This form is a Quitclaim Deed where the Grantors are three individuals and the Grantees are five individuals. Grantors convey and quitclaim any interest they might have in the described property to Grantees. This deed complies with all state statutory laws.

New York Quitclaim Deed from Three Individuals to Five Individuals

Description

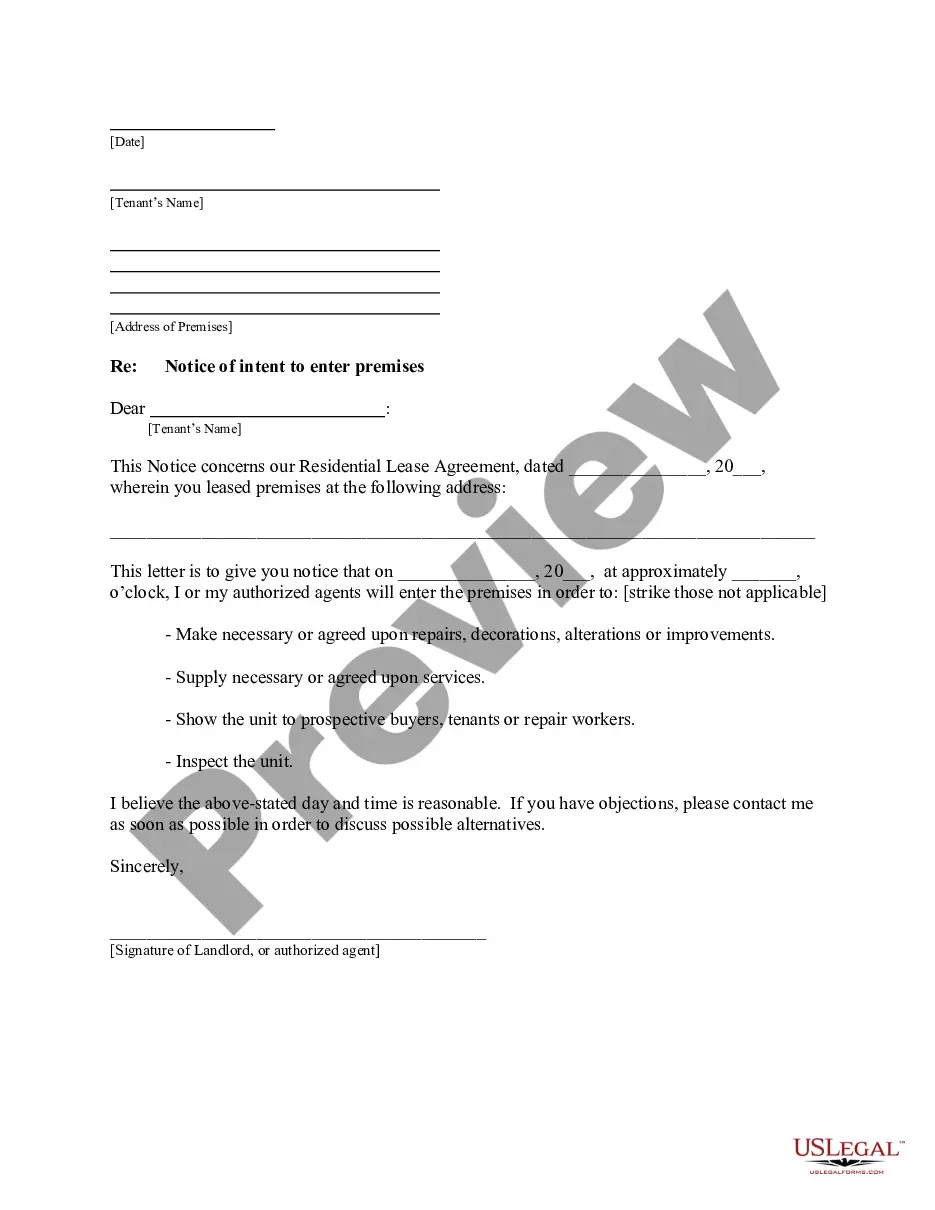

How to fill out New York Quitclaim Deed From Three Individuals To Five Individuals?

US Legal Forms is actually a special platform to find any legal or tax template for filling out, such as New York Quitclaim Deed from Three Individuals to Five Individuals. If you’re sick and tired of wasting time looking for perfect samples and spending money on papers preparation/attorney fees, then US Legal Forms is precisely what you’re trying to find.

To experience all the service’s advantages, you don't have to install any software but simply pick a subscription plan and create an account. If you already have one, just log in and get a suitable template, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need New York Quitclaim Deed from Three Individuals to Five Individuals, check out the instructions listed below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to reach the register page.

- Select a pricing plan and continue registering by entering some information.

- Select a payment method to complete the registration.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure regarding your New York Quitclaim Deed from Three Individuals to Five Individuals template, contact a lawyer to examine it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

Under the gift tax rules, the grantor must pay tax on the property through a federal income tax return. The recipient of the property is allowed to pay the tax if she agrees to make the payment. Individuals are allowed an exclusion of $13,000.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.