Kentucky LLC Operating Agreement for Married Couple

Description

How to fill out LLC Operating Agreement For Married Couple?

Are you currently in the situation where you require documents for both business and personal use nearly every day.

There is a multitude of legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the Kentucky LLC Operating Agreement for Married Couples, designed to fulfill state and federal regulations.

When you have found the right form, click Get now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your version. You can find all the document templates you have purchased in the My documents list. You can acquire another version of the Kentucky LLC Operating Agreement for Married Couples at any time if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, one of the largest selections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kentucky LLC Operating Agreement for Married Couples template.

- If you do not have an account and wish to begin utilizing US Legal Forms, follow these steps.

- Obtain the form you need and verify it is for the correct region/state.

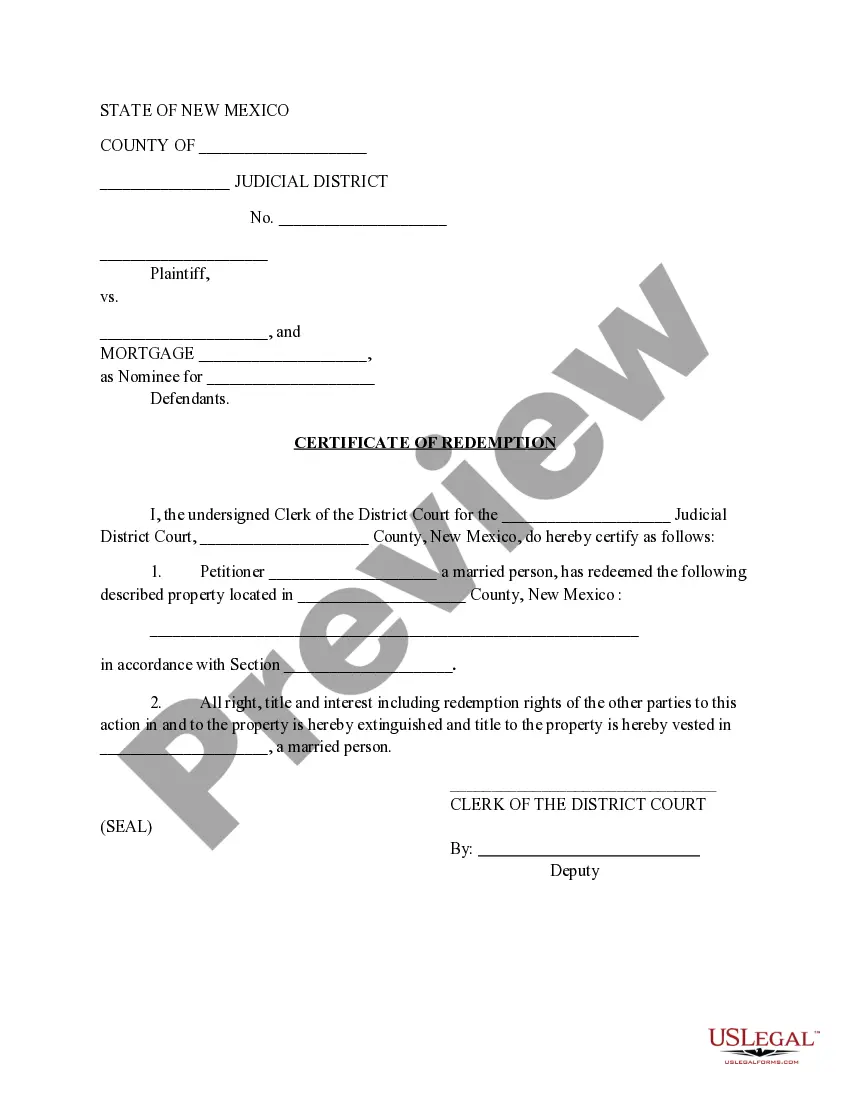

- Utilize the Review button to examine the form.

- Check the overview to confirm you have selected the appropriate form.

- If the form is not what you’re looking for, use the Lookup field to find the form that satisfies your needs and requirements.

Form popularity

FAQ

To amend your Kentucky LLC Articles of Organization you submit form Articles of Amendment to the Kentucky Secretary of State (SOS). The form is available in your online account once you sign up with Northwest. You can also find the amendment form on the SOS website.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

How to Form an LLC (5 steps)Step 1 Choose Your State.Step 2 Select a Name.Step 3 Select a Registered Agent.Step 4 File for Your LLC (Articles of Organization)Step 5 Write the LLC Operating Agreement.Step 1 Name Your LLC.Step 2 State of Jurisdiction (Choose Your State)Step 3 Select Type.More items...

An LLC operating agreement is not required in Kentucky, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?