Kentucky Marketing Consultant Agreement - Self-Employed

Description

How to fill out Marketing Consultant Agreement - Self-Employed?

US Legal Forms - one of the largest collections of official documents in the United States - offers a variety of legitimate record templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest editions of forms such as the Kentucky Marketing Consultant Agreement - Self-Employed in moments.

If you already have a subscription, Log In to download the Kentucky Marketing Consultant Agreement - Self-Employed from the US Legal Forms repository. The Download button will appear on each form you view. All previously downloaded forms can be accessed from the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make changes. Fill out, edit, and print or sign the downloaded Kentucky Marketing Consultant Agreement - Self-Employed. Each template you add to your account does not expire and is yours indefinitely. So, if you need to download or print another copy, simply go to the My documents section and click on the form you want. Access the Kentucky Marketing Consultant Agreement - Self-Employed with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the proper form for your city/county.

- Click the Review button to analyze the form's content.

- Verify the form description to ensure that you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Yes, you can legally refer to yourself as a consultant if you offer specialized advice or services. However, it is essential to ensure you meet any relevant qualifications or licensing requirements in your field. Using a Kentucky Marketing Consultant Agreement - Self-Employed can establish your legitimacy and clarify the nature of your consulting services.

You do not necessarily need an LLC to be a consultant; however, forming one can provide legal protection and potential tax advantages. It helps separate your personal and business assets. Consider the Kentucky Marketing Consultant Agreement - Self-Employed from USLegalForms to complement your business structure and ensure proper documentation.

Yes, an independent contractor can serve as a consultant, provided they offer specialized services to clients. This arrangement allows for flexibility and can be beneficial for both parties. Make sure to use a Kentucky Marketing Consultant Agreement - Self-Employed to protect your rights and clarify expectations.

Becoming a self-employed consultant involves several steps, beginning with assessing your skills and the demand in your industry. Establish your brand and marketing strategy to attract clients. A Kentucky Marketing Consultant Agreement - Self-Employed available through USLegalForms can help you manage your contracts effectively.

