North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

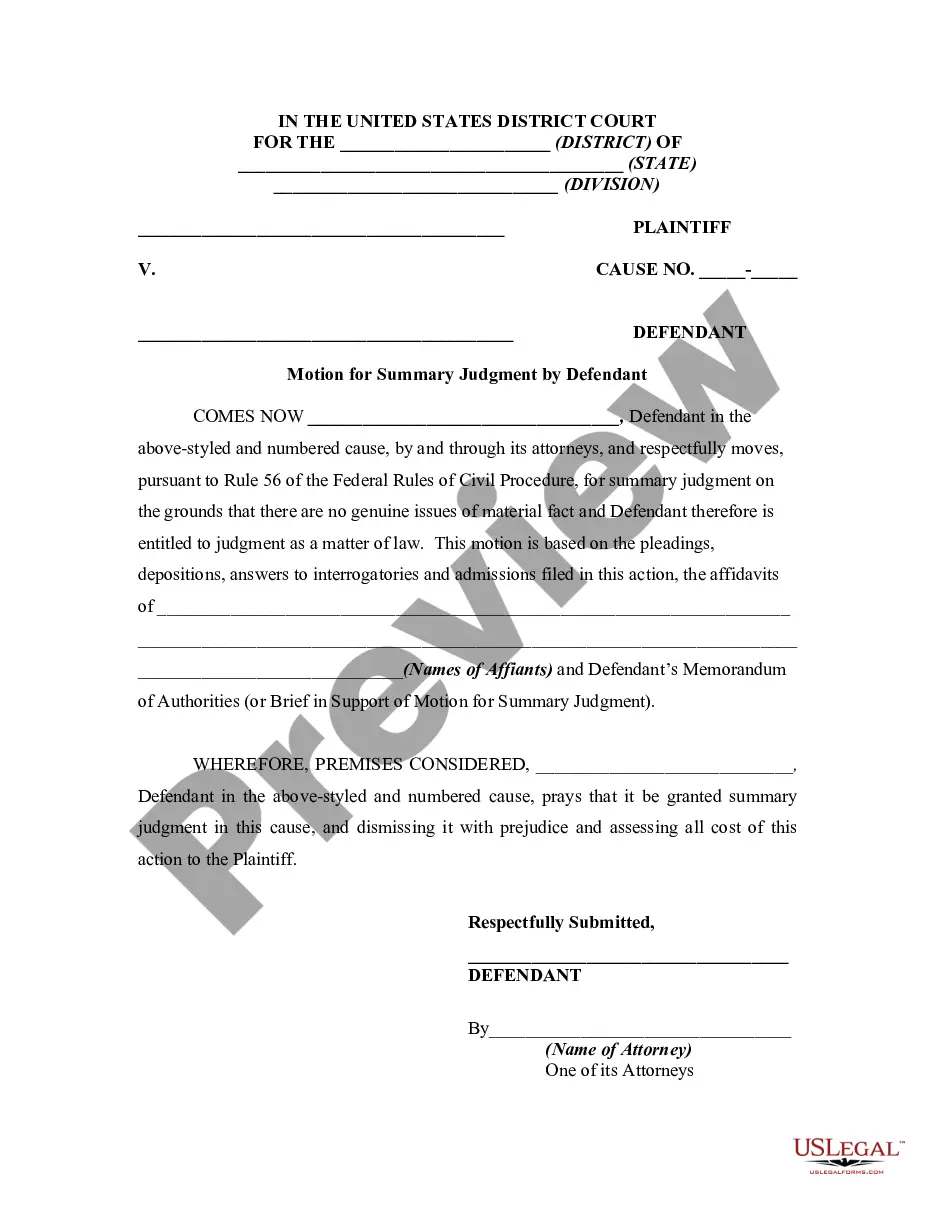

Choosing the best lawful record format can be quite a battle. Of course, there are tons of layouts accessible on the Internet, but how do you get the lawful type you will need? Utilize the US Legal Forms site. The service delivers 1000s of layouts, like the North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that you can use for business and private requirements. Each of the types are checked by experts and meet up with state and federal needs.

Should you be previously registered, log in for your account and click the Download key to have the North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Make use of your account to check from the lawful types you possess acquired in the past. Visit the My Forms tab of your own account and get another duplicate of your record you will need.

Should you be a new user of US Legal Forms, allow me to share easy guidelines that you can follow:

- First, make sure you have selected the appropriate type for the area/region. You are able to look through the form making use of the Preview key and study the form information to make sure this is the best for you.

- In the event the type fails to meet up with your needs, utilize the Seach discipline to discover the appropriate type.

- Once you are certain that the form is proper, select the Get now key to have the type.

- Choose the costs prepare you want and enter in the essential information. Create your account and purchase an order using your PayPal account or Visa or Mastercard.

- Opt for the file formatting and down load the lawful record format for your device.

- Complete, revise and print and indicator the received North Carolina Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms will be the most significant local library of lawful types that you can discover numerous record layouts. Utilize the company to down load appropriately-made documents that follow status needs.

