Kentucky Extended Date for Performance

Description

How to fill out Extended Date For Performance?

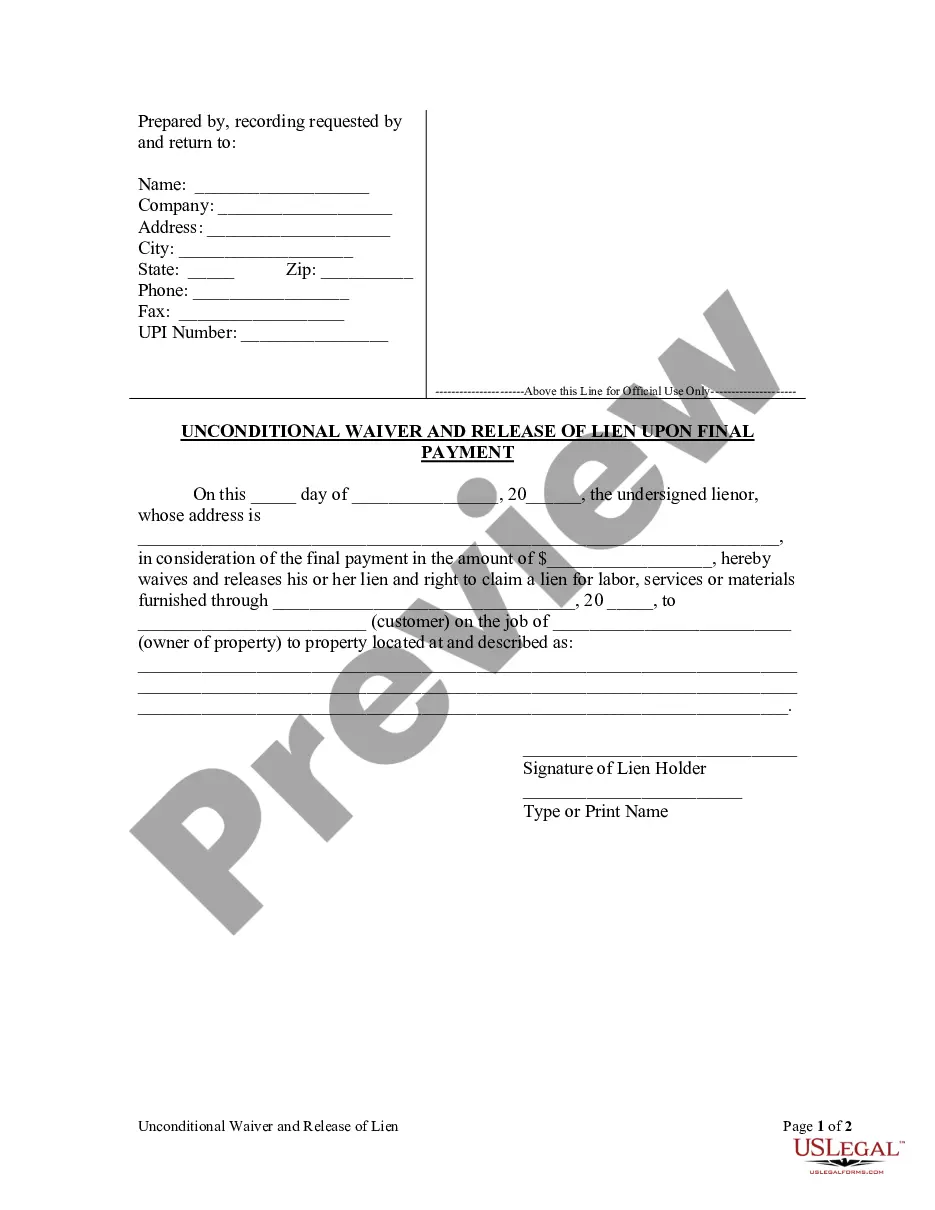

Selecting the appropriate sanctioned document format may be challenging. Clearly, there are numerous templates accessible online, but how would you acquire the sanctioned form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the Kentucky Extended Date for Performance, which can be utilized for business and personal purposes. All the documents are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Kentucky Extended Date for Performance. Use your account to verify the sanctioned templates you may have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: Initially, ensure you have selected the correct form for your city/county. You can browse the template using the Review button and check the form description to confirm this is the right one for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are confident that the template is correct, click on the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the payment using your PayPal account or credit card. Select the document format and download the sanctioned document format for your device. Complete, modify, print, and sign the received Kentucky Extended Date for Performance.

- US Legal Forms is the largest collection of sanctioned templates where you can find numerous document samples.

- Utilize the service to download professionally crafted documents that adhere to state requirements.

Form popularity

FAQ

Several states, including Kentucky, have announced extended tax deadlines for various reasons, such as natural disasters or public health emergencies. If you are interested in the Kentucky Extended Date for Performance, you may find similar extensions in states like California and Texas. These extensions are designed to alleviate stress during tricky financial periods. For clarity on these deadlines, you can leverage UsLegalForms to find comprehensive tax-related documentation and details.

Yes, Kentucky PTE, or pass-through entities, does accept federal extensions. This means that if you have filed for a federal extension, you may also benefit from a Kentucky Extended Date for Performance. Utilizing this option allows you more time to file your state tax returns without penalties. If you require assistance navigating these extensions, UsLegalForms offers valuable resources to simplify the process.

Form 720 is a specific document used for reporting and paying the Kentucky state income tax. It is crucial for individuals and businesses that need to declare their earnings and tax obligations. With the implementation of the Kentucky Extended Date for Performance, this form can be submitted later than the usual deadlines, providing taxpayers with added flexibility. If you are unsure about how to fill it out, consider using UsLegalForms to access accurate guidance and templates.

Yes, Kentucky recognizes the federal extension, allowing you to use Form 7004 for additional time to file. By leveraging such federal provisions, you can help meet the Kentucky Extended Date for Performance. Always confirm that you also file the necessary state form to ensure compliance.

To file for an extension on your taxes, you typically need to fill out the appropriate form, which in Kentucky is Form 725. Ensure you submit it before the deadline to avoid any penalties and to achieve the Kentucky Extended Date for Performance. Consider using resources from USLegalForms for guidance.

To file an extension in Kentucky, complete Form 725 and submit it either electronically or by mail. This will grant you additional time to file your taxes while aligning with the Kentucky Extended Date for Performance. Platforms like USLegalForms make this process user-friendly and efficient.

Some states do not accept federal extensions, including Louisiana and North Carolina. Each state has its rules regarding tax extensions, so it’s crucial to be aware of them to comply with the Kentucky Extended Date for Performance. Always check state guidelines when filing an extension.

Yes, Kentucky does accept the federal extension Form 7004. By filing this form, you can obtain additional time to file your taxes while adhering to the Kentucky Extended Date for Performance. It is essential to ensure that both forms are filed accurately and timely.

To mail a KY extension, you should send it to the address provided on the form. Ensure that you send it to the correct location to meet the Kentucky Extended Date for Performance. Double-check the mailing instructions as they may vary based on your filing situation.

The extension form for the Kentucky state tax return is the Form 725. This form allows you to extend the time to file your tax return while ensuring compliance with the Kentucky Extended Date for Performance. It’s important to submit this form before the regular tax deadline to avoid penalties.