Kentucky Sample Letter regarding Chapter 13 Plan

Description

How to fill out Sample Letter Regarding Chapter 13 Plan?

Have you been in a position that you require paperwork for sometimes enterprise or individual reasons virtually every day time? There are a lot of legitimate document themes available online, but locating types you can rely on is not easy. US Legal Forms provides thousands of kind themes, just like the Kentucky Sample Letter regarding Chapter 13 Plan, which are published to meet federal and state demands.

Should you be currently informed about US Legal Forms web site and also have your account, just log in. After that, you are able to download the Kentucky Sample Letter regarding Chapter 13 Plan template.

If you do not provide an accounts and wish to start using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is for the proper town/county.

- Take advantage of the Review switch to examine the shape.

- See the explanation to ensure that you have chosen the proper kind.

- If the kind is not what you are trying to find, take advantage of the Research discipline to obtain the kind that meets your requirements and demands.

- If you get the proper kind, click on Purchase now.

- Select the costs prepare you would like, fill in the necessary details to generate your bank account, and buy the transaction making use of your PayPal or bank card.

- Pick a convenient file file format and download your copy.

Locate all of the document themes you may have purchased in the My Forms menus. You can obtain a additional copy of Kentucky Sample Letter regarding Chapter 13 Plan anytime, if necessary. Just go through the essential kind to download or print out the document template.

Use US Legal Forms, one of the most extensive selection of legitimate varieties, in order to save time as well as prevent blunders. The support provides expertly made legitimate document themes which you can use for an array of reasons. Make your account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

It's a Long Term Commitment ? Filing Chapter 13 bankruptcy requires you to make a long-term commitment to the process. Tough To Get Credit or a Mortgage for 7 Years ? Other impacts include the inability to get credit cards at a good rate, and filing Chapter 13 makes it tough to get a mortgage.

Kentucky Chapter 13 Bankruptcy Information Under a chapter 13 bankruptcy, a debtor proposes a 3-5 year repayment plan to the creditors offering to pay off all or part of the debts from the debtor's future income.

In that case, the bankruptcy trustee will likely discover the bonus income through your yearly tax return, and could request an upward modification of your plan payments to include the bonus income. The adjustment is not automatic and requires the order of the bankruptcy court.

Once your repayment plan gets confirmed, you must continue to make timely payments to the bankruptcy trustee each month for the duration of your plan. You must also continue to make payments on debts, such as your mortgage or car payment, which you proposed to pay outside of bankruptcy.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

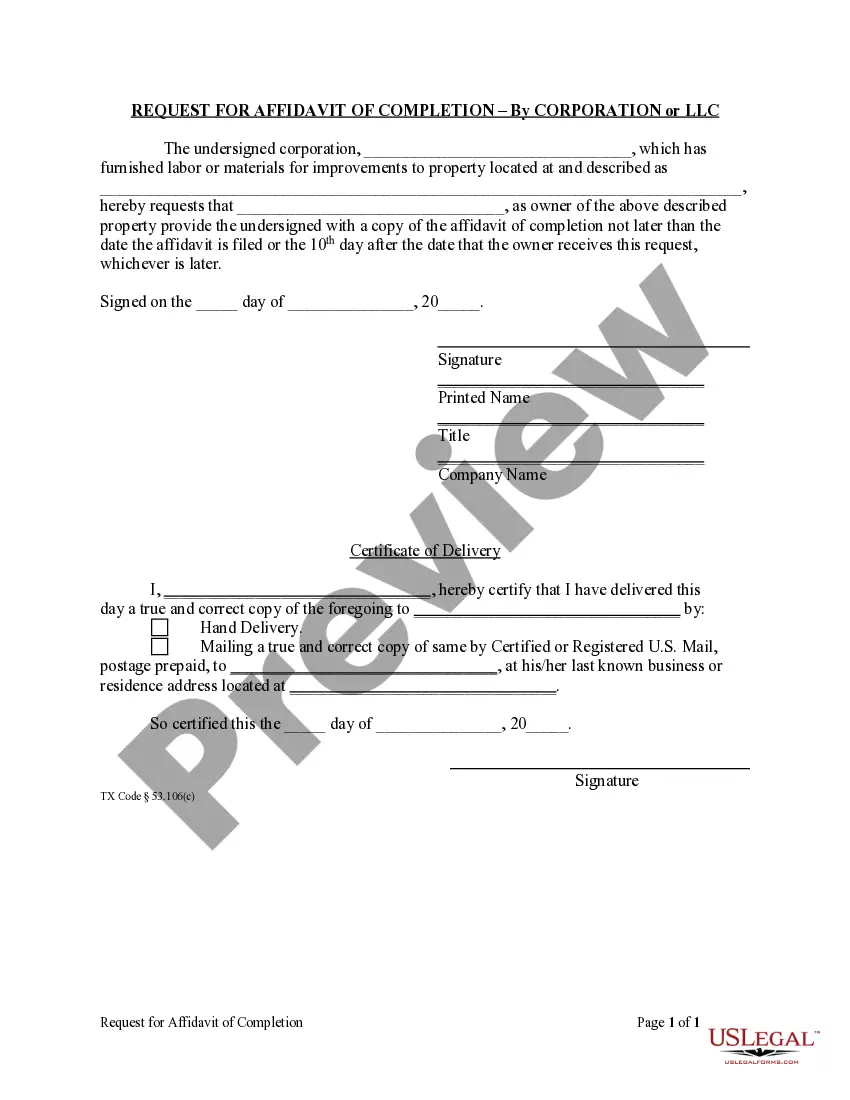

Key Elements to Include in the Letter It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors.