Kentucky Private Annuity Agreement

Description

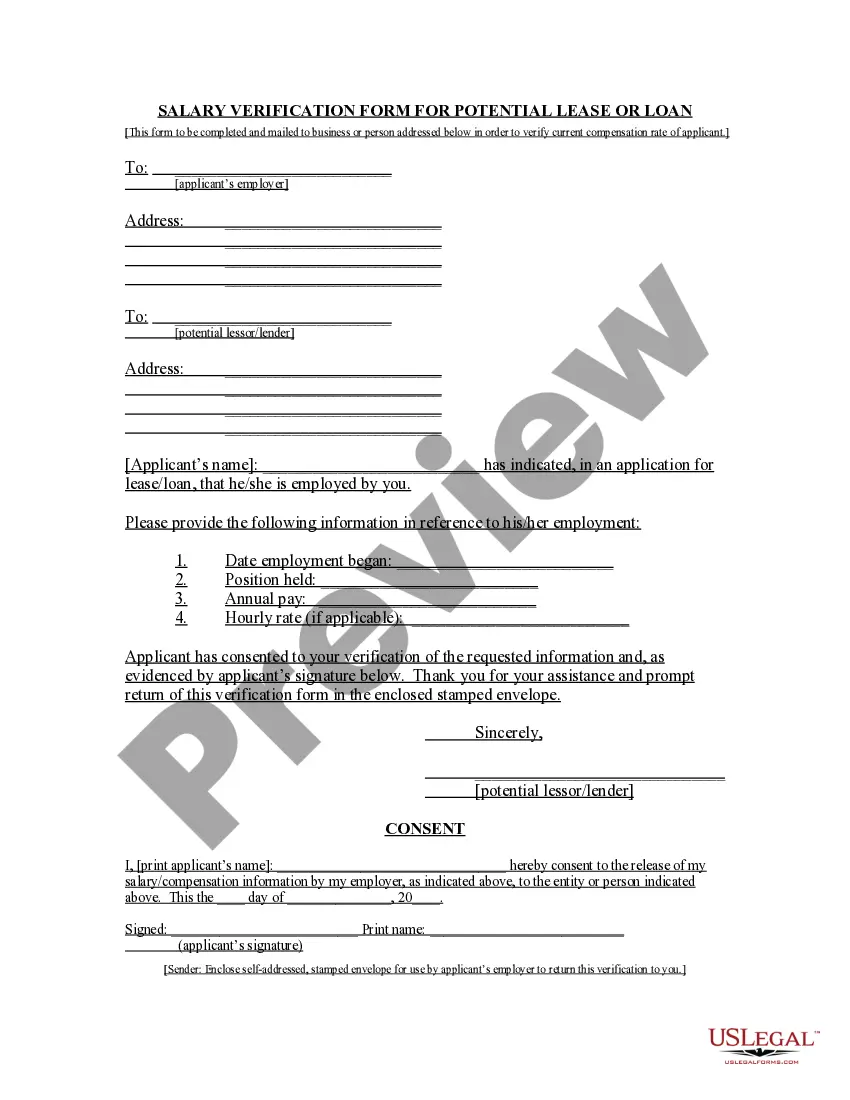

How to fill out Private Annuity Agreement?

Locating the appropriate legal document format can be a challenge.

Clearly, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your area/county. You can review the form using the Preview option and read the form description to confirm it is right for you. If the form does not meet your needs, use the Search section to find the appropriate form. When you are sure that the form is suitable, click on the Get now button to acquire the form. Choose your preferred payment plan and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded Kentucky Private Annuity Agreement. US Legal Forms is the largest collection of legal forms where you can find a wide range of document templates. Use the service to download professionally crafted documents that comply with state guidelines.

- The platform offers thousands of templates, including the Kentucky Private Annuity Agreement, suitable for business and personal needs.

- All documents are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Kentucky Private Annuity Agreement.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the necessary document.

Form popularity

FAQ

Certain goods are exempt from sales and use tax including coal and other energy-producing fuels, certain medical items, locomotives or rolling stock, certain farm machinery and livestock, certain seeds and farm chemicals, machinery for new and expanded industry, tombstones, textbooks, property certified as an alcohol

Kentucky allows pension income (including annuities, IRA accounts, 401(k) and similar deferred compensation plans, death benefits, etc.) paid under a written retirement plan to be excluded from income on the Kentucky return.

Or are a part-year Kentucky resident and:while a nonresident. File Form 740-NPR if you are a resident of a reciprocal state: Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin and you had Kentucky income tax withheld and had no other income from Kentucky sources.

Do you pay taxes on annuities? You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

Annuities Can Be Complex.Your Upside May Be Limited.You Could Pay More in Taxes.Expenses Can Add Up.Guarantees Have a Caveat.Inflation Can Erode Your Annuity's Value.The Bottom Line.

Once your contract has matured, you can choose to keep your money in the annuity. You won't receive any checks from the life insurance company. That is, unless you opt to withdraw money on your own or start your income payments according to a definitive withdrawal schedule set by the insurer.