Kentucky Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of legal forms that are evaluated by experts.

You can easily obtain or print the Kentucky Miller Trust Forms for Assisted Living through my assistance.

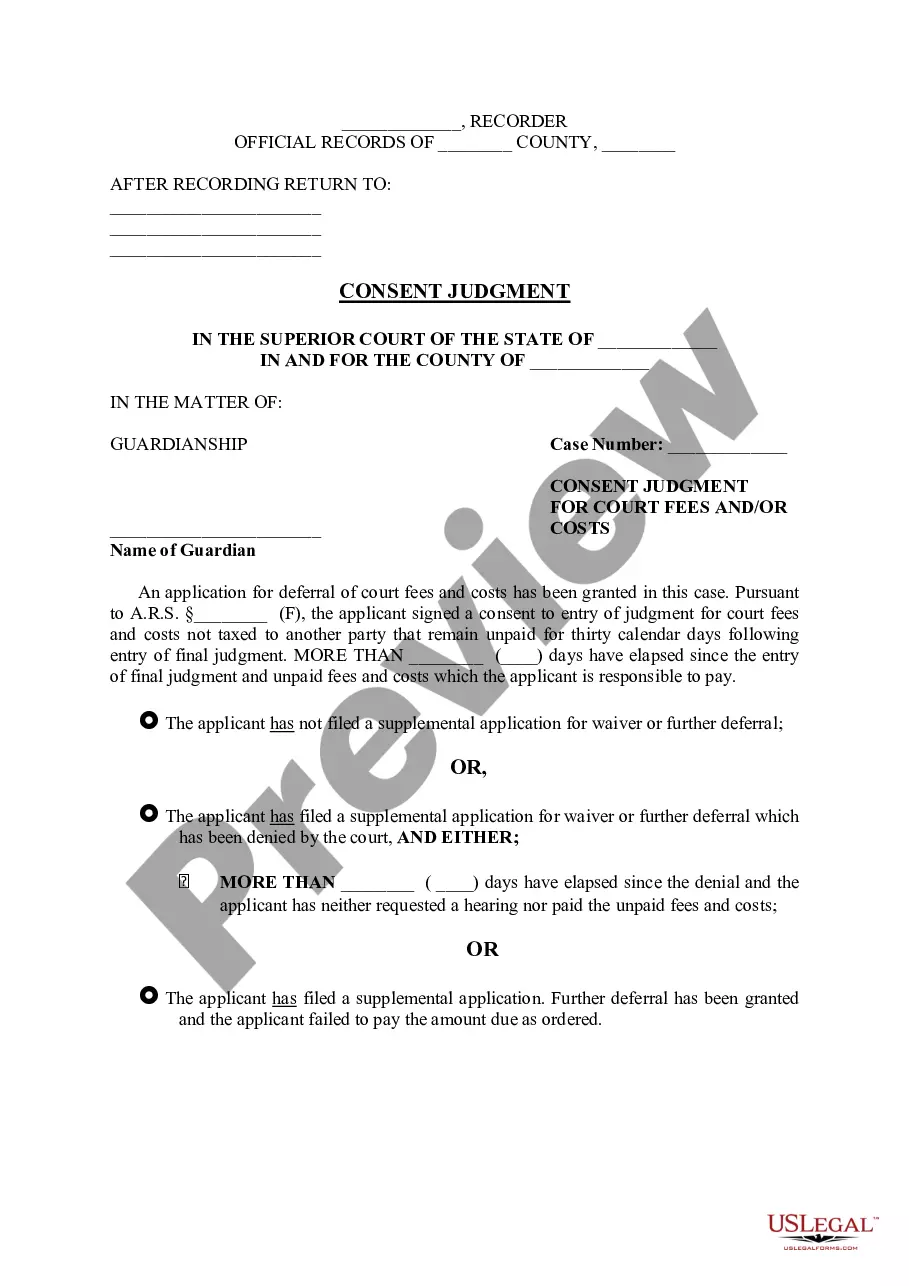

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, edit, print, or sign the Kentucky Miller Trust Forms for Assisted Living.

- Every legal document template you purchase is yours forever.

- To acquire another copy of a purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form details to confirm you have chosen the right template.

Form popularity

FAQ

In Kentucky, several requirements must be met for assisted living services. These typically include age, level of care needed, and compliance with state regulations. Families can benefit significantly by using Kentucky Miller Trust Forms for Assisted Living to organize finances and ensure eligibility. Understanding these requirements helps families make informed decisions about care options available to them.

Yes, KY Medicaid can cover assisted living under certain conditions. To qualify, individuals usually need to meet specific income and asset limits. Utilizing Kentucky Miller Trust Forms for Assisted Living can help you manage your assets effectively, allowing you to access necessary benefits. It is essential to review your eligibility and consult with a professional to understand the application process.

While it is possible to set up a Miller trust without a lawyer, seeking legal advice is wise. Kentucky Miller Trust Forms for Assisted Living provide a framework to create the trust, but a lawyer can help navigate complex legal requirements. This ensures your trust is set up correctly and that all necessary documentation is in place, ultimately protecting your interests.

Although Kentucky Miller Trust Forms for Assisted Living are state-specific, Miller trusts operate similarly in Texas. They allow individuals to convert excess income into a format that qualifies them for Medicaid assistance. By establishing such a trust, you can protect your assets while receiving the necessary care, which is crucial for assisted living situations.

A QIT form, or Qualified Income Trust form, is essential for certain individuals to qualify for Medicaid while securing funds for living expenses. It is specifically designed to meet the criteria needed for Kentucky Miller Trust Forms for Assisted Living. This document helps manage an individual’s income properly, allowing them to receive necessary care without jeopardizing their eligibility for assistance.

To establish a Miller trust, you first need to complete the appropriate Kentucky Miller Trust Forms for Assisted Living. This involves providing details about your financial situation and assets. Once you submit these forms, make sure to follow up with your local authorities to finalize the process and ensure the trust meets all legal requirements.

Yes, you can create a trust without a lawyer, but it involves careful planning. Using Kentucky Miller Trust Forms for Assisted Living can simplify the process, making it easier to ensure compliance with state regulations. However, it's beneficial to consult a professional to avoid any potential mistakes that could affect the trust’s validity.

In Kentucky, funds from a QIT can be utilized for several essential expenses related to assisted living. With the Kentucky Miller Trust Forms for Assisted Living, you can allocate these funds toward medical bills, healthcare premiums, and out-of-pocket costs connected to your care. This setup helps ensure you can afford quality care while adhering to Medicaid guidelines. It is a practical solution that balances your financial needs and healthcare requirements.

A QIT account can be used to set aside income that exceeds Medicaid limits. By using the Kentucky Miller Trust Forms for Assisted Living, you can deposit any excess income into this account, which can then be used for specific expenses. These expenses typically include medical costs, personal care services, and other necessary living expenses. This allows you to manage your funds effectively while ensuring Medicaid coverage.

A Qualified Income Trust (QIT) enables individuals in Kentucky to qualify for Medicaid while maintaining their income. The Kentucky Miller Trust Forms for Assisted Living facilitate the setup of this trust, allowing the excess income to be placed in a dedicated account. This ensures you meet Medicaid eligibility requirements without sacrificing your financial stability. With the right setup, you can protect your assets and receive the care you need.