Kentucky Merchandise Return Sheet

Description

How to fill out Merchandise Return Sheet?

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Kentucky Merchandise Return Sheet, suitable for both business and personal needs. All forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Kentucky Merchandise Return Sheet. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents tab in your account to get another copy of the document you need.

Complete, modify, print, and sign the downloaded Kentucky Merchandise Return Sheet. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally-crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps to follow.

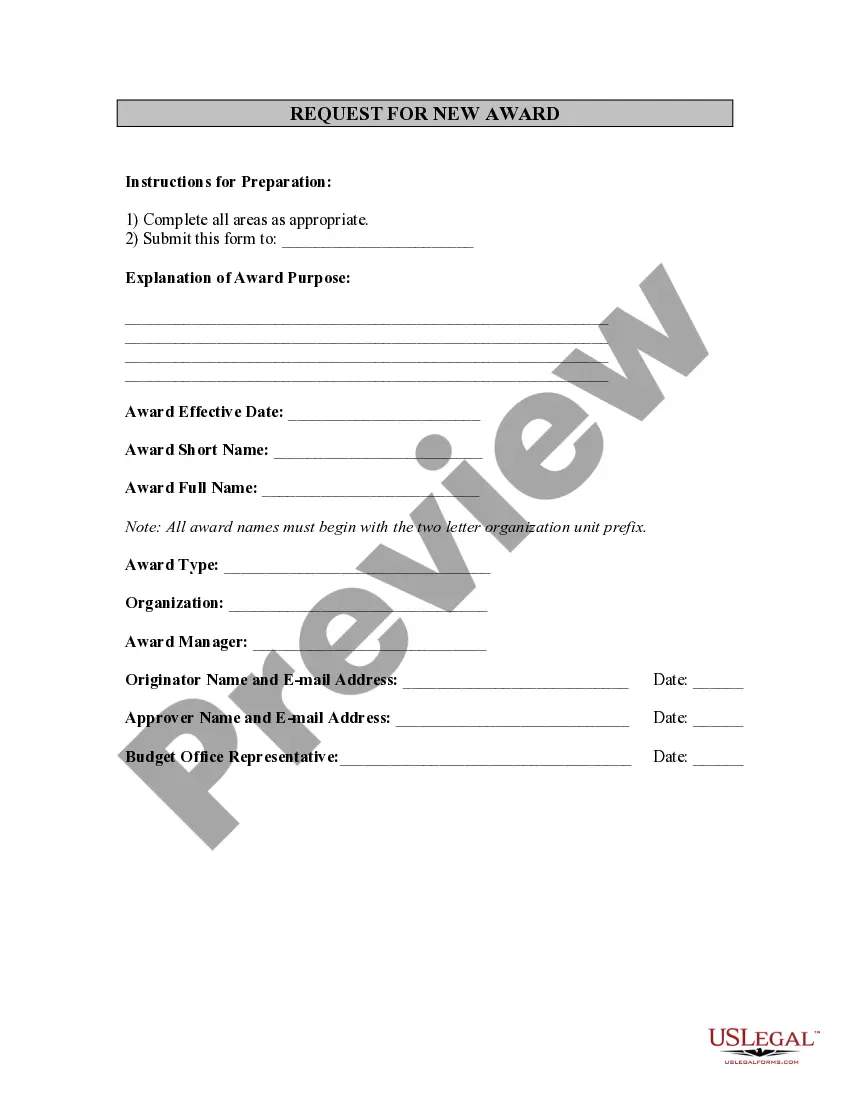

- First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review button and view the form summary to make sure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Get Now button to acquire the form.

- Select the pricing plan you want and input the required details. Create your account and complete the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2's or any 1099's.

You should include the 2nd federal return copy with your state return to mail in. Most states require you to mail in a copy of your Federal Return with your state return.

Returns filed after May 15th should be mailed to Kentucky Department of Revenue, Omitted Tangible Branch, 501 High Street, Station 32, Frankfort, KY 40601.

The final regulations are effective upon their publication in the Federal Register. The mandatory e-filing requirement applies to any income tax return for an individual, estate or trust. However, certain returns that the IRS cannot accept electronically are currently exempt from the requirement.

How do you know what to send? When you file a Schedule C for your Federal return, Kentucky requires a full copy of the Federal return as an attachment. Filed electronically, TurboTax will file it correctly. If you mail in the KY return, you must include a copy of the 1040 and all attachments.

Verify that the purchaser has a Kentucky (or other state) resale certificate and Tax ID Verify the validity of your buyer's sales tax ID on the Kentucky Department of Revenue website or with the issuing state's department of revenue. You can find links to verify resale certificates in every state here.

Electronic Filing Mandate - Kentucky follows the Federal mandate that a preparer must e-file KY individual returns unless they file 10 or fewer returns in a calendar year. E-File Registration Requirements - Acceptance in the Kentucky e-file program is automatic with acceptance in the Federal e-file program.

No, only state returns go to your state. If you have to mail your federal return, you will need to mail that to IRS.

California law requires tax preparers to e-file if they prepare: More than 100 individual income tax returns. 1 or more returns using tax preparation software.

Yes. Wisconsin requires a complete copy of your federal return. Payment If you owe an amount with your return, paper clip your payment to the front of Form 1, unless you are paying by credit card or online.