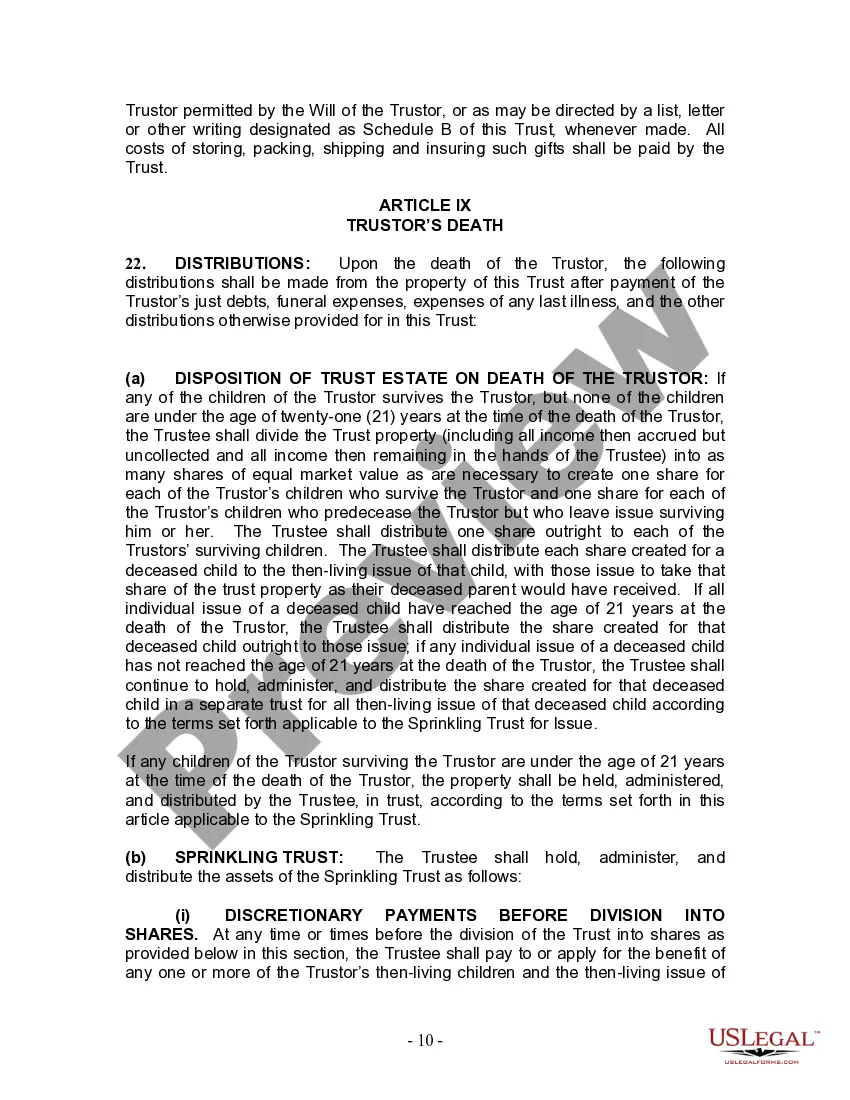

Florida Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

Gain access to one of the most comprehensive collections of legal documents.

US Legal Forms is, in fact, a platform to locate any state-specific document in just a few clicks, including the Florida Living Trust for individuals who are Single, Divorced, or Widowed with Children samples.

There's no need to squander hours searching for a court-acceptable form.

That's it! You need to fill out the Florida Living Trust for individual, Who is Single, Divorced, or Widowed with Children template and proceed with the checkout. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily browse through approximately 85,000 useful forms.

- Our certified experts guarantee that you receive the latest templates every time.

- To utilize the document library, select a subscription plan and set up an account.

- If you have already registered, simply Log In and then click Download.

- The Florida Living Trust for individuals, Who is Single, Divorced, or Widowed with Children file will automatically be saved in the My documents section (a dedicated area for every form you store on US Legal Forms).