Form popularity

FAQ

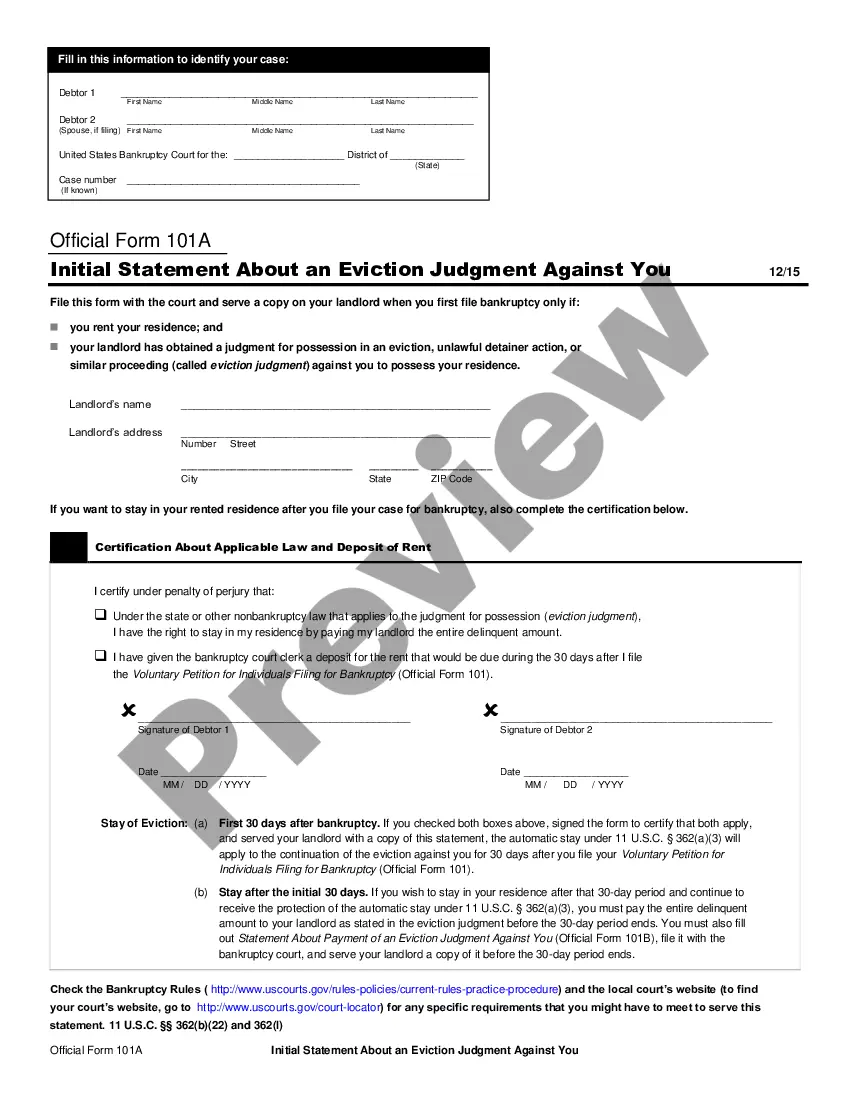

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

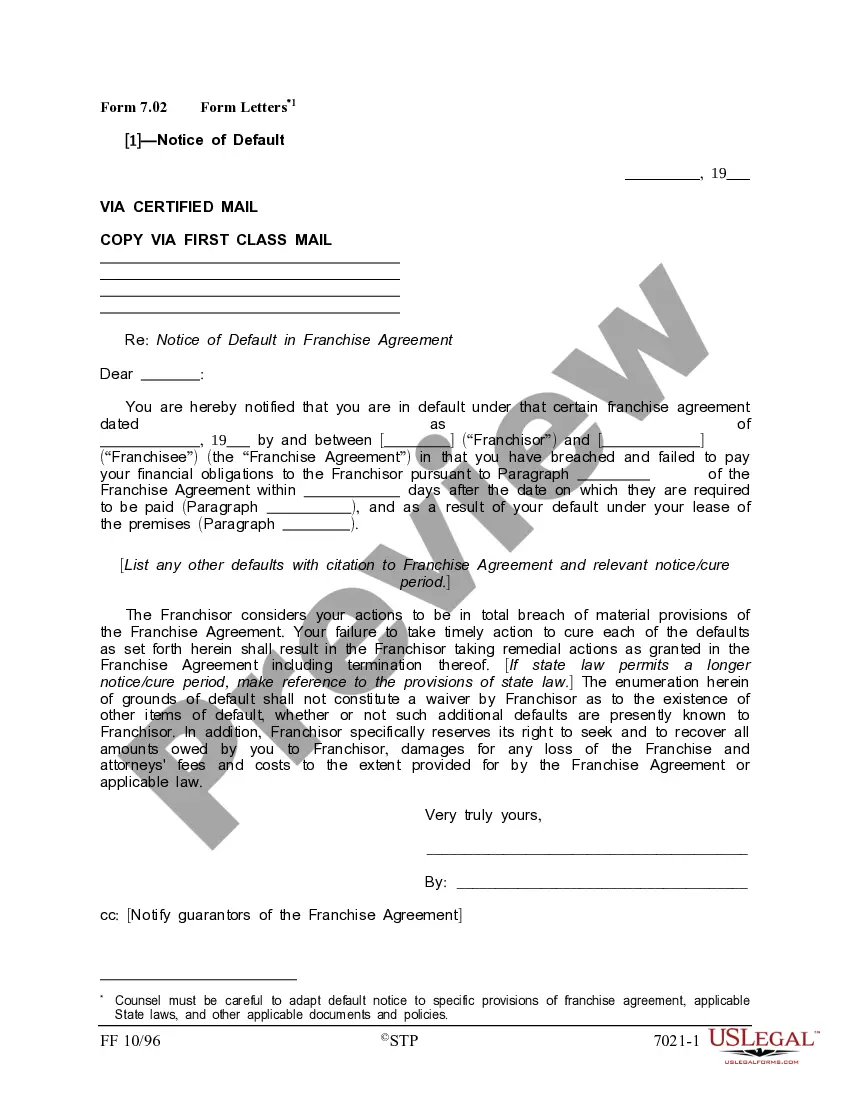

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

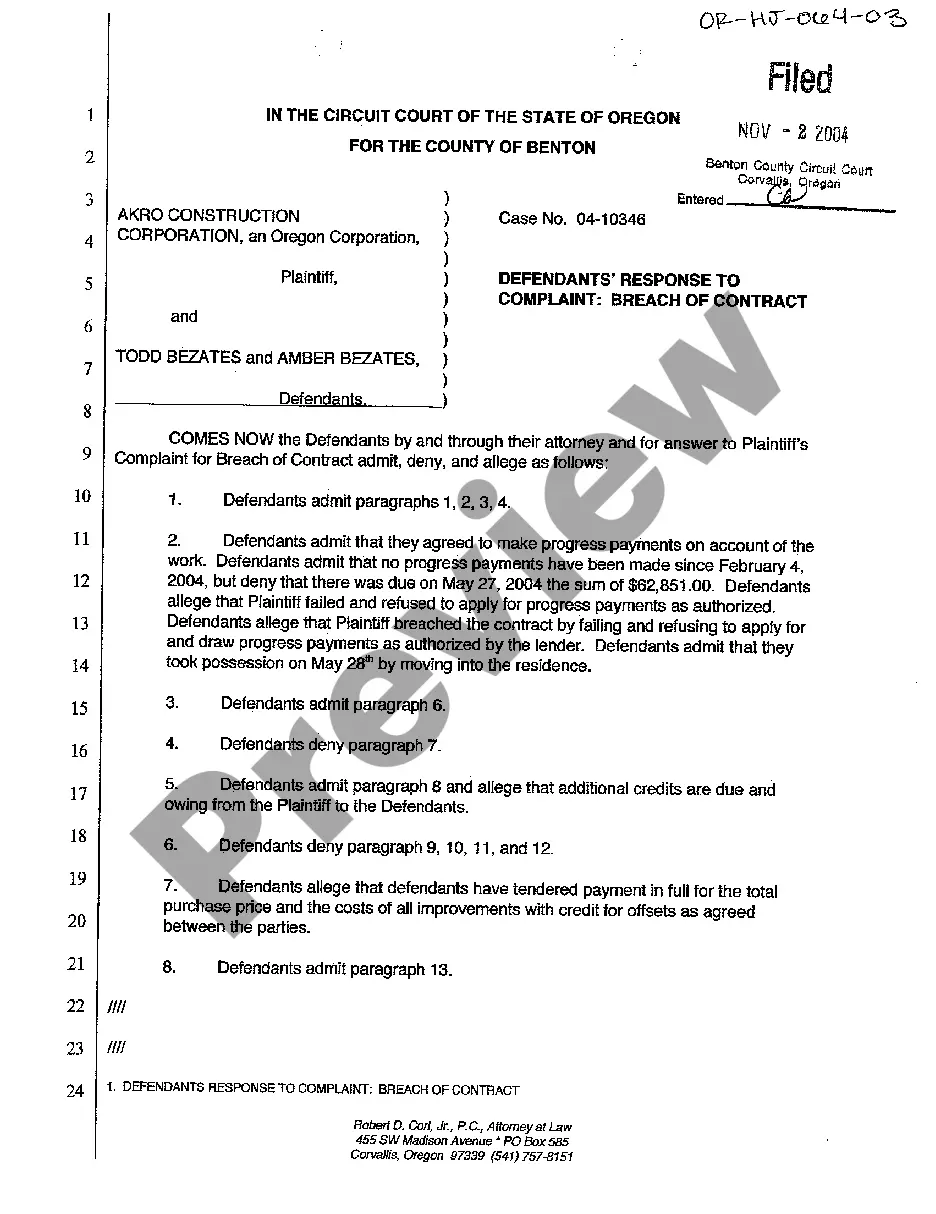

After writing a general dispute letter or a 609 credit disputing letter, followed by a 611 credit disputing letter, consumers can send a 623 credit disputing letter. With a 623 credit disputing letter, consumers request the credit agency to provide evidence to validate that the debt is theirs.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.