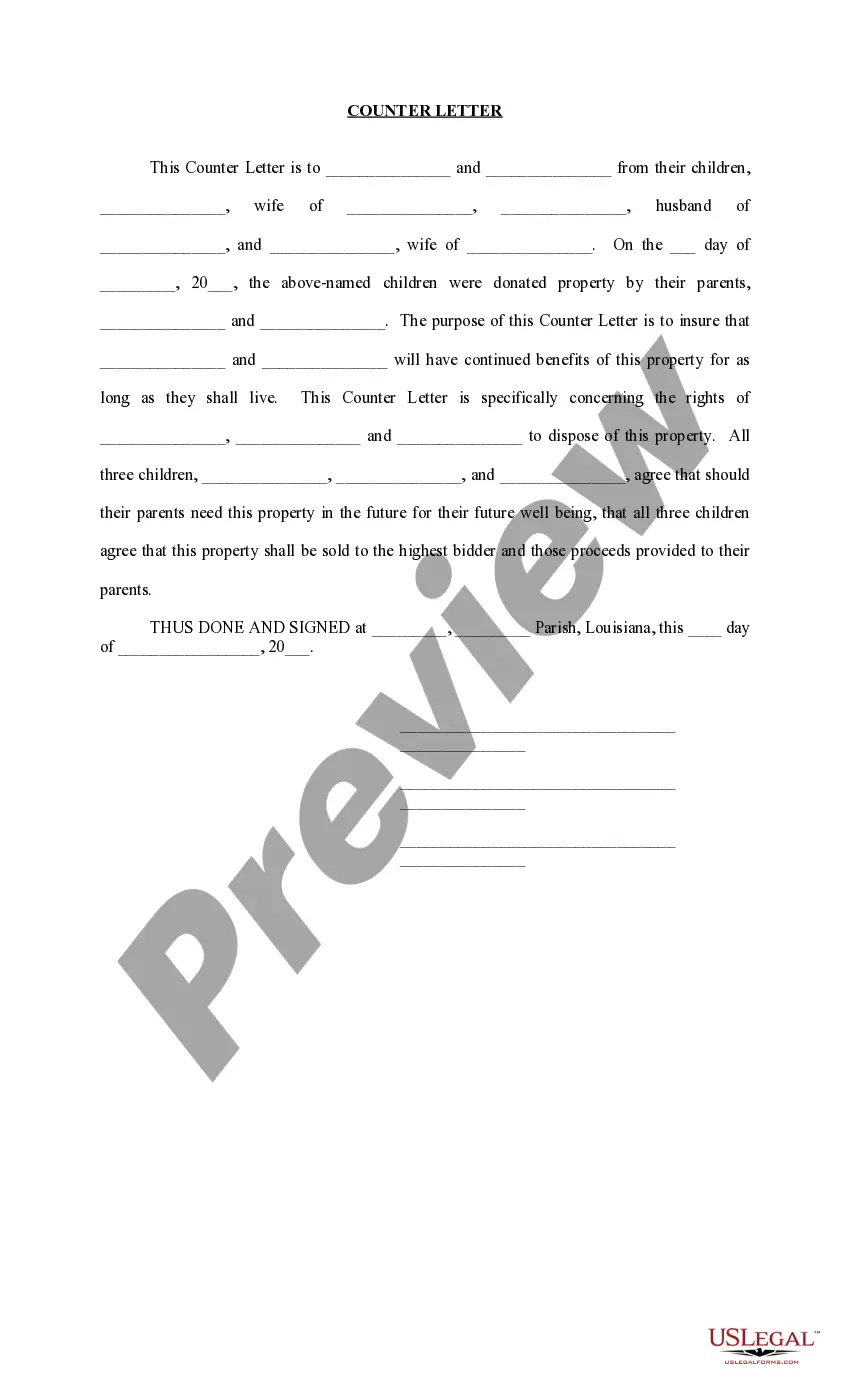

- Ensure you have chosen the correct form for your city/state. Click the Preview option to examine the form's details.

- Review the form information to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now option. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Kentucky has a lenient time requirement for probate. According to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

KRS Chapter 395. Includes enactments through the 2021 Special Session. The KRS database was last updated on 04/29/2022. . 001 Definition of "fiduciary."

Is Probate Required in Kentucky? Probate is required for most estates in Kentucky. State law dictates how the process is handled and how assets are divided up to the heirs. Anyone handling an estate must know the current law for the probate process.

Which Estates Go Through Probate in Kentucky? Typically, those estates with greater than $15,000 in probate assets will be subject to probate. So what kind of assets are probate assets? Generally, any assets held in an individual's name only are subject to probate.

How much Probate in Kentucky costs. Probate and settling an estate generally costs an average of $15,000 unless you use tools that make it easier, but remember that the money you will be spending will be the estate's money, not your own.

You can use the simplified small estate process in Kentucky if no will leaves personal property, and there is a surviving spouse and the value of property subject to probate is $15,000 or less, or if there is no surviving spouse and someone else has paid at least $15,000 in preferred claims. Ky.

In Kentucky, living trusts can be used to avoid probate for essentially any asset you own. That would include real estate, bank accounts, vehicles, and so on. You need to create a trust document that names someone to serve as successor trustee, the one to take over as trustee after your death.

Basic Requirements for Serving as a Kentucky Executor Your executor must be: at least 18 years old, unless your will specifically names a younger person executor, and. of sound mind -- that is, not judged incapacitated by a court.

In Kentucky, an estate must remain open for at least six months to allow time for creditors to submit their bills to the estate. Thus, a simple estate can be settled in as short a time as six months.