Kentucky Request for Accounting of Disclosures of Protected Health Information

Description

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

It is feasible to spend hours online attempting to locate the legal document template that meets the federal and state requirements you seek.

US Legal Forms offers a wide array of legal forms that have been reviewed by experts.

It is easy to download or print the Kentucky Request for Accounting of Disclosures of Protected Health Information from our services.

Review the form description to verify that you have chosen the correct form. If available, utilize the Review button to examine the document template as well.

- If you hold a US Legal Forms account, you may Log In and click the Acquire button.

- Subsequently, you can complete, edit, print, or sign the Kentucky Request for Accounting of Disclosures of Protected Health Information.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

HIPAA Disclosure Accounting or Accounting of Disclosures (AOD) is the action or process of keeping records of disclosures of PHI for purposes other than Treatment, Payment, or Healthcare Operations. You are required by law to provide patients a list of all the disclosures of their PHI that you have made outside of TPO.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

The Privacy Rule at 45 CFR 164.528 requires covered entities to make available to an individual upon request an accounting of certain disclosures of the individual's protected health information made during the six years prior to the request.

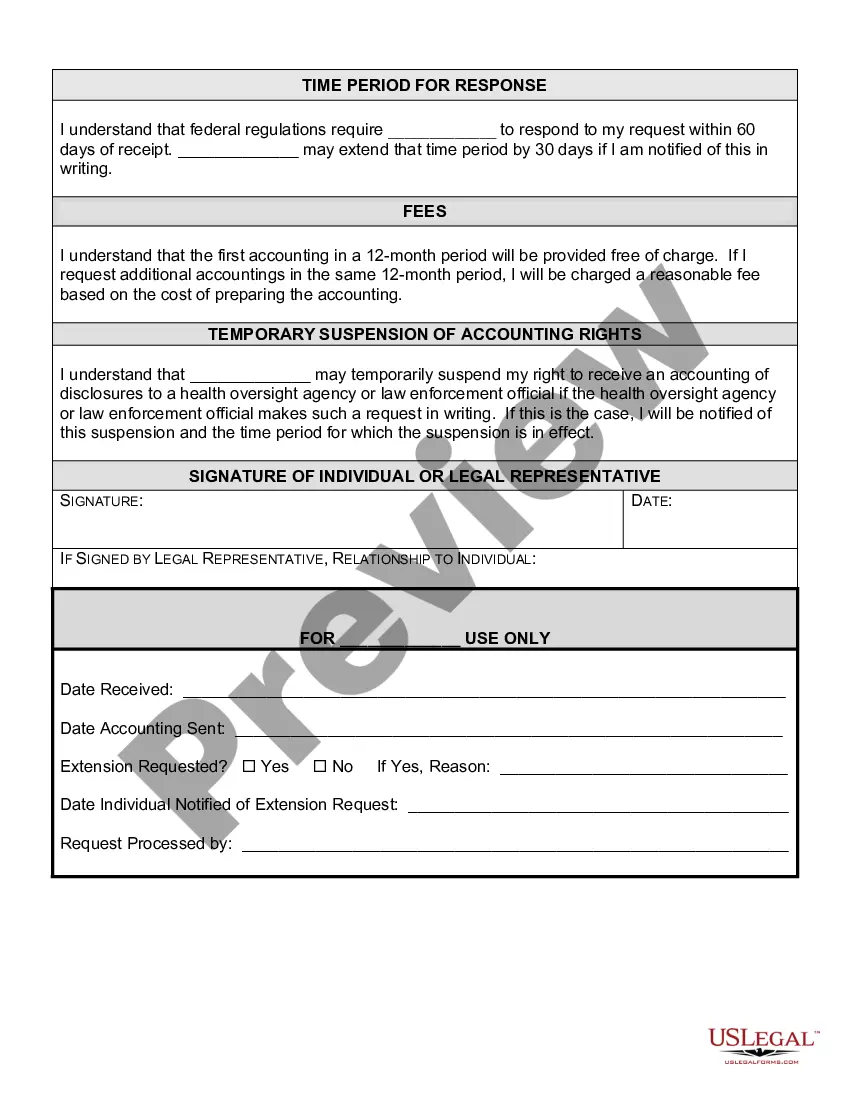

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the

The maximum disclosure accounting period is the six years immediately preceding the accounting request, except a covered entity is not obligated to account for any disclosure made before its Privacy Rule compliance date.

For each disclosure, the accounting must include: (1) The date of the disclosure; (2) the name (and address, if known) of the entity or person who received the protected health information; (3) a brief description of the information disclosed; and (4) a brief statement of the purpose of the disclosure (or a copy of the

A covered entity must provide the first accounting (during any 12 month period) free of charge. If an individual requests more than one accounting during a year, the covered entity may impose a cost-based fee on subsequent requests.

45 CFR § 164.528 - Accounting of disclosures of protected health information. A§ 164.528 Accounting of disclosures of protected health information. (a) Standard: Right to an accounting of disclosures of protected health information. (ix) That occurred prior to the compliance date for the covered entity.

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the