New Mexico Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

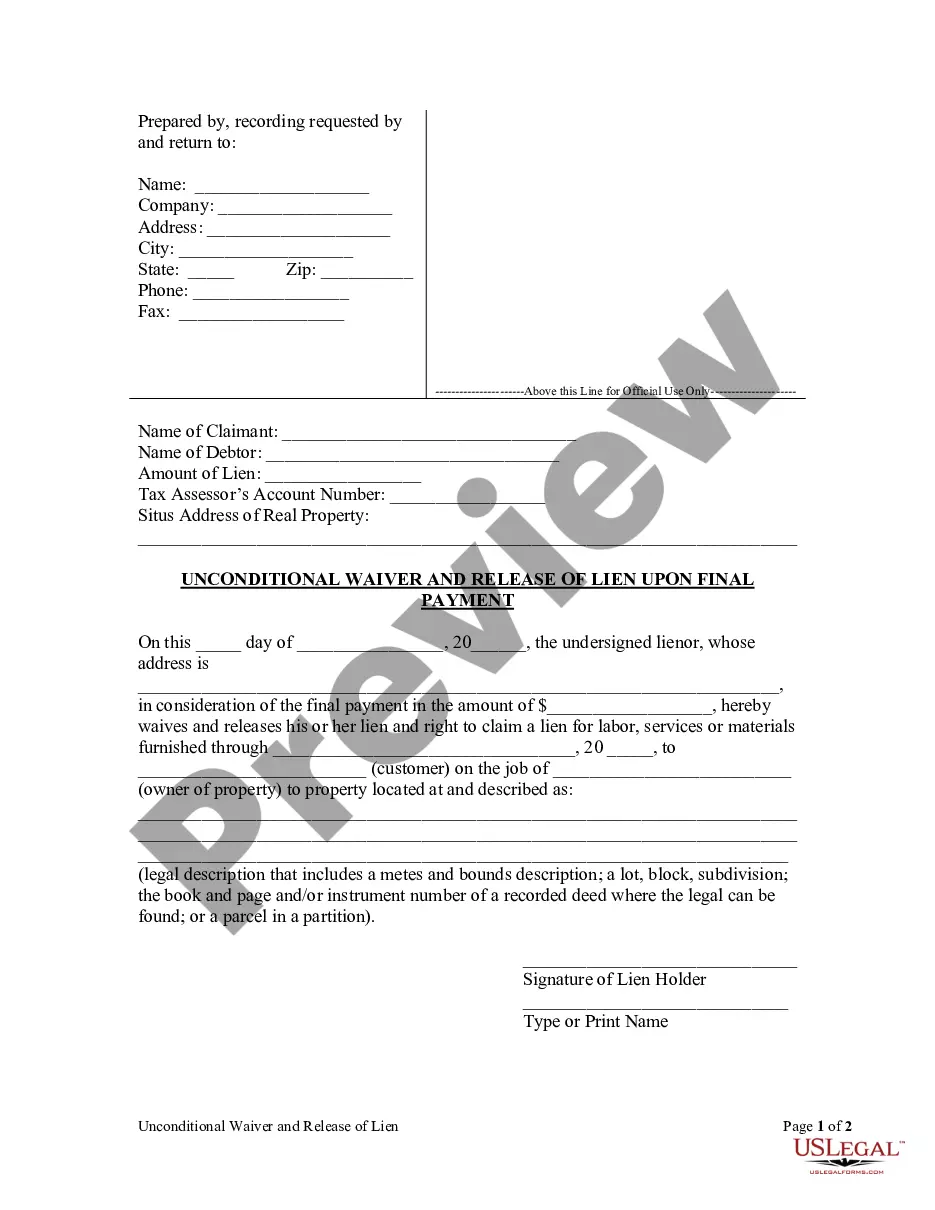

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

If you wish to complete, obtain, or print out lawful file layouts, use US Legal Forms, the greatest assortment of lawful forms, which can be found on the Internet. Utilize the site`s easy and convenient research to discover the documents you will need. A variety of layouts for company and personal purposes are categorized by groups and suggests, or key phrases. Use US Legal Forms to discover the New Mexico Challenge to Credit Report of Experian, TransUnion, and/or Equifax in just a number of click throughs.

If you are currently a US Legal Forms consumer, log in to your bank account and then click the Download option to find the New Mexico Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Also you can accessibility forms you in the past acquired inside the My Forms tab of the bank account.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your right town/country.

- Step 2. Utilize the Review method to look over the form`s articles. Don`t overlook to see the outline.

- Step 3. If you are not satisfied together with the type, make use of the Research field near the top of the screen to find other types from the lawful type format.

- Step 4. After you have identified the shape you will need, go through the Acquire now option. Select the prices plan you choose and include your accreditations to sign up for an bank account.

- Step 5. Approach the financial transaction. You should use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format from the lawful type and obtain it on the gadget.

- Step 7. Full, modify and print out or signal the New Mexico Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

Each lawful file format you acquire is your own for a long time. You may have acces to every single type you acquired in your acccount. Go through the My Forms portion and choose a type to print out or obtain again.

Be competitive and obtain, and print out the New Mexico Challenge to Credit Report of Experian, TransUnion, and/or Equifax with US Legal Forms. There are thousands of specialist and status-distinct forms you can utilize for your personal company or personal demands.

Form popularity

FAQ

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus ? Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

The law was passed in 1970 and amended twice. It is primarily aimed at the three major credit reporting agencies ? Experian, Equifax and TransUnion ? because of the widespread use of the information those bureaus collect and sell.

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.