- To create a new account, follow the brief instructions provided below.

- If you need to use a state-specific template, make sure to specify the correct state.

- If possible, review the description to grasp all the details of the form.

- Utilize the Preview feature if it’s available to examine the document's details.

- If everything is satisfactory, click Buy Now.

- After selecting a pricing option, set up your account.

- Make a payment using your card or PayPal.

- Download the template to your computer by clicking on the Download button.

Form popularity

FAQ

To write a Florida Living Trust for individuals who are single, divorced, or widowed with children, start by outlining your assets and deciding how you want them distributed. Gather the necessary information, including names of beneficiaries and your chosen successor trustee. You can simplify this process by using USLegalForms, which offers user-friendly templates and guidance to ensure your trust meets all Florida legal requirements. Secure your family's future with a solid trust that clearly reflects your wishes.

Divorce can have significant implications for a Florida Living Trust for individuals who are single, divorced, or widowed with children. When you divorce, the terms of your living trust may need revision to reflect your new situation and intentions regarding the distribution of your assets. It is crucial to update beneficiaries and make necessary adjustments to ensure that your children, rather than an ex-spouse, are protected. Consulting with a legal expert can help you navigate this process effectively.

The biggest mistake parents often make when establishing a Florida Living Trust for individuals who are single, divorced, or widowed with children is failing to clearly define their wishes. Many assume that their intentions are obvious or will be understood by their children, which can lead to confusion and conflict later on. Additionally, not updating the trust as family circumstances change—such as remarriage or having more children—can create significant issues. To avoid these pitfalls, consider using the US Legal Forms platform to ensure your trust properly reflects your desires and protects your loved ones.

There is no specific net worth requirement to establish a Florida Living Trust for individuals who are single, divorced, or widowed with children. Even if your estate is modest, a trust can help avoid probate and provide peace of mind regarding asset distribution. However, if you have significant assets or concerns about how your children will inherit, it becomes increasingly important to have a trust in place. Evaluating your situation with tools from USLegalForms can help you determine the right approach for your needs.

Individuals in Florida, particularly those who are single, divorced, or widowed with children, should consider a living trust. If you possess assets or have specific wishes regarding the distribution of your estate, a living trust can provide clarity and control. It is especially crucial for parents who want to protect their children's interests and ensure they are cared for after passing. By using a platform like USLegalForms, you can easily create a customized Florida Living Trust that meets your family's unique needs.

Having a Florida Living Trust for individuals who are single, divorced, or widowed with children can simplify the management of your estate. Although it is not strictly necessary, a living trust provides numerous benefits, including avoiding probate and ensuring your assets are distributed as per your requirements. This can be particularly helpful if you have children, as it allows for smoother transitions and protections for their inheritance. Overall, creating a trust can be a wise decision for safeguarding your family's future.

A Florida Living Trust for individuals, who are single, divorced, or widowed with children, usually revolves around sole control and benefits. A single living trust allows you to manage your assets independently, ensuring your children receive their inheritance according to your wishes. In contrast, a joint living trust combines the assets of two individuals, allowing them to manage those assets together. This distinction can affect how your estate is handled, especially if you wish to have specific arrangements for your children.

In Florida, you do not need to file your living trust with the state. Your Florida Living Trust for individuals who are single, divorced, or widowed with children operates privately and outside of the courts. However, it's crucial to maintain accurate records and distribute the assets according to your trust terms.

In scenarios where one spouse passes away, a living trust generally continues to operate smoothly. The surviving spouse usually maintains access to the trust assets without the need for probate. This aspect of a Florida Living Trust for individuals, who are single, divorced, or widowed with children, simplifies matters, providing peace of mind during an emotionally challenging time.

Absolutely, you can prepare your own living trust in Florida. Many individuals choose to use online resources or templates to create their Florida Living Trust for individuals who are single, divorced, or widowed with children. However, consider having a legal expert review your documents to ensure they meet state laws and adequately protect your assets.