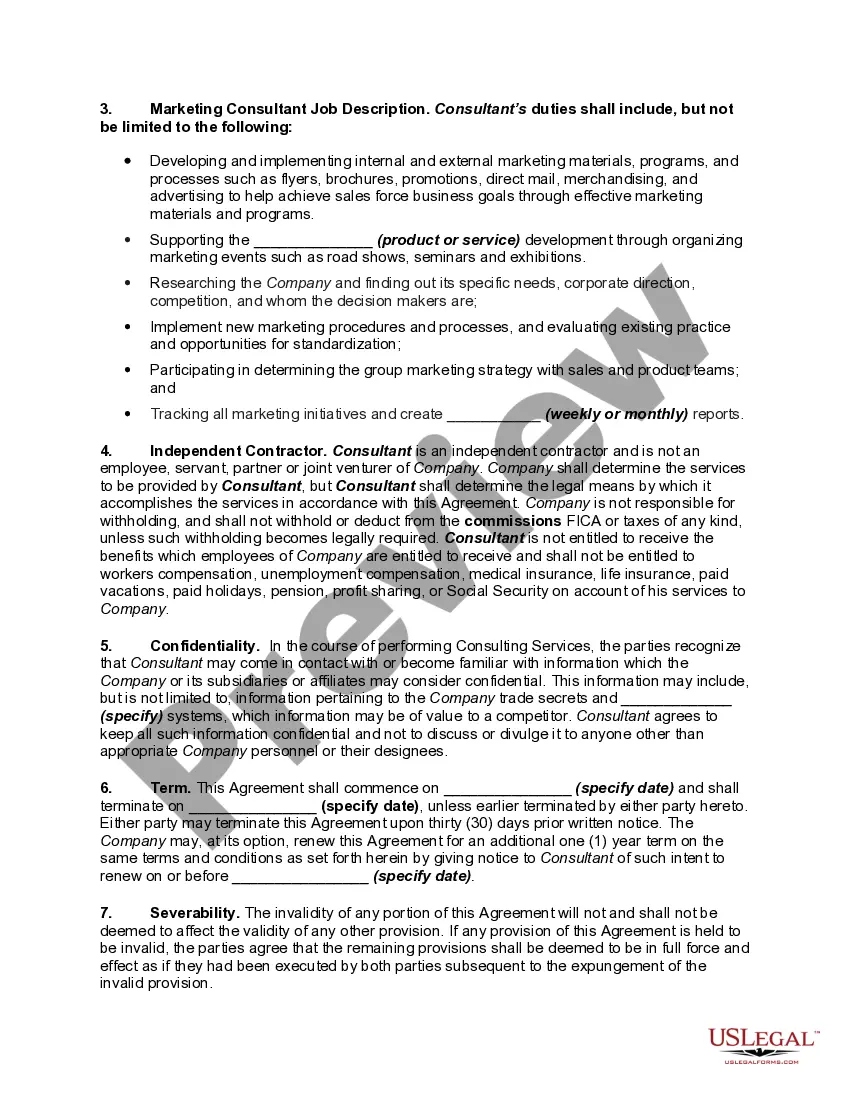

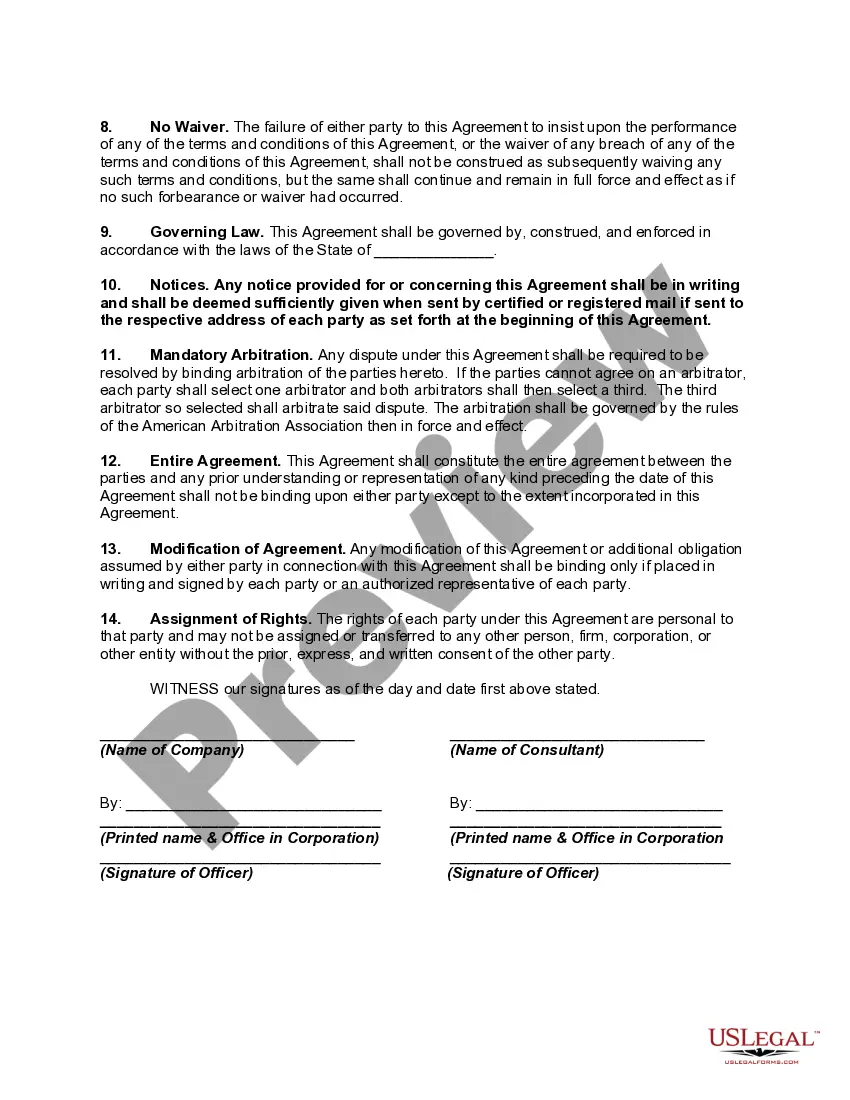

Setting up a consulting agreement begins with defining the terms of your engagement. It's crucial to outline your responsibilities, payment terms, and the project scope. Using a well-structured Kentucky Marketing Consultant Agreement - Self-Employed from USLegalForms can streamline this process and ensure all necessary details are included.

The key difference between a consultant and a contractor lies in the nature of their work. A consultant, under a Kentucky Marketing Consultant Agreement - Self-Employed, primarily offers advice and strategies, while a contractor usually implements specific tasks or projects according to a client's directives. Consultants focus on providing expertise and recommendations, whereas contractors execute the plans and projects. Understanding this distinction can help you navigate your professional opportunities more effectively.

A consultant typically qualifies as a professional who provides expert advice in a specific field. In the context of a Kentucky Marketing Consultant Agreement - Self-Employed, this individual may specialize in marketing strategies, brand development, or promotional campaigns. Consultants often work independently and offer their skills to businesses on a project-by-project basis. To determine if you qualify, consider your expertise and the services you can provide to clients.

Yes, a consultant can also work as a W-2 employee, but it usually depends on the nature of the work arrangement. In some cases, consultants may take on roles as part-time employees while maintaining their consulting business. It is essential to understand the implications of a Kentucky Marketing Consultant Agreement - Self-Employed to ensure compliance and clarify the working relationship.

Yes, as a consultant, you are typically classified as self-employed. This status allows you to manage your business independently, which is particularly beneficial when working with clients under a Kentucky Marketing Consultant Agreement - Self-Employed. Being self-employed gives you more control over your work and the ability to set your own rates.

Consultants should have a clear contract that outlines the terms of their services. A Kentucky Marketing Consultant Agreement - Self-Employed is ideal for specifying project details, compensation, and responsibilities. This agreement protects both the consultant and the client by providing clarity and fostering professional relationships.